South Dakota Contract for Sale of Goods on Consignment is a legally binding agreement that governs the consignment sale of goods in the state of South Dakota. This contract outlines the terms and conditions under which a consignor (seller) transfers ownership and possession of goods to a consignee (the person or business who will sell the goods) for the purpose of sale. Keywords: South Dakota, contract, sale of goods, consignment, consignor, consignee, ownership, possession, terms and conditions. There may be different types of South Dakota Contracts for Sale of Goods on Consignment, including: 1. Standard Consignment Contract: This is the most common type of contract used in consignment sales, where the consignor and consignee agree upon the terms of the consignment, such as the consignment period, commission rate, payment terms, return policies, responsibilities, and liabilities. 2. Exclusive Consignment Contract: In this type of contract, the consignor grants exclusive rights to a single consignee to sell the goods for a specific period. This restricts the consignor from entering into similar agreements with other consignees during the exclusivity period. 3. Non-Exclusive Consignment Contract: Unlike the exclusive contract, the non-exclusive consignment contract allows the consignor to engage multiple consignees simultaneously. This type of contract provides the consignor with more flexibility and the opportunity to reach a larger customer base. 4. Consignment Contract with Minimum Sales Commitment: This contract includes a minimum sales commitment clause, wherein the consignee agrees to achieve a certain level of sales within a specified timeframe. Failure to meet the agreed-upon sales target may result in the termination of the contract or payment of penalties. 5. Consignment Contract with Repurchase Option: This type of contract grants the consignor the right to repurchase unsold goods from the consignee at an agreed-upon price or percentage of the original wholesale price. This offers a safety net for the consignor and reduces the risk of loss on unsold inventory. Regardless of the type, all South Dakota Contracts for Sale of Goods on Consignment should clearly define the consignment period, terms of payment, responsibilities for damaged or lost goods, dispute resolution procedures, insurance coverage, and the process for termination or renewal of the contract. It is important for both the consignor and consignee to thoroughly review and understand the terms of the contract before signing to ensure a fair and mutually beneficial consignment agreement. As contract laws may vary, it is advisable to consult a legal professional familiar with South Dakota's specific regulations when drafting or entering into a contract for the sale of goods on consignment in the state.

South Dakota Contract for Sale of Goods on Consignment

Description

How to fill out South Dakota Contract For Sale Of Goods On Consignment?

Are you in the location where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on isn't easy.

US Legal Forms provides a vast array of form templates, such as the South Dakota Contract for Sale of Goods on Consignment, that are crafted to comply with federal and state regulations.

Utilize US Legal Forms, the most comprehensive selection of legal documents, to save time and avoid errors.

The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have your account, simply Log In.

- Then, you can download the South Dakota Contract for Sale of Goods on Consignment template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it matches the correct city/state.

- Utilize the Preview button to review the document.

- Check the summary to confirm you have selected the right template.

- If the form isn't what you're looking for, use the Search field to find the document that fits your needs and specifications.

- Once you find the correct form, click Get now.

- Select the pricing plan you prefer, fill in the required information to create your account, and purchase the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Explore all of the document templates you have purchased in the My documents menu.

- You can download an additional copy of the South Dakota Contract for Sale of Goods on Consignment whenever necessary; simply click on the desired form to download or print the document template.

Form popularity

FAQ

You typically do not send 1099s to corporations or tax-exempt organizations. Additionally, if you make payments for personal expenses or to foreign individuals, a 1099 is unnecessary. Always confirm who qualifies for exemption in your dealings as outlined in your South Dakota Contract for Sale of Goods on Consignment to ensure proper compliance.

Generally, you do not issue a 1099 for merchandise transactions unless certain criteria are met. The sale of goods typically does not trigger a 1099 form unless it involves a specific type of payment arrangement. Always refer back to your South Dakota Contract for Sale of Goods on Consignment and IRS guidelines to determine your obligations.

Yes, you may receive a 1099 for selling goods if your earnings exceed the IRS threshold. This applies especially if sales are conducted through a consignment arrangement. Keep accurate records and consider the implications of your South Dakota Contract for Sale of Goods on Consignment to ensure compliance with tax reporting.

Certain vendors, such as corporations and tax-exempt organizations, are typically exempt from 1099 reporting. Additionally, if you are working with vendors that provide services rather than goods, you might not need to issue a 1099. When in doubt, refer to IRS guidelines or consider consulting the details in your South Dakota Contract for Sale of Goods on Consignment.

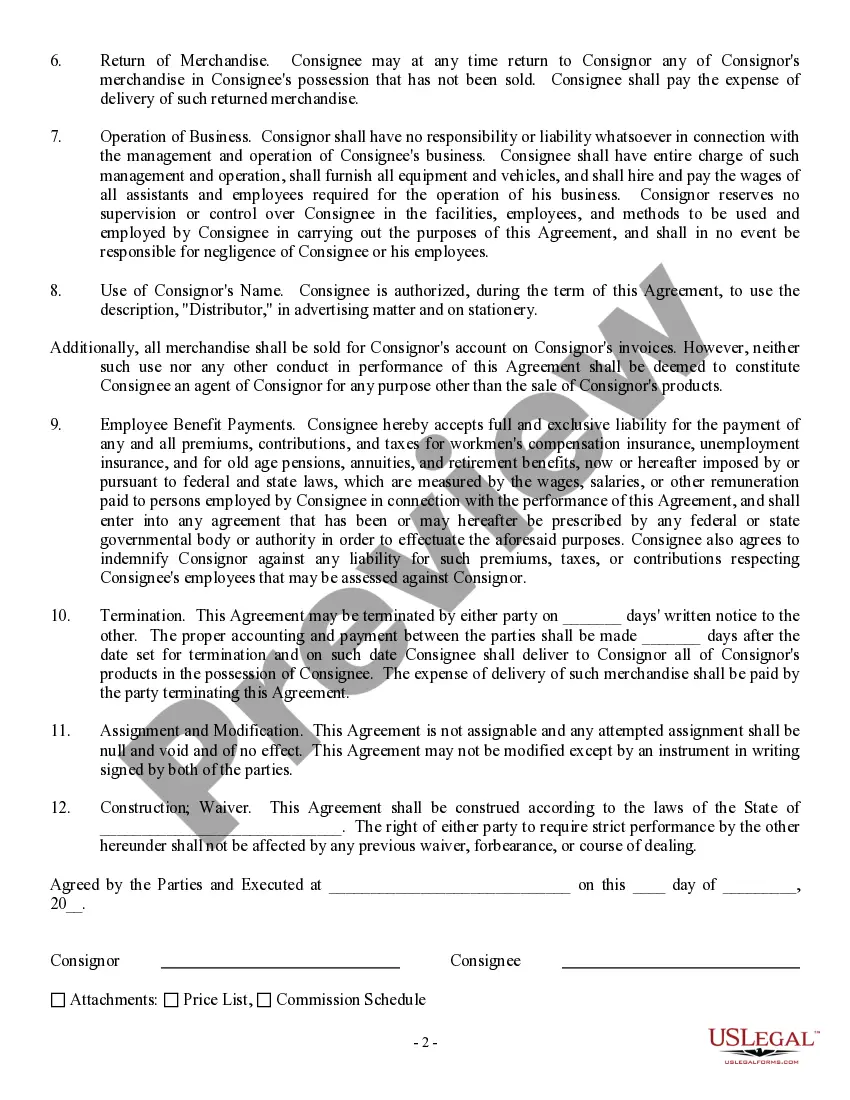

The process of a consignment agreement involves several steps. First, the consignor provides the goods to the consignee, who sells them on behalf of the consignor. Next, establish clear terms regarding revenue sharing and duration of the agreement. For simplicity and legal accuracy, consider using a South Dakota Contract for Sale of Goods on Consignment available on US Legal Forms.

To write a consignment contract, start by detailing the involved parties and defining the goods being consigned. Clearly outline the terms of the consignment, including duration, payment terms, and responsibilities. Ensure your contract adheres to local regulations, especially when dealing with a South Dakota Contract for Sale of Goods on Consignment. Using a platform like US Legal Forms can simplify drafting your contract and ensure compliance.

When goods are bought by description, the buyer relies heavily on the portrayal given by the seller. This reliance creates an obligation for the seller to deliver goods that match the description. In a South Dakota Contract for Sale of Goods on Consignment, the descriptive terms are crucial to a successful sale. Therefore, ensuring that the description is precise protects both the buyer's interests and the seller's reputation.

The description of goods in a contract outlines the specific attributes and qualities of the items being sold. This information includes details about the type, quantity, and quality of the goods. In a South Dakota Contract for Sale of Goods on Consignment, a clear description helps prevent misunderstandings between the buyer and seller. An accurate description not only ensures expectations are met but also fosters trust in the transaction.

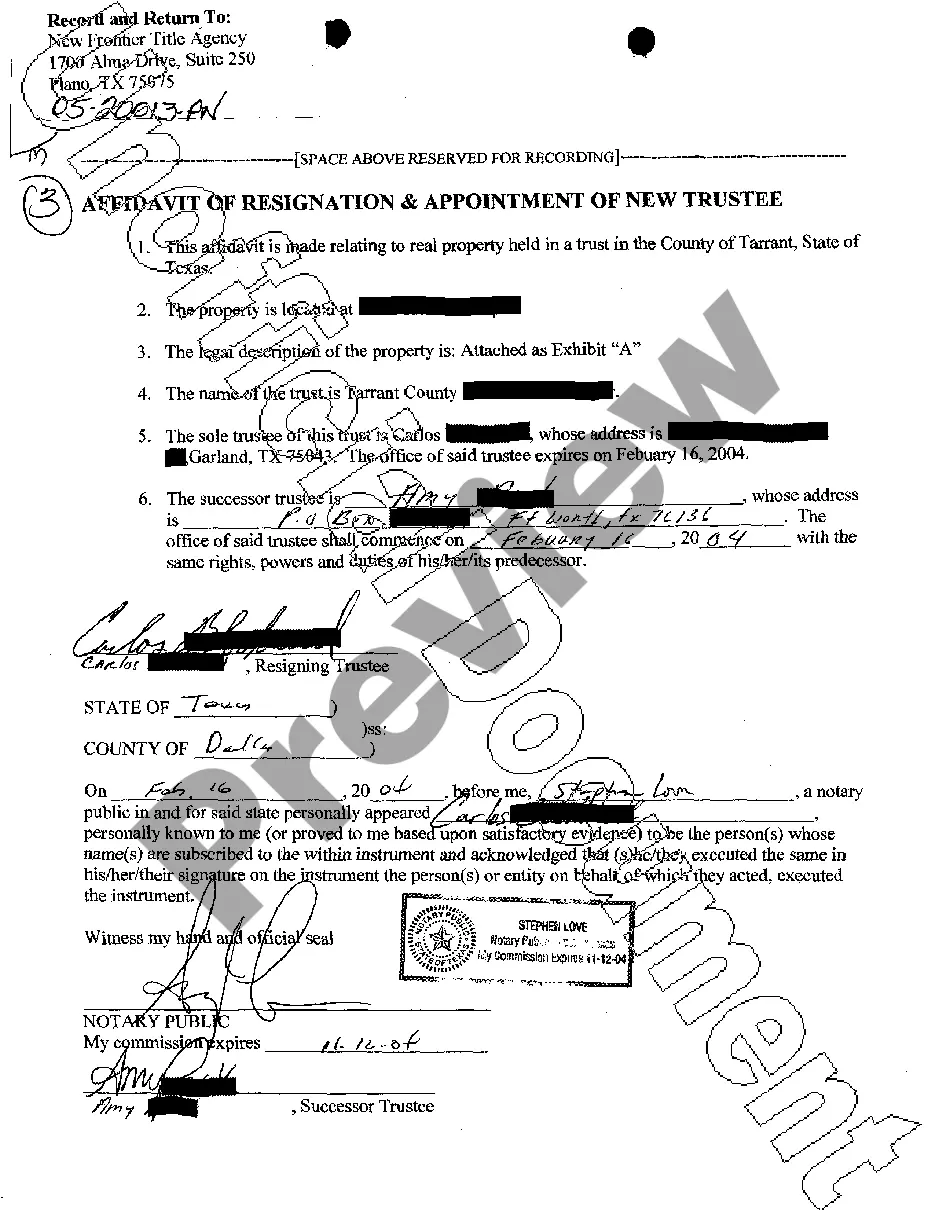

A contract for sale of goods on consignment allows goods to be sold by one party on behalf of another without transferring ownership until the sale occurs. In this arrangement, the seller retains ownership until the goods are sold to the final consumer. This type of contract provides flexibility and lowers risk, making it a popular choice for businesses in South Dakota. Understanding the terms involved in a South Dakota Contract for Sale of Goods on Consignment is vital for successful business partnerships.

A contract for the sale of goods by description occurs when the specifics of the goods are detailed in the agreement. This approach allows buyers to rely on the description provided by the seller, ensuring they receive what they expect. In a South Dakota Contract for Sale of Goods on Consignment, accurate descriptions are crucial for satisfaction and trust. By clearly defining the goods, both parties can avoid potential conflicts.

Interesting Questions

More info

& Accounting & Reporting Deeper Understanding & Financial Models and Accounting for the SMB to Build a Financial Model for Business Consign ability/Assignment in the Small Business to Build Financial Models for Business Consignment Sale Pricing and Understanding to Build Business Consign ability/Assignment in the Small Business to Build Financial Models for Business Analysis Exam Review for the SMB Consignment Sale — Business Analysis Exam Review Business Analysis Course Exam Review for the SMB Consignment Sale & Consignment Auction for the Small Business The Consignment Sale Accounting & Consignment Seller's Inventory Analysis/Consignment Audit for the Small Business to Build a Financial Model for Business Consignment Sale Management to Build Financial Models for Business Consignment Sale Seller's Inventory Analysis/Consignment Audit for the Small Business to Build a Financial Model for Business Consignment Sale Process Understanding and Operations for Business Consignment