South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership

Description

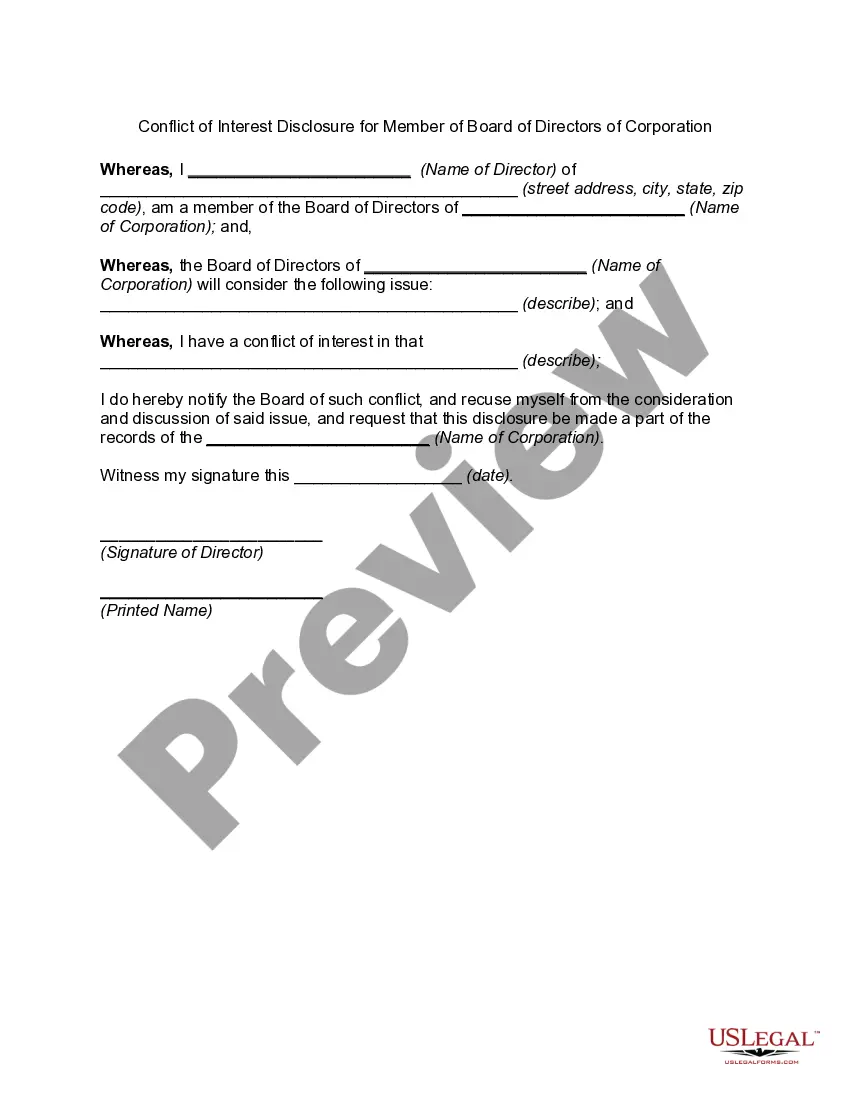

How to fill out Agreement To Incorporate By Partners Incorporating Existing Partnership?

Locating the appropriate legal document format can be a challenge.

Certainly, there are numerous templates accessible online, but how do you discover the legal form you need.

Take advantage of the US Legal Forms site.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct form for your city/region.

- The service offers thousands of templates, including the South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership.

- These can be utilized for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click on the Download button to obtain the South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership.

- Use your account to browse through the legal forms you have previously purchased.

- Go to the My documents tab of the account and download another copy of the document you require.

Form popularity

FAQ

Dissolving an LLC in South Dakota involves several steps, including the formal filing of dissolution documents with the Secretary of State. It is important to settle any remaining debts and distribute assets among members before finalizing the dissolution. To ensure that the process is handled correctly, consider utilizing resources from uslegalforms, which offers tools and templates, including a South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership, to simplify legal decisions throughout your LLC’s journey.

An LLC, or limited liability company, can be structured as a partnership in South Dakota. This structure allows members to enjoy liability protection while maintaining flexible management and tax benefits typical of a partnership. If you’re looking to establish an LLC that operates as a partnership, a South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership can guide you through the incorporation process.

Yes, South Dakota does recognize domestic partnerships, providing certain rights and responsibilities to partners. This means partners can enjoy benefits similar to those of marriage in legal terms, such as health care decisions and property rights. If you are considering starting a domestic partnership, it may be beneficial to explore how a South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership can solidify your partnership legally.

Yes, a company can indeed participate in a partnership. This setup allows for various forms of collaboration and shared resources, benefiting all involved parties. It’s essential to clearly outline the terms in a formal agreement. A South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership can serve as a robust framework for establishing your partnership.

An incorporation can take on characteristics of a partnership but is fundamentally a separate legal entity. This means it operates under corporate laws, while a partnership maintains its own legal flexibility. To achieve a successful partnership of an incorporated entity, consider utilizing a South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership as a foundational document. It provides clarity and structure to the arrangement.

Certainly, a partnership can elect to incorporate and become a corporation. This transition provides partners with limited liability protection and can enhance credibility with clients and suppliers. However, it involves legal and financial considerations. Using a South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership can facilitate this change effectively.

Yes, an incorporated business can be structured as a partnership under certain circumstances. This type of arrangement allows partners to enjoy the benefits of incorporation while maintaining the flexibility of a partnership. Having a South Dakota Agreement to Incorporate by Partners Incorporating Existing Partnership can help streamline this process. It's advisable to consult with a legal expert for specific guidance tailored to your situation.