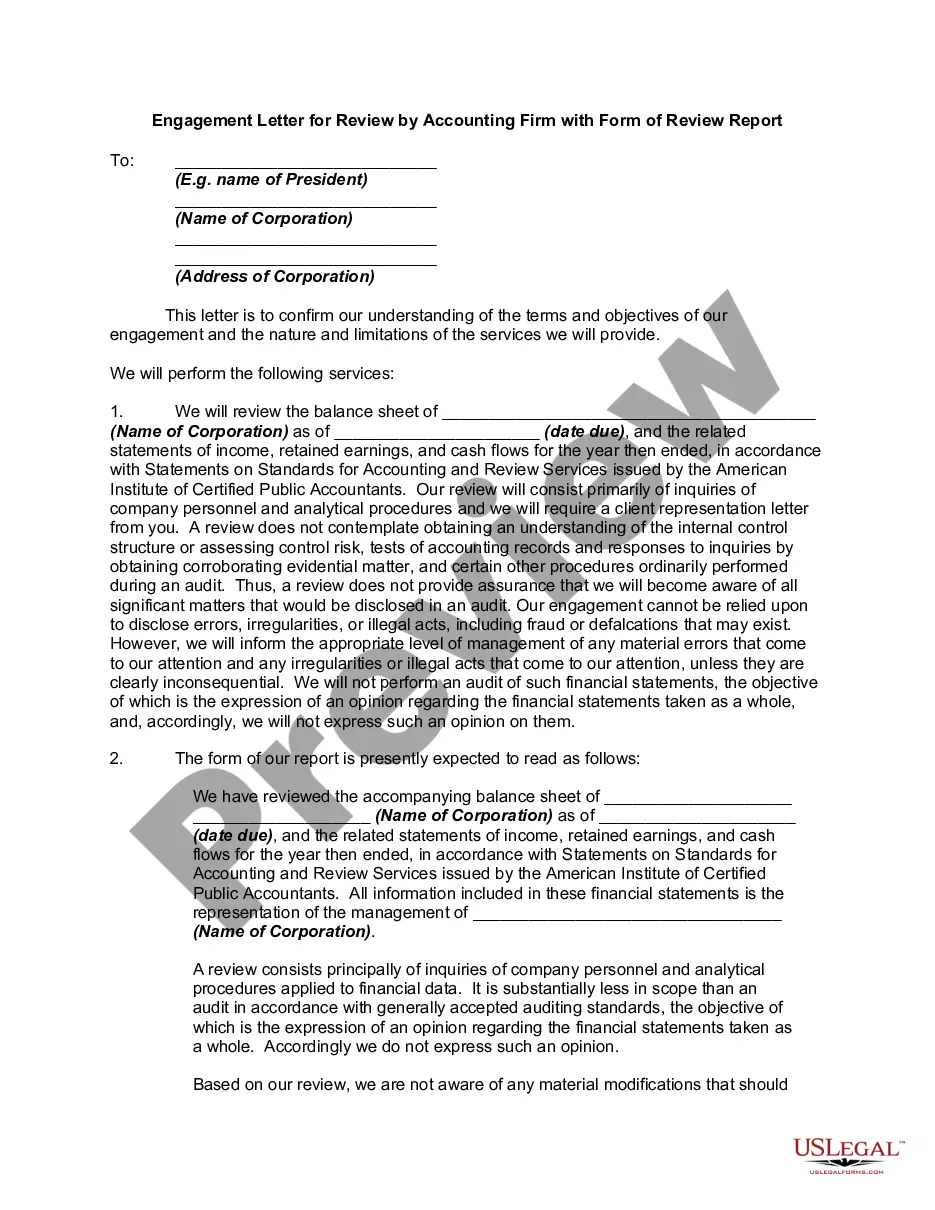

Generally, a contract to employ a certified public accountant need not be in writing.

However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation

Description

How to fill out Engagement Letter Between Accounting Firm And Client For Tax Return Preparation?

Selecting the finest authorized document template can be a challenge. Naturally, there are many templates accessible online, but how do you identify the legal form you require? Utilize the US Legal Forms website.

The service provides a vast array of templates, including the South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation, which can be utilized for both business and personal needs. All forms are verified by experts and comply with federal and state regulations.

If you are already a member, Log In to your account and click on the Obtain button to access the South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation. Use your account to search through the legal forms you have previously acquired. Visit the My documents section of your account to download another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to download professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your city/region.

- You can review the form using the Review option and read the form description to confirm it is appropriate for you.

- If the form does not meet your needs, utilize the Search area to find the suitable form.

- Once you are confident that the form is correct, click on the Buy now button to acquire the form.

- Choose your desired pricing plan and enter the necessary information.

- Create your account and complete the order using your PayPal account or credit card.

Form popularity

FAQ

A CPA letter from a tax preparer is a formal document that positions the Certified Public Accountant (CPA) as the responsible party for preparing a client's tax returns. This letter may include essential information about disclosures, client duties, and associated fees. Receiving such a letter ensures that the client understands the CPA's role and the services they will receive. Utilizing a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation can enhance transparency and trust in this process.

A tax engagement letter is a specific type of engagement letter focused on tax-related services. It outlines what the accountant will do, such as preparing returns, advising on tax savings, and any compliance requirements. This letter is crucial for clarifying responsibilities and duties regarding tax matters. A South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation can serve as an effective template for this purpose.

The primary purpose of an engagement letter is to define the scope of work between a client and an accounting firm. It establishes guidelines for the services to be rendered, the timeline, and the fees involved. By providing clear expectations, both parties can avoid disputes and enhance communication. Therefore, implementing a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation is beneficial for effective collaboration.

A tax return engagement letter is a formal document that outlines the terms between an accounting firm and a client regarding tax return preparation services. This letter clarifies the responsibilities of both parties and the specific services provided. By formalizing the engagement, it helps prevent misunderstandings and ensures that both the accounting firm and the client are on the same page. Using a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation strengthens this professional relationship.

The engagement letter is typically prepared by the accounting firm providing the services. In cases involving tax returns, like a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation, the firm outlines the terms and scope specific to those services. By having the accounting firm draft the letter, clarity and professionalism are maintained. This process also ensures that all legal and compliance requirements are met, protecting both parties involved.

The CPA review engagement letter is a document that outlines the terms of a review service conducted by a Certified Public Accountant. This letter specifies the objectives, scope, and deliverables of the review, similar to a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation. It ensures that clients understand the nature of the services they will receive, fostering transparency and trust. Proper documentation helps maintain high standards in financial reporting and preparation.

An engagement in accounting refers to a formal arrangement between an accountant and a client regarding specific services. This includes everything from tax return preparation to financial audits. A South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation documents the responsibilities and expectations of both parties, ensuring a smooth working relationship. Engaging with the right professional can smooth out tax preparation and improve financial outcomes.

An engagement letter from an accountant is a formal document that defines the scope of services provided to a client. In the context of a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation, this letter specifies the type of tax services, deadlines, and required documentation. This document protects both the accountant and the client by ensuring understanding regarding the services rendered and responsibilities. It creates a basis for accountability in the accounting relationship.

A letter of engagement outlines the agreement between an accounting firm and a client. For example, in a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation, the letter details the services to be provided, the responsibilities of each party, and the terms of payment. This clarity helps prevent misunderstandings and ensures that both parties are on the same page. It acts as a formal record of the expectations set by both sides.

To prepare your taxes effectively, you should provide your accountant with essential documents including your W-2 forms, 1099 forms, and any receipts related to deductions. Additionally, you need to share your previous year’s tax return for reference. Importantly, consider having a South Dakota Engagement Letter Between Accounting Firm and Client For Tax Return Preparation in place to outline your agreement with the accountant. This letter helps clarify the services provided and ensures a smooth process for your tax preparation.