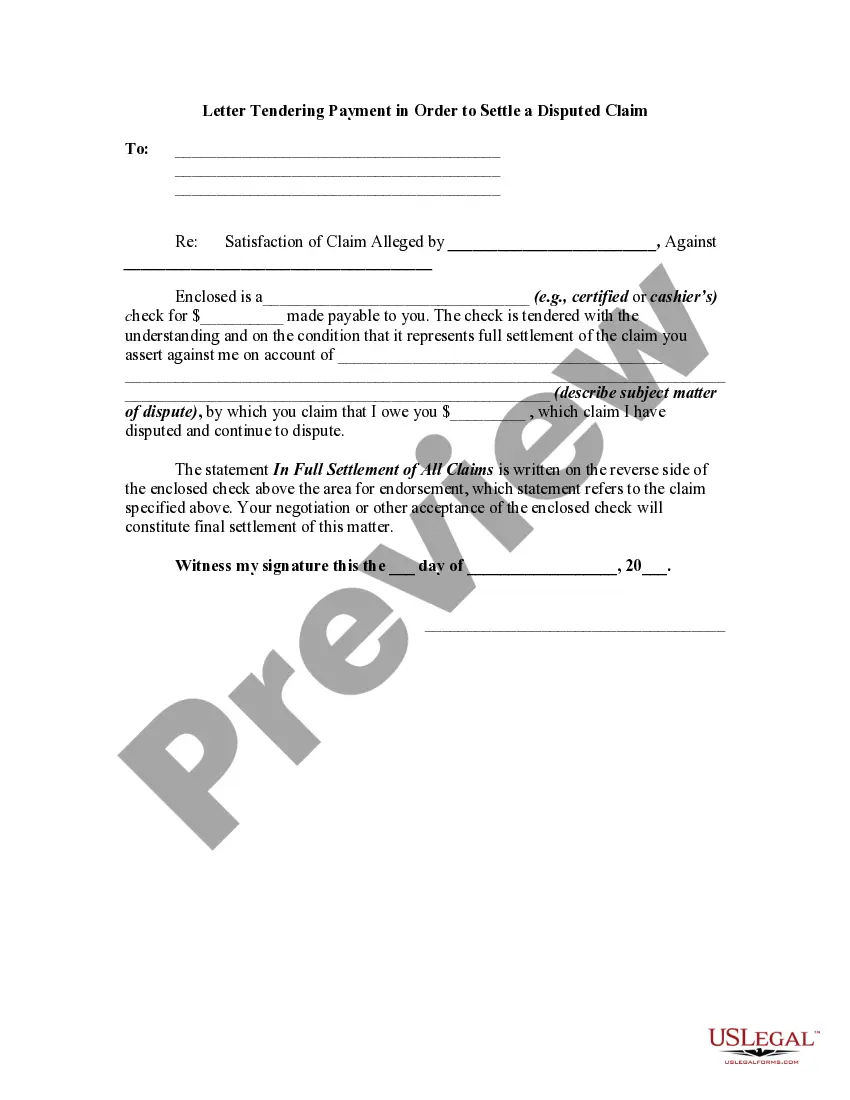

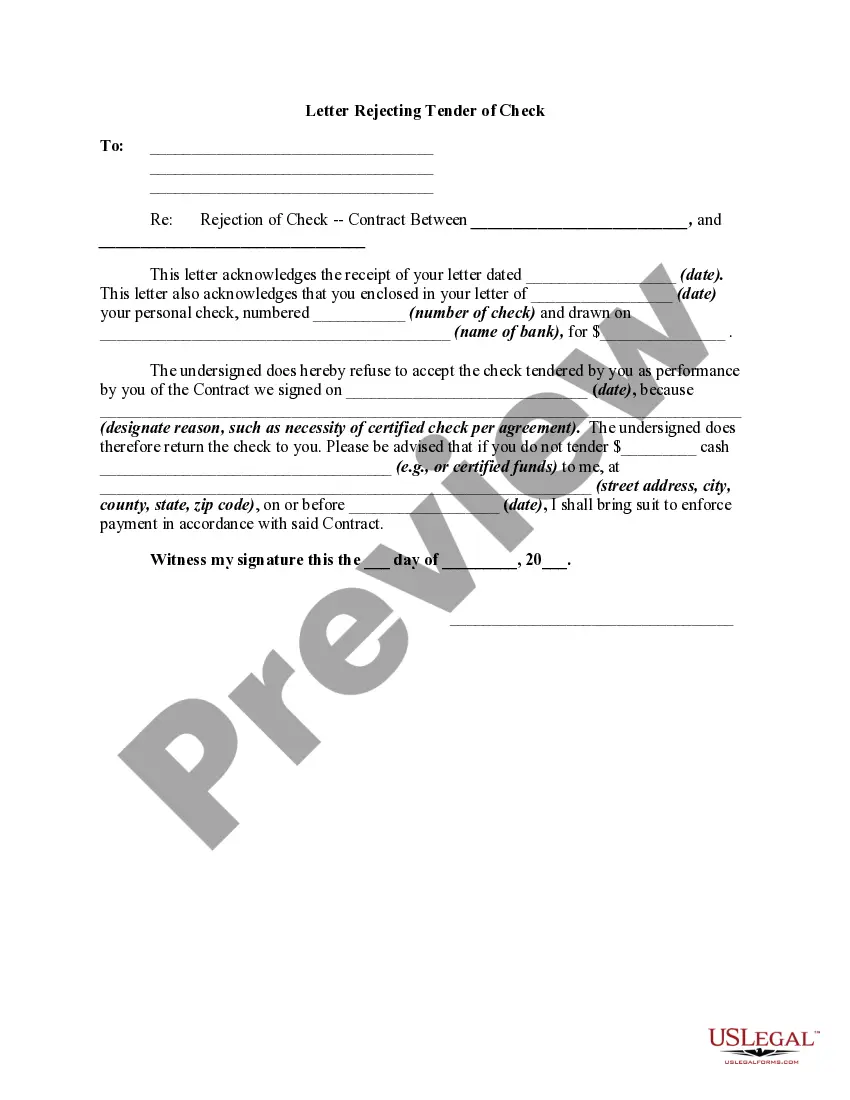

The word tender has been defined as an offer of money or goods in payment or satisfaction of a debt or other obligation. An offer to perform is a tender. A tender involves an unconditional offer by a the person making the tender to pay an amount in lawful currency that is at least equal to the amount owing in a specified debt. The purpose of tender is to close a transaction so that the person making the tender may be relieved of further liability for the debt or obligation. This form is a sample of a rejection of such a tender.

South Dakota Letter Rejecting Tender of Check

Description

How to fill out Letter Rejecting Tender Of Check?

If you need to obtain, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's simple and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it onto your device. Step 7. Complete, modify, and print or sign the South Dakota Letter Rejecting Tender of Check.

- Utilize US Legal Forms to acquire the South Dakota Letter Rejecting Tender of Check in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to obtain the South Dakota Letter Rejecting Tender of Check.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review function to browse the contents of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A durable power of attorney in South Dakota is a specific legal document that grants someone the authority to manage your financial and legal matters, even if you become unable to make decisions. This document provides peace of mind, knowing someone you trust will handle your affairs according to your wishes. Establishing one is an important step in planning for the future. For easy access to relevant templates, check out USLegalForms.

The primary difference lies in the durability aspect. In Illinois, a durable power of attorney remains effective even if the principal becomes incapacitated, while a standard power of attorney does not. This distinction is crucial when planning your estate or managing your affairs during difficult times. For those navigating these decisions, using a reliable platform like USLegalForms can simplify the process.

In South Dakota, a power of attorney is not required to be notarized; however, notarization offers additional benefits. A notarized document provides stronger legal proof of your intentions and can make it more accepted by third parties. Thus, while notarization is not mandatory, it is a wise choice to ensure your document is acknowledged without issues. USLegalForms can provide you with the necessary templates that comply with South Dakota regulations.

A durable power of attorney is a legal document that allows you to appoint someone to manage your financial affairs on your behalf. This type of power of attorney remains in effect even if you become incapacitated. It's essential to create one to ensure your financial matters are handled according to your wishes. If you need assistance, consider visiting USLegalForms for templates and guidance.

An order to show cause in South Dakota is a legal document that requires a party to explain why a certain action should not be taken in a case. This typically arises in disputes where one party seeks immediate relief or a specific order from the court. For instance, if you receive a South Dakota Letter Rejecting Tender of Check, it may lead to a situation where you might need to respond with an order to show cause. Engaging with platforms like UsLegalForms can help you navigate these legal processes effectively.

In South Dakota, a judgment is generally valid for 20 years from the date it is entered. This period allows the prevailing party to enforce the judgment through various means, if necessary. However, it's smart to keep track of your financial obligations and legal responsibilities. If you receive a South Dakota Letter Rejecting Tender of Check, understanding your judgment rights is vital.

The maximum interest rate allowed by law in South Dakota is generally set at 12% per year for most types of debts, unless specified differently in a written contract. Understanding this rate is crucial for managing loans and financial agreements. Keeping this in mind can help you avoid unexpected financial burdens, especially when drafting documents like a South Dakota Letter Rejecting Tender of Check.

An offer of judgment in South Dakota is a formal proposal made by one party to settle a legal dispute before trial. This offer can help expedite the resolution process and limit legal costs. If the offer is accepted, it results in a judgment that settles the case. Knowing about this can be beneficial when dealing with issues related to a South Dakota Letter Rejecting Tender of Check.

In South Dakota, certain personal property can be seized to satisfy a judgment. This includes bank accounts, vehicles, and valuable assets, while some property may be exempt. It is essential to know your rights and protections under South Dakota law. If you're facing such circumstances, consider looking into a South Dakota Letter Rejecting Tender of Check to manage any financial disputes effectively.

The Sunshine law in South Dakota promotes transparency in government by allowing public access to meetings and records. It ensures that citizens stay informed about governmental actions and decisions. This law plays a crucial role in maintaining accountability among public officials and institutions. Understanding this can help you navigate legal situations, including issues surrounding a South Dakota Letter Rejecting Tender of Check.