South Dakota Owner Financing Contract for Home

Description

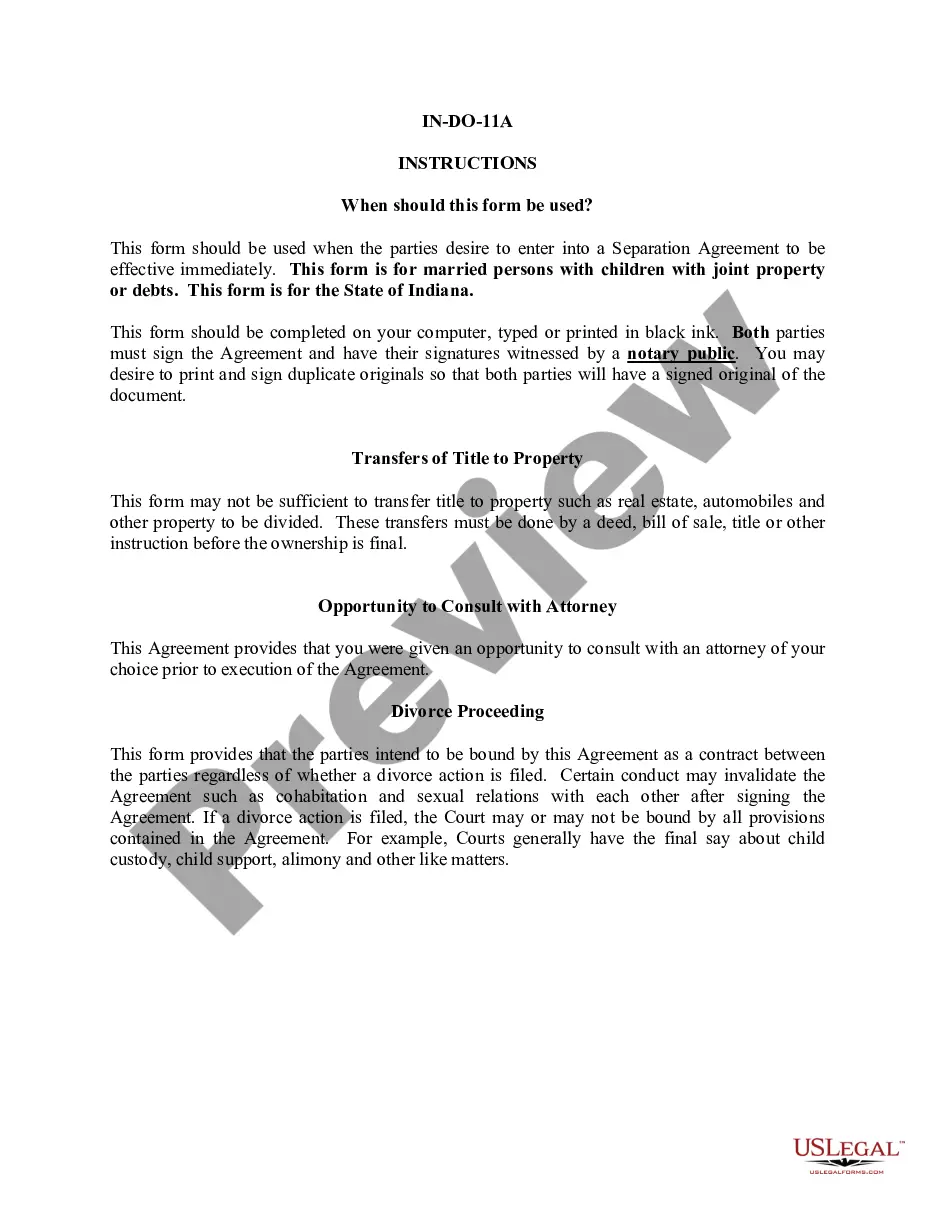

How to fill out Owner Financing Contract For Home?

US Legal Forms - one of the largest repositories of authentic documents in the United States - provides an extensive selection of legal form templates that you can download or create.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the South Dakota Owner Financing Contract for Home in moments.

If you already have an account, Log In to download the South Dakota Owner Financing Contract for Home from the US Legal Forms collection. The Download button will appear on every form you view. You can access all your previously saved forms in the My documents section of your account.

Make modifications. Fill out, edit, and print or sign the saved South Dakota Owner Financing Contract for Home.

Any template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you want.

Access the South Dakota Owner Financing Contract for Home with US Legal Forms, the largest library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you wish to use US Legal Forms for the first time, here are uncomplicated guidelines to help you begin.

- Ensure you have selected the correct form for your city/state. Click the Review button to analyze the form’s details. Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the pricing plan you prefer and provide your information to create an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

An example of owner financing is when a seller allows the buyer to make monthly payments directly to them instead of a bank. For instance, if a buyer purchases a home for $200,000 with a $20,000 down payment, they may finance the remaining $180,000 through a South Dakota Owner Financing Contract for Home. This arrangement can benefit both parties by providing flexibility in payment terms.

Contract for deed arrangements come with disadvantages, such as the potential for high-interest rates and the risk of losing payments if the buyer defaults. Additionally, the seller may face challenges if they need to evict the buyer. Before entering such an agreement, it's wise to evaluate the risks involved, especially within the context of a South Dakota Owner Financing Contract for Home.

Setting up an owner financing contract involves drafting a written agreement that outlines the payment terms, interest rates, and any other conditions relevant to the sale. It's often wise to consult with a real estate attorney or use resources like USLegalForms to create a legally compliant South Dakota Owner Financing Contract for Home. This ensures that all parties understand their rights and responsibilities.

Typically, the seller and buyer collaboratively establish the owner financing agreement. This process may involve real estate agents or legal professionals to ensure all terms are clear and legally binding. If you are unsure how to proceed, platforms like USLegalForms can offer templates and guidance for a South Dakota Owner Financing Contract for Home.

Typical terms for owner financing include a down payment of 10-20%, an interest rate ranging from 5% to 10%, and a repayment term of 5 to 30 years. These terms can vary based on market conditions and the agreement between buyer and seller. A well-formulated South Dakota Owner Financing Contract for Home can help to lay out these terms effectively.

Good terms for seller financing include a reasonable interest rate, a manageable payment schedule, and a clear payment amount. Both parties should also agree on the down payment percentage to establish a foundation of trust. Crafting the terms in a South Dakota Owner Financing Contract for Home can provide clarity and protection for everyone involved.

Seller financing agreements often range from five to thirty years, depending on the terms agreed upon by both parties. Typically, owners may opt for shorter terms to ensure they receive their funds sooner. It is crucial to establish a detailed South Dakota Owner Financing Contract for Home to define these periods accurately.

To report a seller-financed mortgage, begin by documenting the terms of the agreement, including the total amount financed and payment history. Depending on your circumstances, you may need to report the interest income when filing taxes. It's advisable to consult tax regulations or use US Legal Forms to help create or manage your South Dakota Owner Financing Contract for Home, ensuring all necessary details are correctly reported.

In South Dakota, a contract for deed allows the seller to maintain the title to the property until the buyer completes all payment obligations. This agreement serves as a way to secure financing while providing the buyer the benefits of possession and use. It is essential to create a South Dakota Owner Financing Contract for Home that outlines payment terms, responsibilities, and contingencies for a smooth transaction.

When discussing seller financing with a seller, it's important to describe it as an agreement where they offer direct financing to the buyer. Explain that this arrangement can simplify the sale process, allowing them to attract more buyers. By offering a South Dakota Owner Financing Contract for Home, sellers can negotiate terms that suit their needs while generating income through interest payments.