An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota General Form of Irrevocable Trust Agreement

Description

How to fill out General Form Of Irrevocable Trust Agreement?

Selecting the appropriate legal document template can be a challenge.

Clearly, a multitude of themes exist online, but how can you locate the legal form you require? Utilize the US Legal Forms website.

This service offers a vast array of templates, including the South Dakota General Form of Irrevocable Trust Agreement, suitable for both business and personal purposes.

- All forms are reviewed by experts and meet federal and state regulations.

- If you are already a member, sign in to your account and click on the Download button to retrieve the South Dakota General Form of Irrevocable Trust Agreement.

- Leverage your account to browse through the legal forms you have previously acquired.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure that you have selected the right form for your city/county. You can browse the form using the Review button and read the form description to confirm it meets your needs.

Form popularity

FAQ

You cannot create an irrevocable trust for yourself in the typical sense, as the trust must operate independently of your personal control once established. However, you can set up a South Dakota General Form of Irrevocable Trust Agreement where a trustee manages the assets on your behalf, providing benefits like asset protection and tax advantages. It's essential to consult with a legal expert to navigate the specifics and ensure your intentions are fulfilled.

Yes, you can prepare your own irrevocable trust using templates and resources available online. However, it is crucial to ensure that the document meets all legal requirements for a valid South Dakota General Form of Irrevocable Trust Agreement. While DIY options are available, considering professional assistance can help you tailor the trust to your specific needs and avoid potential pitfalls.

One downside of an irrevocable trust is that once you create it, you cannot change its terms or take back assets placed in it. This means you lose control over those assets, which can be a concern for many individuals. Additionally, while a South Dakota General Form of Irrevocable Trust Agreement can offer tax benefits and protection from creditors, it may limit your flexibility in managing your estate in the long run.

To establish a valid trust in South Dakota, you must meet certain requirements, such as having a clear intent to create a trust, identifiable assets, and a designated trustee. The South Dakota General Form of Irrevocable Trust Agreement outlines these aspects, ensuring that your trust adheres to state laws. Working with a trusted source like USLegalForms can simplify the process and ensure compliance with all legal requirements.

Yes, you can write your own irrevocable trust; however, this process can be complex. It is highly recommended to use the South Dakota General Form of Irrevocable Trust Agreement as a template to guide you. Utilizing a trusted platform like USLegalForms can help you navigate the legal language and ensure all necessary components are included, significantly reducing the risk of errors.

In South Dakota, the laws governing irrevocable trusts are designed to offer flexibility and protection for both grantors and beneficiaries. The South Dakota General Form of Irrevocable Trust Agreement is recognized under state law, providing clear guidelines on how trusts should be established and managed. It is crucial to work within these legal frameworks to ensure your trust operates effectively and complies with tax regulations.

A common example of an irrevocable trust is a life insurance trust. This type of trust allows you to transfer ownership of your life insurance policy into the trust, thereby removing it from your estate. This can provide tax benefits and ensure that beneficiaries receive the insurance payout without going through probate, which aligns with the principles of a South Dakota General Form of Irrevocable Trust Agreement.

To structure a South Dakota General Form of Irrevocable Trust Agreement, you need to identify the assets you want to place in the trust, designate a trustee, and outline the terms of the trust. This includes specifying how the assets will be managed and distributed to the beneficiaries. It's important to ensure that the trust complies with South Dakota laws and meets your specific goals for asset protection and tax planning.

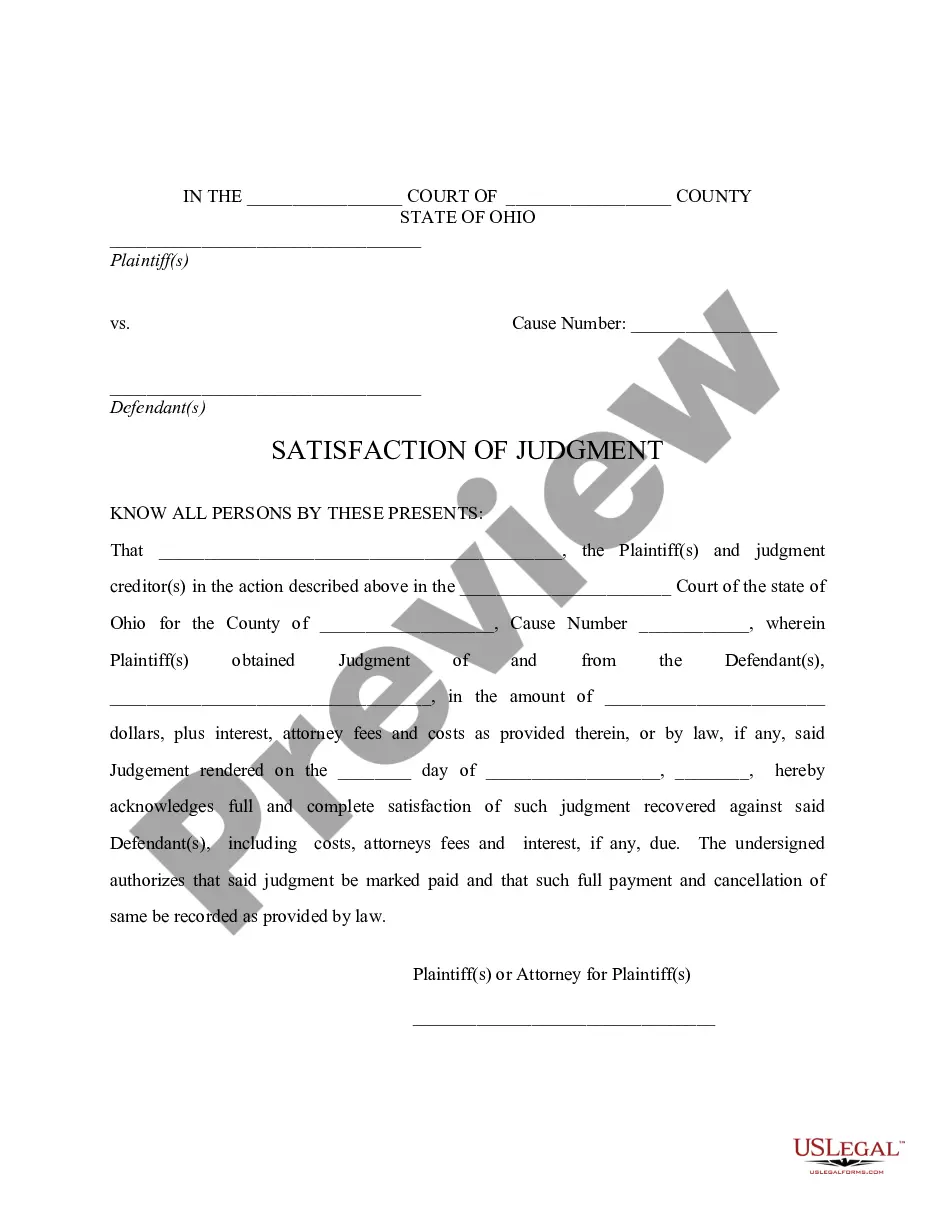

Filling out a trust agreement involves careful attention to detail. You start by entering the names of the trustor, trustee, and beneficiaries in the South Dakota General Form of Irrevocable Trust Agreement. Next, outline the terms of the trust, including its purpose and how the assets will be managed and distributed. Make sure to review your completed document thoroughly and consider seeking legal advice if necessary.

There are various types of irrevocable trusts, but three common categories include irrevocable life insurance trusts, charitable remainder trusts, and special needs trusts. Each type serves a different purpose, such as minimizing taxes or providing for a beneficiary with special needs. The South Dakota General Form of Irrevocable Trust Agreement can be tailored to fit the specific requirements of these various trust types.