In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

Description

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

Have you visited a location where you need to have documentation for both organizational or personal activities nearly every day.

There are numerous legal document templates accessible online, but finding versions you can trust is not simple.

US Legal Forms provides thousands of document templates, including the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, which can be formulated to meet state and federal regulations.

When you find the correct document, click on Acquire now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using your PayPal or credit card. Select a convenient format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/state.

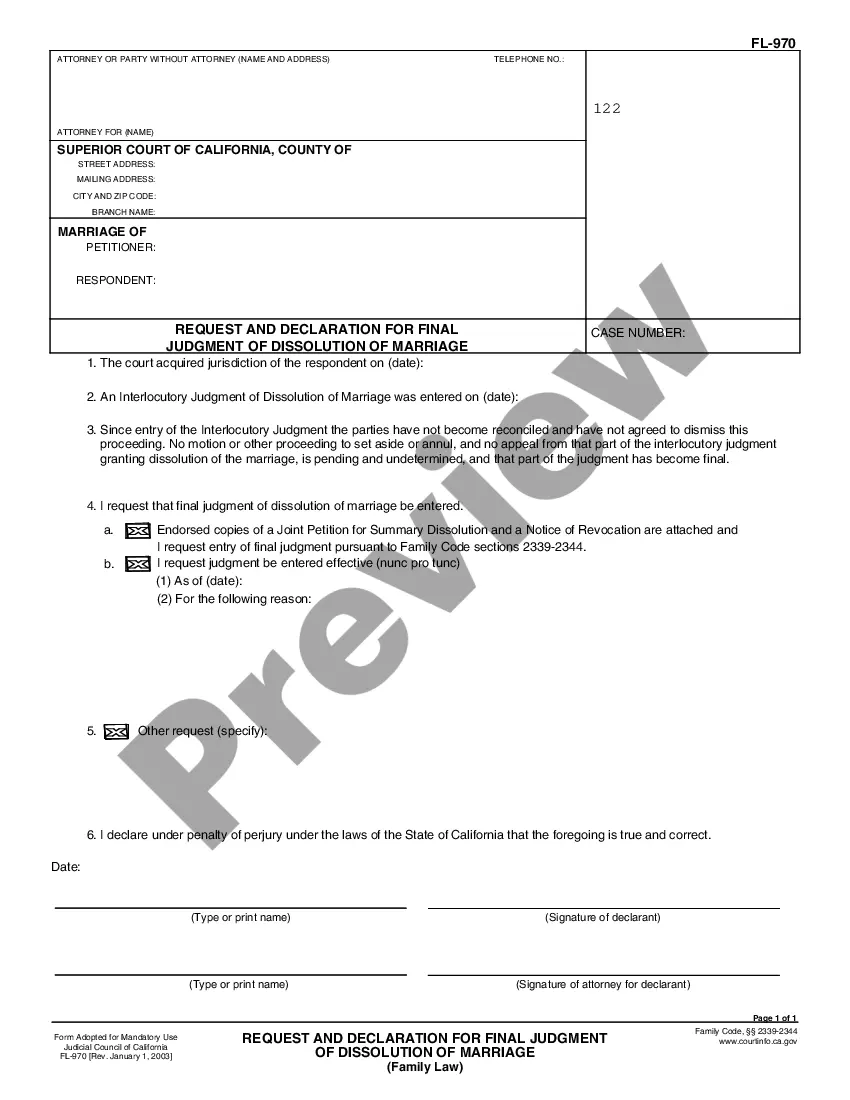

- Utilize the Preview button to review the form.

- Check the outline to confirm you have selected the right form.

- If the form does not meet your requirements, use the Research section to find the form that fits your needs.

Form popularity

FAQ

Renters in South Dakota have several rights designed to protect their interests, including the right to a habitable living environment and privacy. Additionally, they have rights concerning security deposits and lease agreements. Familiarity with these rights, especially in the context of the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, can empower tenants in their housing choices.

In South Dakota, landlords are required to return a security deposit within 14 days after a tenant moves out. They must also provide an itemized list of any deductions that might apply. This timeframe is essential for remaining compliant with the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

The guaranty language of a lease refers to the specific clauses that ensure the lessee’s obligations are met. It usually states that the guarantor will cover any unpaid rent or damages if the lessee fails to fulfill their obligations. This is closely tied to the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, reinforcing the security of the lessor.

South Dakota has a balanced approach to landlord-tenant laws, offering protections for both parties. While it upholds fundamental rights for tenants, such as security deposits and privacy, landlords also retain rights to enforce lease terms. Thus, understanding your rights within the framework of the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease is crucial.

In South Dakota, there are no specific laws capping how much a landlord can increase rent. However, landlords are encouraged to notify tenants well in advance of any increases, ideally as specified in the lease agreement. This consideration is vital for maintaining a smooth relationship, in line with the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

Law 43 32 26 in South Dakota addresses various duties of landlords and tenants concerning lease agreements. It outlines expectations for maintenance and repair of rental properties, ensuring that both parties fulfill their obligations. Understanding this law can protect you and enhance compliance with the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

In South Dakota, a landlord generally must provide reasonable notice before entering a rental property. Typically, 24 hours' notice suffices, unless there is an emergency. It is essential to understand your rights under the lease, including the South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

In South Dakota, a debt typically becomes uncollectible after six years if the creditor has not taken legal action to collect it. This period refers to the length of the statute of limitations on debt. If you have signed a South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, it is essential to manage obligations diligently. Utilizing platforms like uslegalforms can provide you with valuable resources and templates for maintaining compliance.

The statute of limitations for breach of contract in South Dakota is also six years. This timeframe applies to most contracts, ensuring that parties have a reasonable period to seek resolution. If you find yourself facing issues related to a South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, understanding this limitation is crucial. Consultation with legal experts can help clarify your rights and obligations.

In South Dakota, the statute of limitations on debt is generally six years. This means that creditors have six years from the date of default to file a lawsuit to collect the debt. If you are working under a South Dakota Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease, it is important to keep track of this timeframe. Seeking legal advice can help ensure you meet the necessary deadlines.