Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

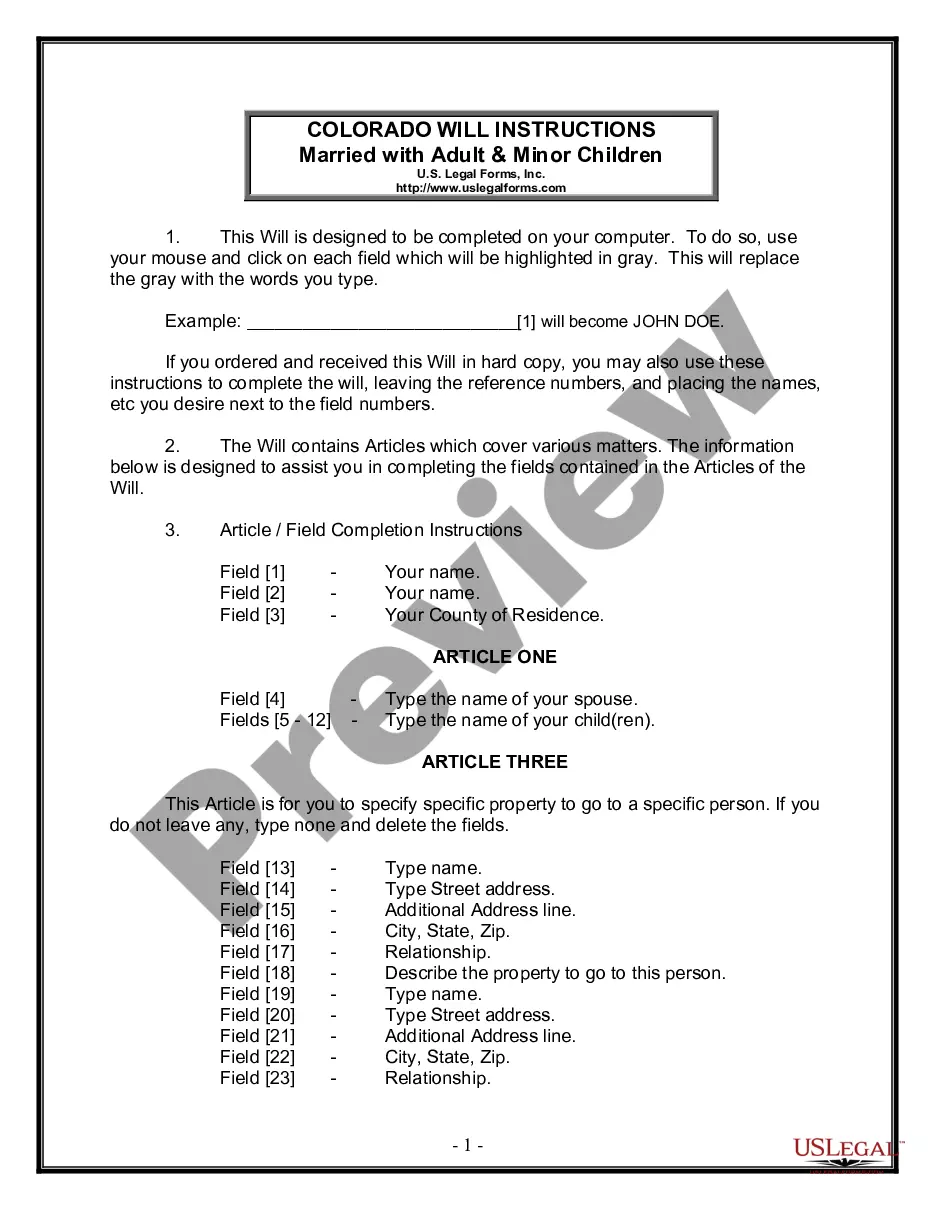

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A South Dakota Fiduciary — Estatothersus— - Tax Return Engagement Letter is a formal agreement between a licensed tax professional or firm and a trustee or executor responsible for filing tax returns on behalf of an estate or trust in South Dakota. This letter outlines the terms and conditions of the engagement, ensuring a clear understanding of the services provided, responsibilities of both parties, and any fees or compensation involved. South Dakota has specific tax laws and regulations governing the filing of fiduciary tax returns for estates or trusts. It is crucial to engage the services of a qualified tax professional who is well-versed in these rules to ensure accurate and compliant tax reporting. The South Dakota Fiduciary — Estatothersus— - Tax Return Engagement Letter typically covers essential details such as: 1. Identification of the parties: The engagement letter should clearly state the names and contact information of the tax professional or firm and the trustee or executor. This ensures there is no confusion regarding the involved parties. 2. Scope of services: The engagement letter specifies the services that the tax professional will provide, such as the preparation and filing of South Dakota fiduciary tax returns, calculation of taxable income, deductions, and credits, and any necessary correspondence with tax authorities. 3. Responsibilities: The letter delineates the responsibilities of both parties for accurate and complete information exchange. The trustee or executor is responsible for providing all necessary financial records, tax documents, and relevant information, while the tax professional is responsible for utilizing their expertise to prepare accurate tax returns in accordance with South Dakota's tax laws. 4. Deadlines: The engagement letter should outline the deadlines for the completion and filing of the tax returns, taking into consideration South Dakota's specific filing requirements. 5. Fees and compensation: The letter states the fee structure, payment terms, and any additional costs such as postage, photocopying, or third-party service charges. It is important to define the payment schedule and whether the fees are based on an hourly rate or a fixed fee arrangement. 6. Confidentiality: The engagement letter should include a confidentiality clause, assuring the trustee or executor that all information disclosed during the engagement will be treated with strict confidentiality in accordance with professional standards and legal requirements. Different types or variations of South Dakota Fiduciary — Estatothersus— - Tax Return Engagement Letters may exist based on the complexity of the estate or trust, the terms of the engagement, and the level of services required. However, the essential elements mentioned above should be covered in all engagement letters to ensure a clear understanding and mutual agreement between both parties.