South Dakota Employment Verification Letter for Mortgage serves as a document that confirms an individual's employment details, including job position, income, and stability, for the purpose of obtaining a mortgage loan. This letter is essential for lenders to assess the borrower's ability to repay the loan and ensure its feasibility. Keywords: South Dakota, Employment Verification Letter, Mortgage, types, job position, income, stability, lender, borrow, loan, repayment, feasibility. In South Dakota, there are primarily two types of Employment Verification Letters for Mortgage: 1. Standard Employment Verification Letter: The Standard Employment Verification Letter in South Dakota outlines the borrower's job position, income, and length of employment. It provides crucial information necessary for the lender to assess the stability and consistency of the borrower's income stream. This type of letter is typically obtained from the employer directly or through authorized Human Resources personnel. 2. Self-Employed Employment Verification Letter: For self-employed individuals seeking a mortgage in South Dakota, a specialized Self-Employed Employment Verification Letter is required. This letter provides a detailed overview of the borrower's self-employment status, income generation, and business stability. The lender uses this letter to evaluate the borrower's ability to maintain a steady income flow and manage financial obligations efficiently. When applying for a mortgage in South Dakota, it is important to ensure that the Employment Verification Letter includes relevant information such as the borrower's full name, the name and contact details of the employer or business, employment start date, current job title or business ownership details, average monthly or annual income, and any other documentation required by the lender. In conclusion, the South Dakota Employment Verification Letter for Mortgage is a critical document that provides lenders with necessary information about a borrower's employment status, income, and stability. By evaluating this information, lenders can determine the borrower's ability to repay the mortgage loan effectively. Different types of verification letters are used for standard employment and self-employment situations.

South Dakota Employment Verification Letter for Mortgage

Description

How to fill out South Dakota Employment Verification Letter For Mortgage?

Finding the right legitimate papers design might be a have a problem. Of course, there are a lot of web templates available online, but how will you obtain the legitimate kind you need? Take advantage of the US Legal Forms site. The assistance offers 1000s of web templates, like the South Dakota Employment Verification Letter for Mortgage, that you can use for company and private demands. All of the kinds are checked out by professionals and satisfy federal and state demands.

In case you are already registered, log in in your bank account and click the Download key to obtain the South Dakota Employment Verification Letter for Mortgage. Make use of your bank account to look throughout the legitimate kinds you may have purchased earlier. Check out the My Forms tab of the bank account and obtain yet another backup from the papers you need.

In case you are a brand new end user of US Legal Forms, listed below are straightforward guidelines that you can follow:

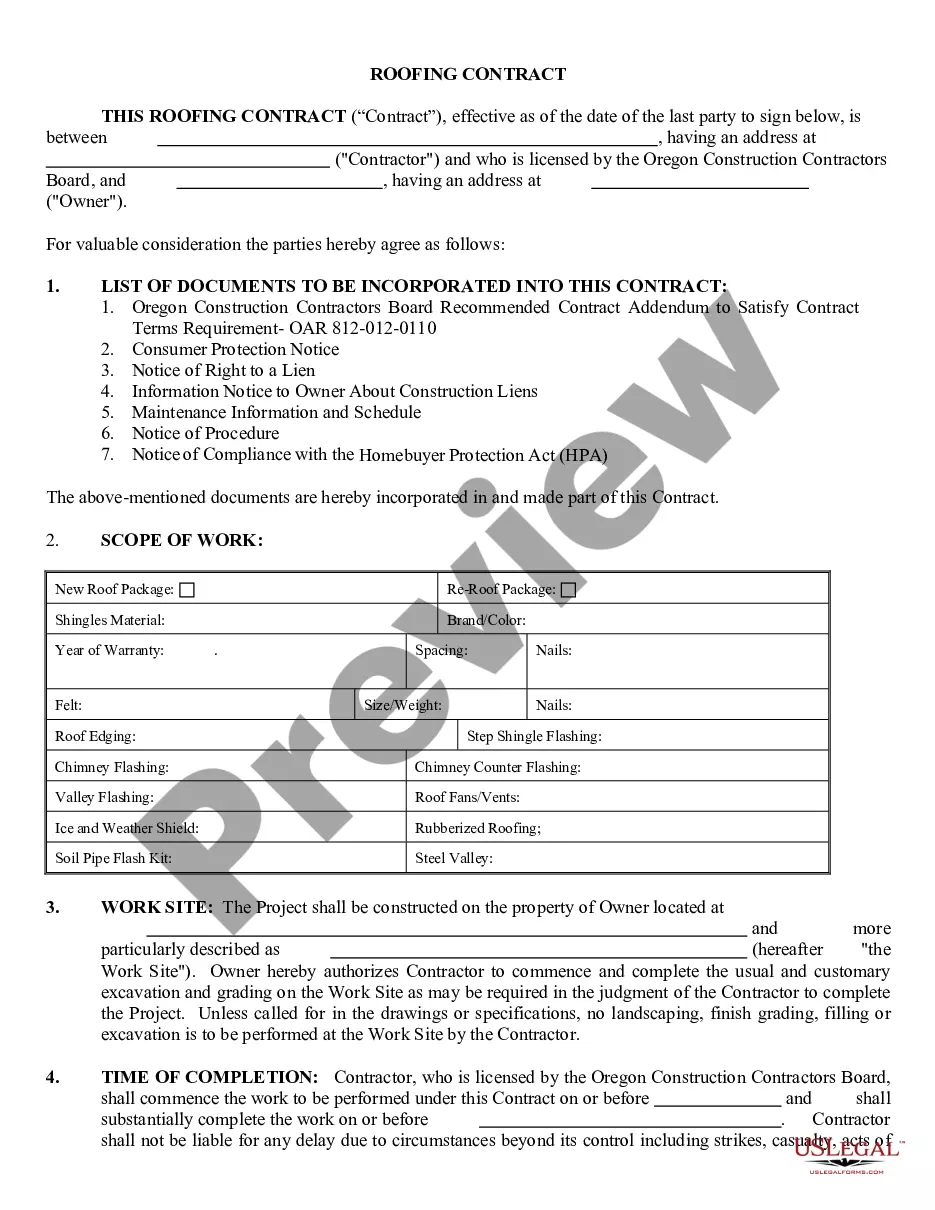

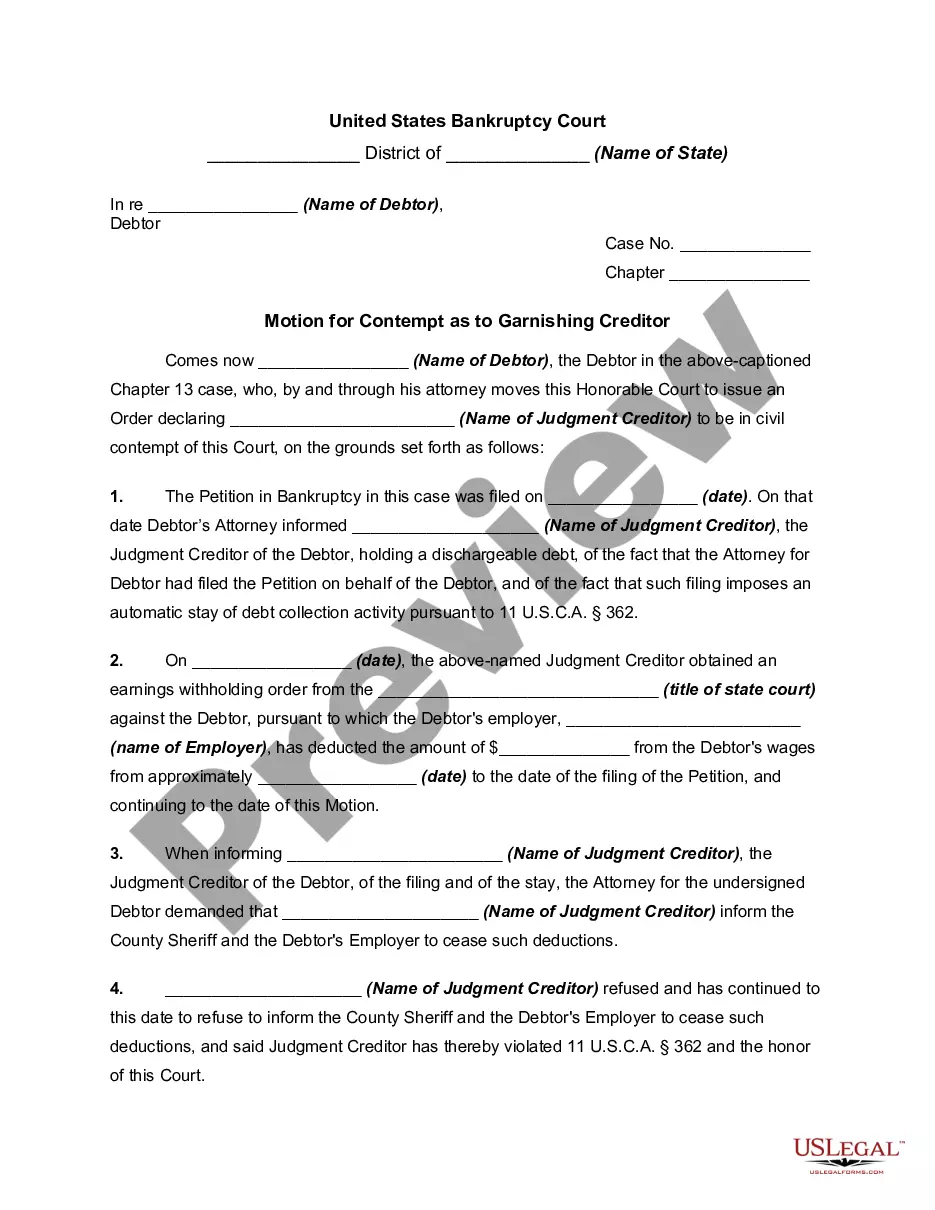

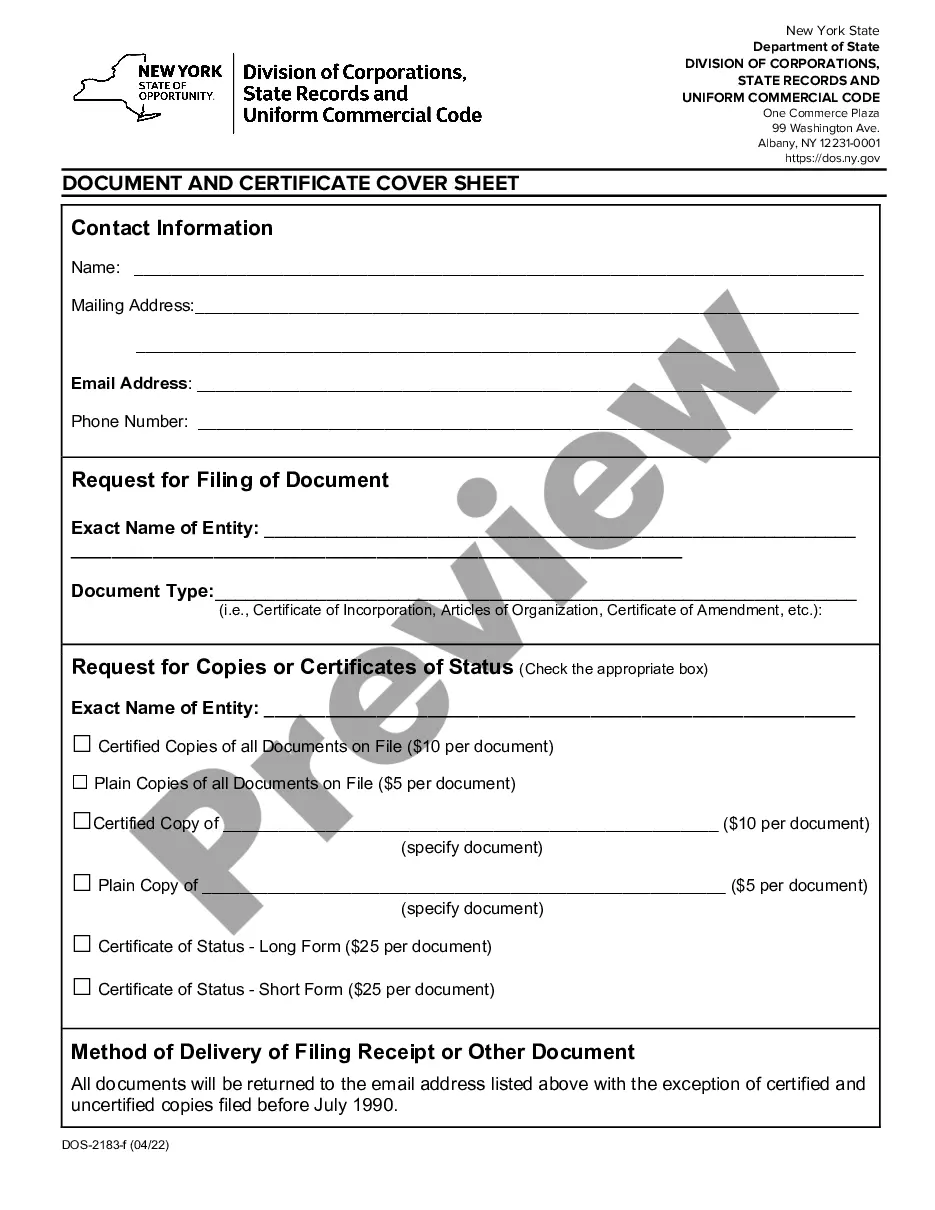

- Very first, make sure you have selected the right kind for the area/state. It is possible to look over the form while using Preview key and read the form description to ensure this is the right one for you.

- When the kind is not going to satisfy your expectations, make use of the Seach discipline to find the proper kind.

- Once you are certain the form is proper, click the Buy now key to obtain the kind.

- Choose the prices program you desire and enter the essential details. Create your bank account and purchase the order using your PayPal bank account or Visa or Mastercard.

- Choose the document file format and down load the legitimate papers design in your gadget.

- Complete, edit and produce and sign the acquired South Dakota Employment Verification Letter for Mortgage.

US Legal Forms will be the biggest catalogue of legitimate kinds that you will find a variety of papers web templates. Take advantage of the service to down load appropriately-made documents that follow express demands.

Form popularity

FAQ

What documents can I provide for proof of income? We will need your official employment offer letter along with your first pay stub in order to verify your income. Your offer letter must include your name, your employer's name, and your confirmed start date.

A paystub can, in some cases, provide adequate proof of employee earnings. Paystubs can be easily d, so verifiers will often require a more formal attestation from a current or past employer, usually provided via state-specific forms like Texas' Form H1028.

The best way to do this is to request a Salary Verification Letter. This is a simple document from the applicant's employer that typically confirms how long they've worked there, what they earn, and whether they remain an employee in good standing.

An employment verification letter should be printed on your company's official letterhead or stationery, including the company logo. It may include the following information: Employer address. Name and address of the company requesting verification.

A proof of income letter determines and confirms an individual's income and employment status. It is a formal, official letter usually composed by employers in order to confirm that an individual currently works for them or has worked for them in the past.

Here's how to write an employment verification letter, and the information to include: Employee name. Job title. Job description. Employment dates. Salary (current or past) Reason for termination (if applicable)

If you work for a big company, you typically have to send a request to your HR representative. However, smaller companies without an HR department may have their manager handle the request. Talk to your colleagues or manager to determine the best person to ask for a letter of employment from.

What Is an Employment Verification Letter? Employment verification letters confirm details about employment status, dates of employment, salary or wage information, and job details. The letter is a formal business document: Therefore, it is often created using company letterhead and signed and dated for authenticity.