An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian

Description

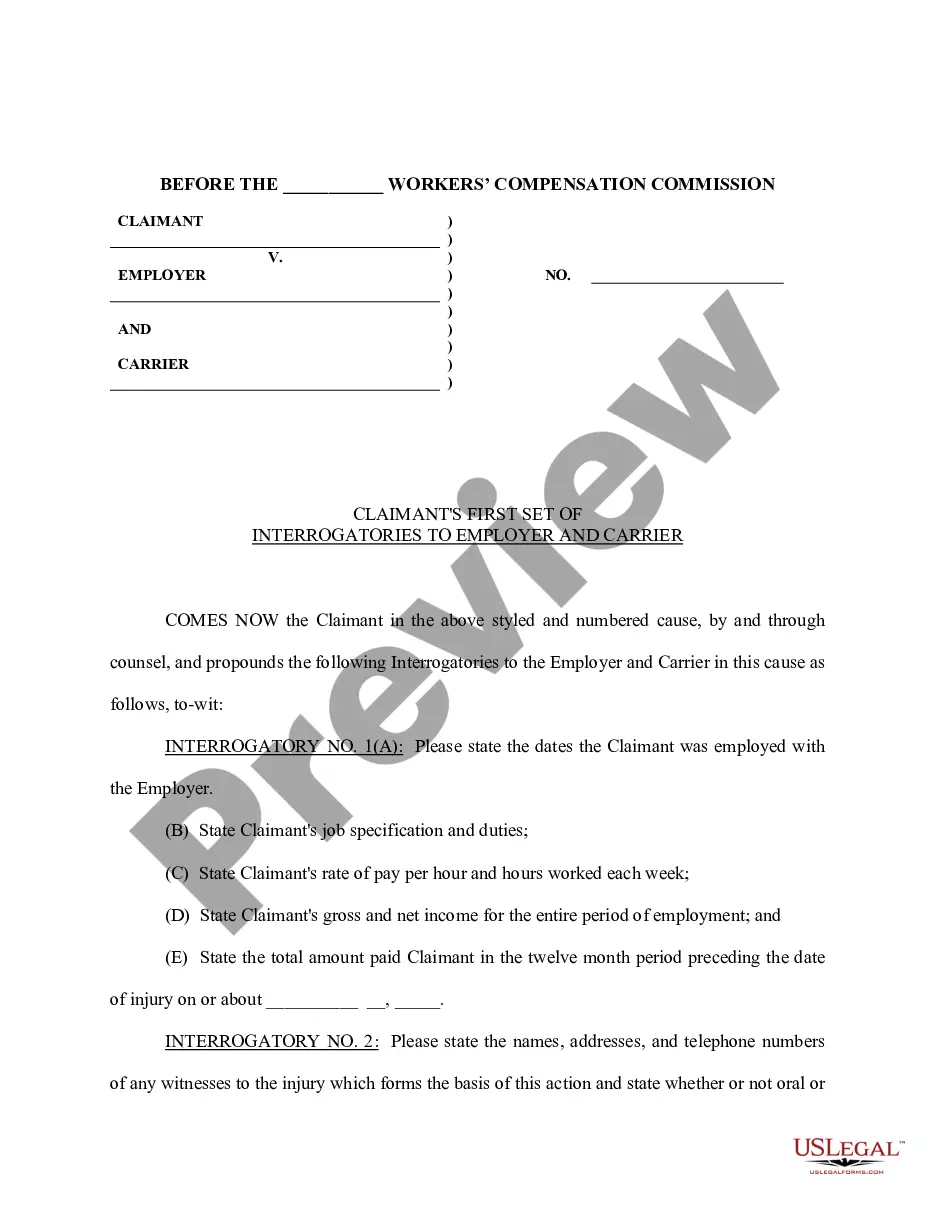

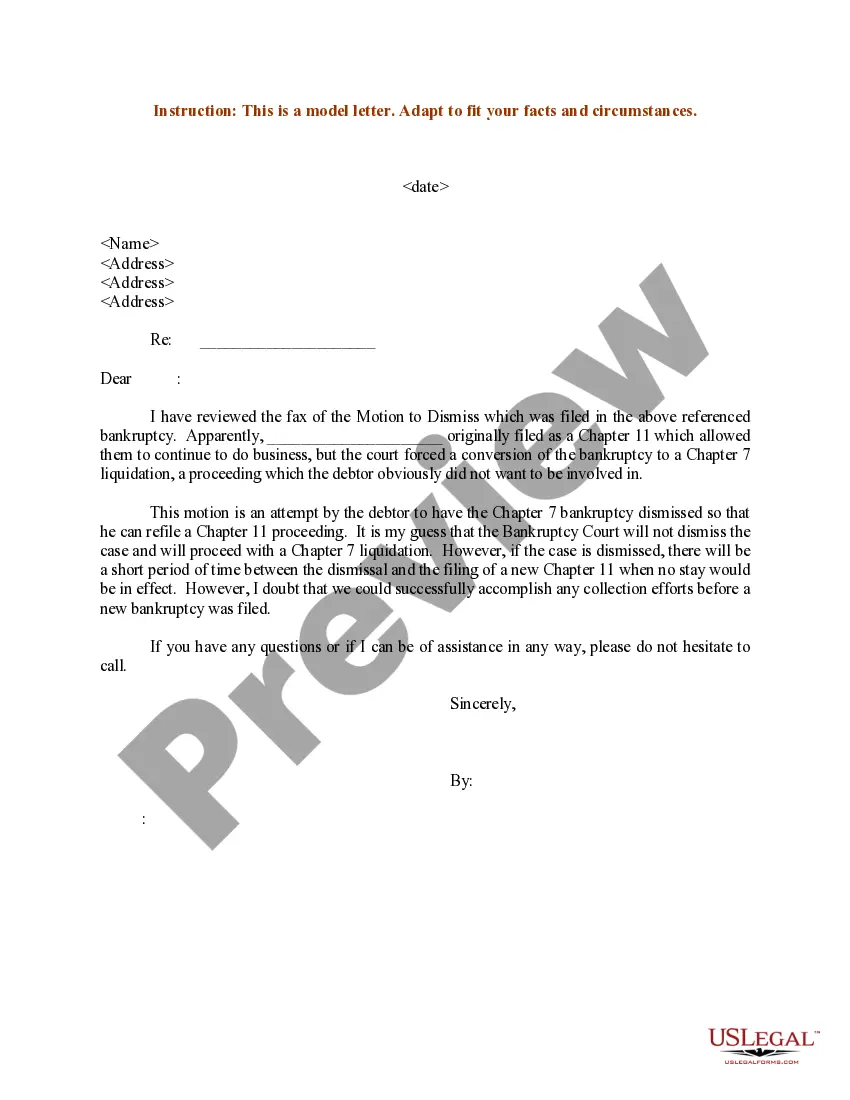

How to fill out Demand For Accounting From A Fiduciary Such As An Executor, Conservator, Trustee Or Legal Guardian?

Are you currently in a situation where you require documents for both business or specific reasons all the time.

There are numerous legal document templates available online, but locating ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the South Dakota Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian, which are created to fulfill federal and state requirements.

Choose a convenient document format and download your copy.

Find all of the document templates you have purchased in the My documents menu. You can download another copy of South Dakota Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian whenever needed. Just click on the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the South Dakota Request for Accounting from a Fiduciary such as an Executor, Conservator, Trustee, or Legal Guardian template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it corresponds to the correct city/region.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

In South Dakota, there are no specific limits on how much a landlord can increase rent, as state law does not establish a maximum percentage. However, landlords must provide reasonable notice before implementing any rent increase, typically 30 days for month-to-month leases. Understanding these regulations can help landlords manage their properties effectively while maintaining positive tenant relationships. This knowledge is essential in light of the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

Eviction rules in South Dakota require landlords to provide proper notice before initiating the eviction process. Typically, a written notice must be given, outlining the reasons for eviction and a specified timeframe for the tenant to vacate. Following these legal procedures ensures that landlords comply with state laws and respect tenants' rights. Therefore, understanding these laws can assist landlords involved in managing properties related to the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

Setting up a trust in South Dakota can provide numerous benefits, including avoiding probate and offering greater control over asset distribution. Moreover, trusts can offer financial privacy and protect your estate from creditors. Weighing these advantages against your specific circumstances can help you decide if creating a trust is worthwhile. Consulting experts can clarify how this relates to the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

Law 43-4-38 in South Dakota governs the general powers of fiduciaries, allowing them to manage and oversee trust property. This law emphasizes the fiduciary's duty to act in the best interests of the beneficiaries while also accounting for the assets involved. Being familiar with this law can ensure that you fulfill your tasks effectively if you serve in a fiduciary capacity under the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

To create a valid trust in South Dakota, certain elements must be present, including a clear intention to create a trust, identifiable beneficiaries, and a lawful purpose. Generally, a written document is necessary for establishing a trust, and it must be signed by the person creating the trust. Understanding these requirements is essential for effective estate planning. Utilizing platforms like uslegalforms can simplify this process regarding the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

In South Dakota, it is illegal to record conversations without the consent of at least one party involved. This law helps protect individuals' privacy rights. If you find yourself in a situation requiring evidence collection, it is wise to follow these regulations strictly to avoid facing legal consequences. Engaging a professional can help navigate such complexities under the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

Law 43-32-26 in South Dakota pertains to the rights and responsibilities of fiduciaries, including Executors, Conservators, Trustees, and Legal Guardians. This law outlines the requirement for fiduciaries to provide a full accounting of their management of financial resources. Therefore, if you are involved in a fiduciary role, understanding this law is crucial to complying with the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

In South Dakota, estates must exceed $50,000 in total value to require probate proceedings. If an estate is valued below this threshold, it may qualify for expedited or simplified processes. Understanding this financial benchmark is essential for navigating the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian effectively.

To obtain legal guardianship of a child in South Dakota, you will need to file a petition with the court and demonstrate that guardianship is necessary for the child's welfare. This process involves notifying the parents and possibly other interested parties. It's vital to understand the responsibilities involved, particularly concerning the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.

In South Dakota, you may obtain guardianship of a child without going to court by obtaining consent from the child's parents or through documentation that establishes your role as a caregiver. It's crucial to ensure that this arrangement meets legal standards and serves the child's best interests. Consult with a legal professional if needed, particularly regarding the South Dakota Demand for Accounting from a Fiduciary such as an Executor, Conservator, Trustee or Legal Guardian.