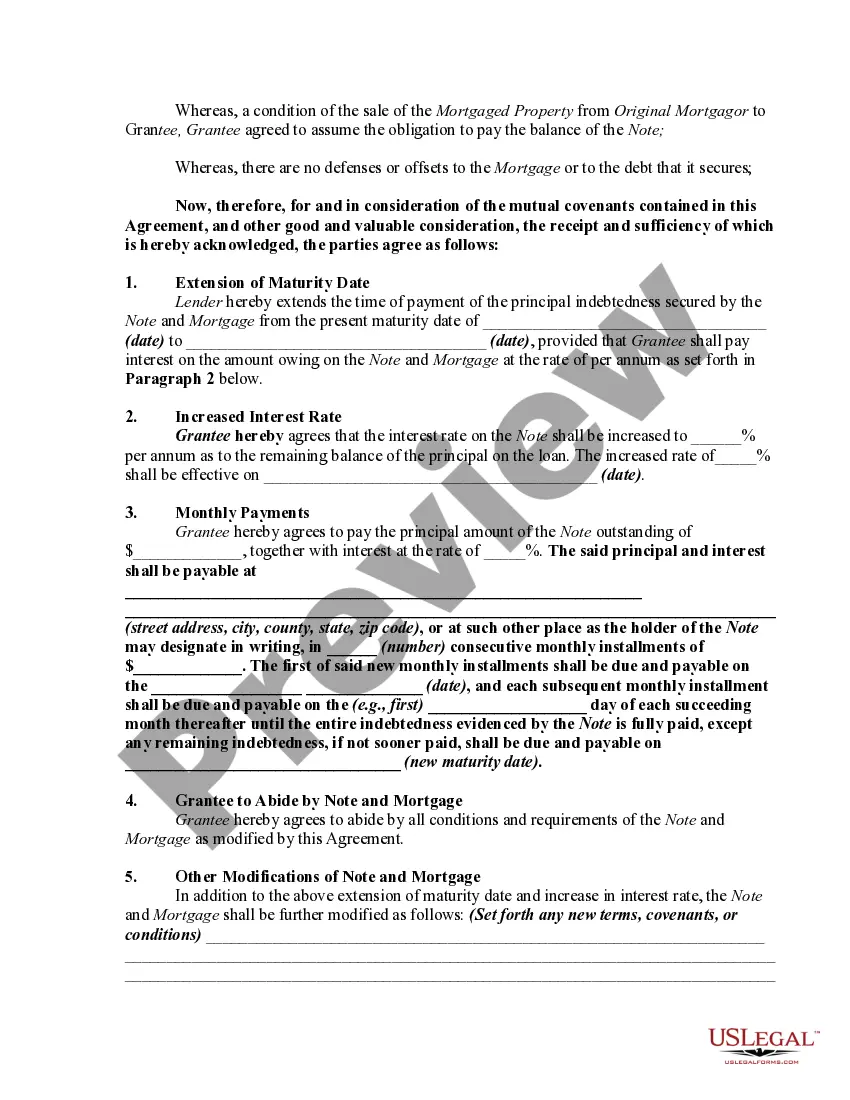

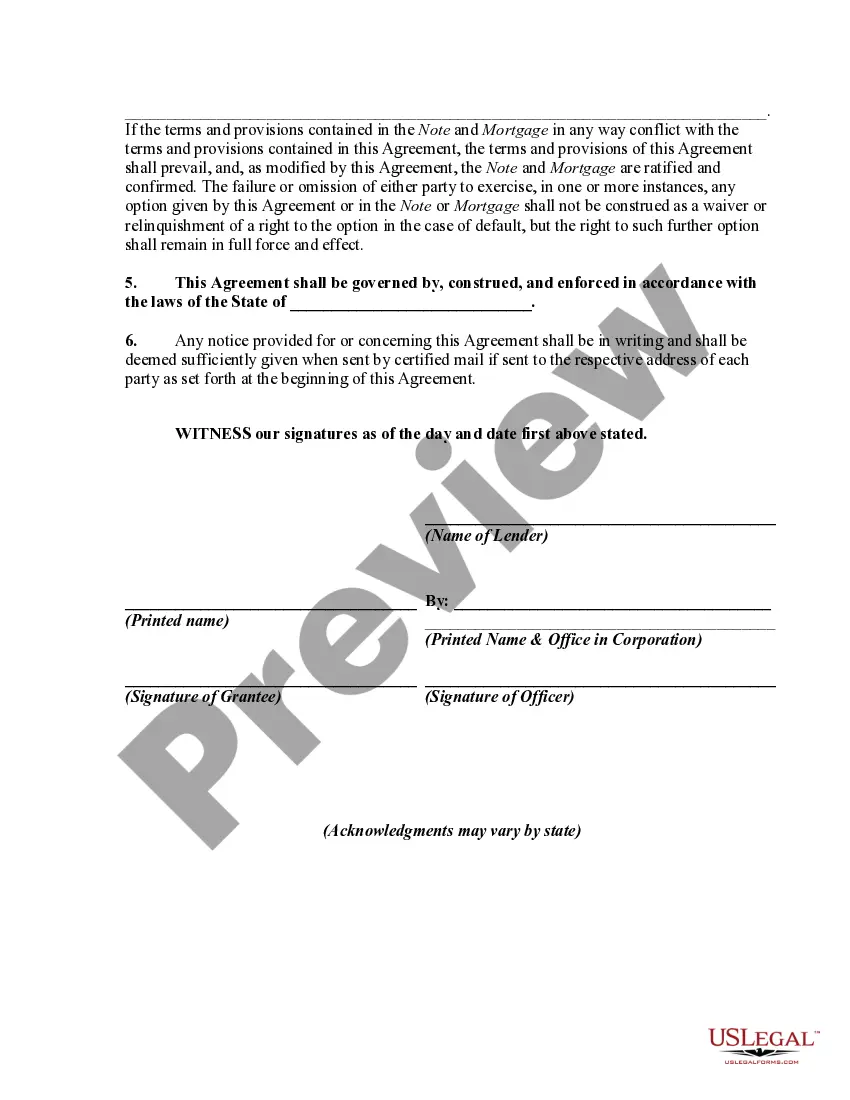

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: South Dakota Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest: Explained Introduction: In South Dakota, a Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest is a legally binding document that allows a new property owner to assume the existing mortgage debt, while also modifying the terms of the mortgage, including an increase in interest rates if agreed upon. This agreement serves as a means to ensure smooth transitions of property ownership while safeguarding the interests of all parties involved. Types of South Dakota Mortgage Extension Agreements with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest: 1. Fixed-Rate Mortgage Extension Agreement: This type of agreement allows the new owner to assume the existing fixed-rate mortgage on the property. By entering into this agreement, the new owner takes responsibility for the remaining mortgage debt and agrees to an extension period, along with any increased interest rates. 2. Adjustable-Rate Mortgage Extension Agreement: In this scenario, the new owner assumes the existing adjustable-rate mortgage, which typically features a variable interest rate. This agreement could involve an extension in the mortgage term, an adjustment in the interest rate, or even both. 3. Refinance Mortgage Extension Agreement: Instead of assuming the original mortgage, this agreement involves the new owner refinancing the property. The new owner takes out a new loan in their name to pay off the existing mortgage debt, with modified terms such as an extension period and increased interest rates if mutually agreed upon. 4. Balloon Mortgage Extension Agreement: This agreement allows the new owner to assume a balloon mortgage, a type of loan with lower monthly payments but a large lump-sum payment due at the end. The new owner agrees to assume the remaining debt and extends the repayment period, potentially at higher interest rates. Content: 1. Understanding a South Dakota Mortgage Extension Agreement: — Definition and purpose of a mortgage extension agreement with assumption of debt by a new owner. — Importance of clarifying terms and responsibilities for a smooth transition. — Overview of the types of mortgage extension agreements available in South Dakota. 2. Key Elements of a South Dakota Mortgage Extension Agreement: — Parties involved: borrower, lender, and new owner assuming the debt. — Details of the original mortgage: loan amount, interest rate, repayment terms, and remaining debt. — Assumption of debt: responsibilities and obligations of the new owner. — Terms of extension: agreed-upon extension period, modified interest rates, and potential changes in payment structure. 3. Process of Assumption and Extension: — Negotiating terms and conditions with the lender. — Verification of the new owner's eligibility and financial capability. — Preparing the necessary documentation and legal forms. — Execution of the agreement and submission to relevant authorities. 4. Implications and Considerations for Both Parties: — Impact on the original borrower's credit and liability after transferring the mortgage. — Protection of the new owner's rights and obligations. — Evaluation of the financial benefits and risks of the agreement. — Available resources for legal assistance and guidance during the process. 5. Conclusion: — Recap of the key points discussed— - Emphasize the importance of obtaining professional advice. — Encouragement to conduct thorough due diligence before entering into the agreement. Keywords: South Dakota, Mortgage Extension Agreement, Assumption of Debt, New Owner, Real Property, Covered by Mortgage, Increase of Interest, Fixed-Rate, Adjustable-Rate, Refinance, Balloon Mortgage.