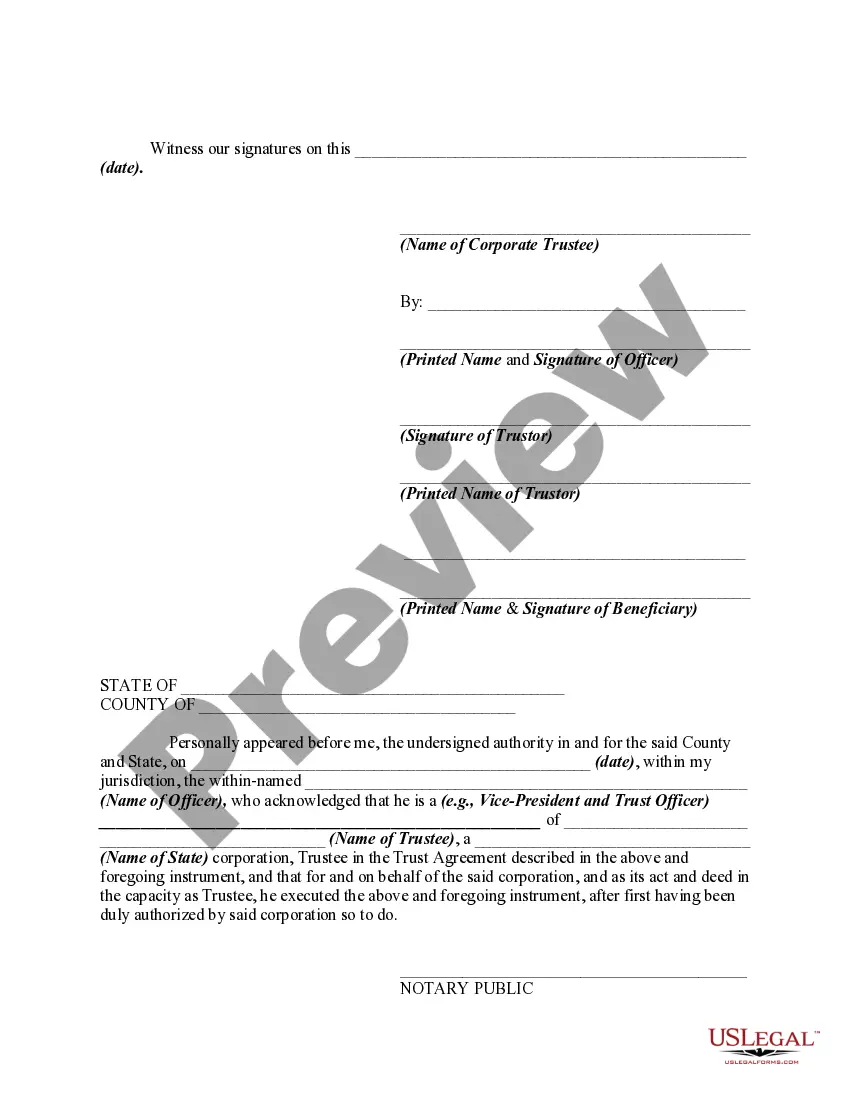

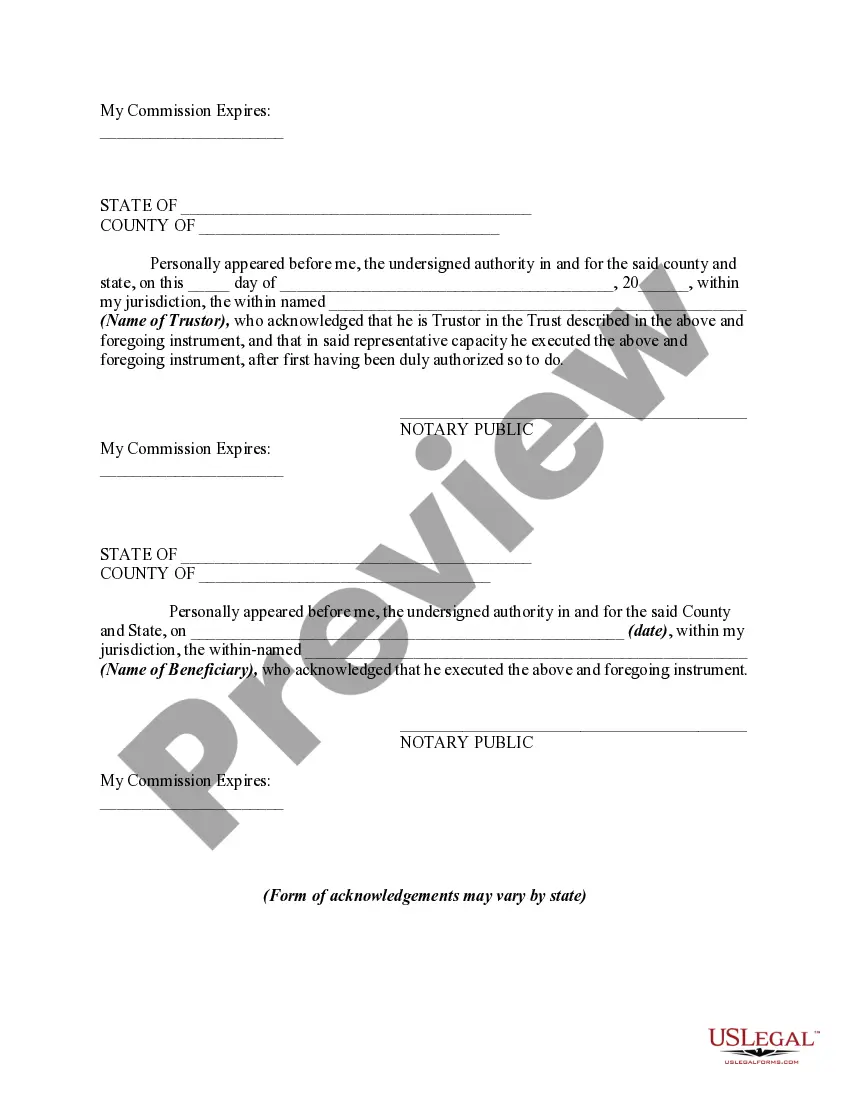

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates available for download or printing. By using the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the South Dakota Agreement to Renew Trust Agreement within moments.

If you already possess a membership, Log In and download the South Dakota Agreement to Renew Trust Agreement from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously obtained forms in the My documents section of your account.

Edit. Fill out, modify, print, and sign the acquired South Dakota Agreement to Renew Trust Agreement.

Every template you add to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you desire. Access the South Dakota Agreement to Renew Trust Agreement with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the appropriate form for your city/state. Click the Preview button to review the contents of the form. Check the form description to ensure that you have chosen correctly.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the right one.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select your preferred pricing plan and provide your information to create an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Choose the format and download the form to your device.

Form popularity

FAQ

Yes, South Dakota is increasingly recognized as an excellent location for establishing a trust. The state offers strong asset protection laws and favorable tax policies, which makes the South Dakota Agreement to Renew Trust Agreement highly appealing. Many legal experts recommend South Dakota for its innovative trust laws and a friendly legal environment. Choosing to create your trust in South Dakota can lead to long-term benefits for your estate planning.

Trust tax in South Dakota is based on the income generated by the trust. It's essential to understand that the South Dakota Agreement to Renew Trust Agreement often provides favorable tax treatment. This means that many individuals find managing a trust in South Dakota to be beneficial, both for administration and taxation. Consulting with a tax professional can help clarify specific rates and obligations.

A trust becomes worthwhile when you wish to protect your assets from probate or effectively manage wealth for future generations. With the South Dakota Agreement to Renew Trust Agreement, you gain enhanced control over your assets and their distribution. If your estate includes real estate, investments, or significant savings, a trust can ensure your legacy is preserved. It offers peace of mind knowing your property will be handled according to your preferences.

A trust agreement serves to outline the management and distribution of your assets. Specifically, the South Dakota Agreement to Renew Trust Agreement helps ensure that your wishes are honored after your passing. This document provides clarity to your beneficiaries, reducing potential disputes. It acts as a legal framework that makes the transfer of assets smoother.

The maximum length of time a trust can last in South Dakota can be significantly longer compared to many other jurisdictions, often allowing trusts to exist for several generations. Under the South Dakota Agreement to Renew Trust Agreement, many structures enable you to avoid the traditional limits that restrict trust durations. This benefit provides valuable estate planning options. For a seamless experience, consider using USLegalForms to help you establish a trust that meets these criteria.

Trusts in South Dakota can last for an extended period, often beyond typical limits found in other states. Specifically, the South Dakota Agreement to Renew Trust Agreement offers provisions that can extend a trust's duration for many years. This flexibility allows you to design a trust that aligns with your long-term financial goals. Utilizing USLegalForms can help you draft a trust that meets these regulations and suits your intent.

In South Dakota, trust laws provide a favorable environment for establishing and managing trusts. The South Dakota Agreement to Renew Trust Agreement allows you to create trusts with flexibility and protections tailored to your needs. These laws promote asset protection and estate planning, making South Dakota an attractive jurisdiction for trust establishment. By using USLegalForms, you can easily navigate these laws to create a compliant agreement.

In South Dakota, trusts operate through the establishment of a legal arrangement to hold and manage assets for beneficiaries. Trusts offer flexibility in managing inheritance and can provide tax benefits. By understanding how to set up and administer trusts, you can protect your assets more effectively. Utilizing a South Dakota Agreement to Renew Trust Agreement can streamline this process, ensuring your wishes are honored.

In South Dakota, the statute of limitations on debt varies depending on the type of debt in question. Generally, it ranges from 6 to 20 years. Knowing these time frames is critical for debtors seeking to resolve or challenge debts. If you face issues related to debt or estate planning, a South Dakota Agreement to Renew Trust Agreement can serve as an important tool in managing these challenges.

Statute 55 2 13 in South Dakota pertains to the rules surrounding irrevocable trusts. This statute defines the conditions under which a trust may be modified or revoked under specific circumstances. Familiarity with this statute can provide clarity to those managing trusts. If you need guidance, a South Dakota Agreement to Renew Trust Agreement can help clarify your options.