A Trust is an entity which owns assets for the benefit of a third person (the beneficiary). A Living Trust is an effective way to provide lifetime and after-death property management and estate planning. When you set up a Living Trust, you are the Grantor. Anyone you name within the Trust who will benefit from the assets in the Trust is a beneficiary. In addition to being the Grantor, you can also serve as your own Trustee. As the Trustee, you can transfer legal ownership of your property to the Trust. A revocable living trust does not constitute a gift, so there are no gift tax consequences in setting it up.

South Dakota Revocable Trust Agreement Regarding Coin Collection

Description

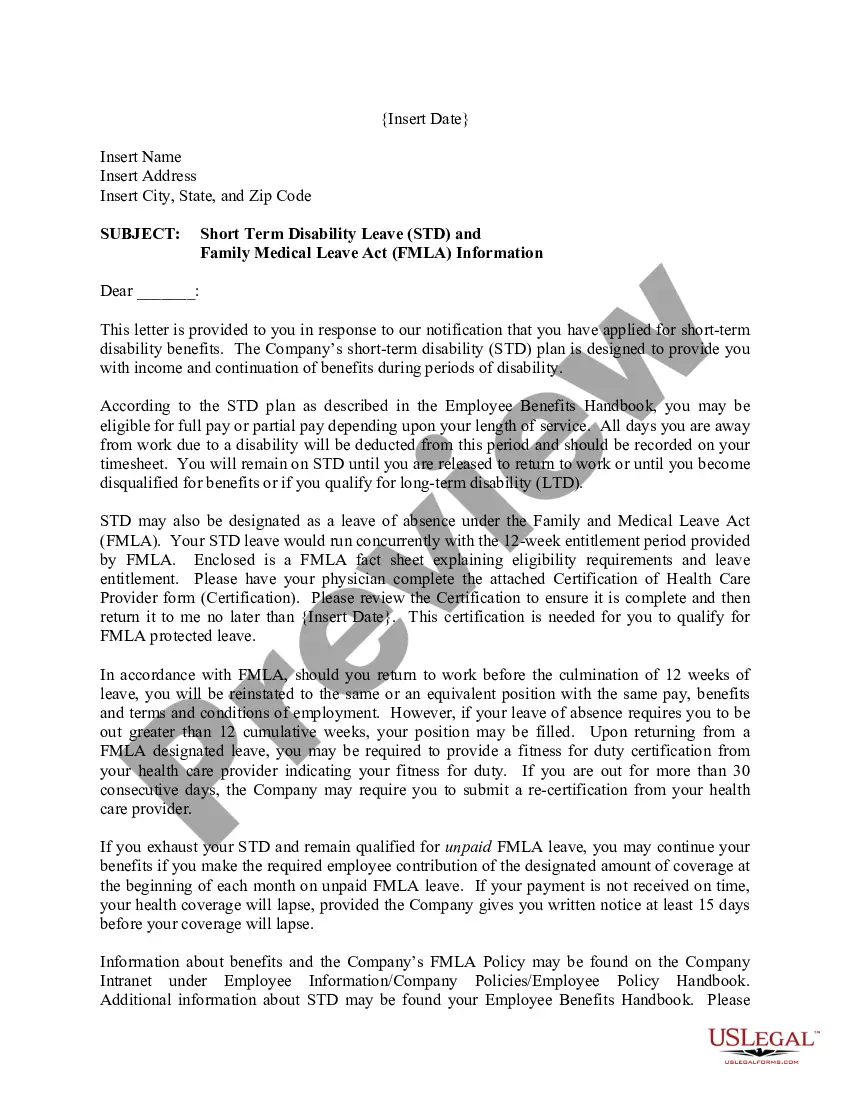

How to fill out Revocable Trust Agreement Regarding Coin Collection?

Finding the appropriate legal document template can be quite a challenge.

Clearly, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the South Dakota Revocable Trust Agreement Concerning Coin Collection, that can be used for both business and personal purposes.

You can preview the form using the Preview button and review the form summary to confirm that it is suitable for you.

- All forms are verified by professionals and comply with state and federal regulations.

- If you are currently registered, sign in to your account and click the Download button to obtain the South Dakota Revocable Trust Agreement Concerning Coin Collection.

- Utilize your account to review the legal forms you have previously purchased.

- Visit the My documents section of your account and acquire an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward steps for you to follow.

- First, ensure that you have selected the correct form for your locality/state.

Form popularity

FAQ

While a revocable living trust offers flexibility, it also has drawbacks. One key disadvantage is that it does not provide asset protection from creditors. Additionally, creating a South Dakota Revocable Trust Agreement Regarding Coin Collection can involve upfront costs and ongoing administration. Understanding these limitations can help you decide if this option fits your needs.

In South Dakota, creditors can access assets in a revocable trust during the grantor's lifetime, as the trust is not considered a separate legal entity. This means that if you face financial difficulties, creditors may pursue the assets held within your South Dakota Revocable Trust Agreement Regarding Coin Collection. It's crucial to understand these implications and plan accordingly.

Setting up a revocable trust in South Dakota involves drafting a South Dakota Revocable Trust Agreement Regarding Coin Collection. You must detail the terms of the trust, appoint a trustworthy trustee, and outline how the assets, including your coin collection, will be managed. Using a reputable service like uslegalforms can simplify the process and ensure that all legal requirements are met.

To create a trust in South Dakota, you need a clear intention to establish a trust, a designated trustee, and identifiable trust property, such as a coin collection. Additionally, the trust should comply with South Dakota laws and be in writing. A South Dakota Revocable Trust Agreement Regarding Coin Collection can guide you through this process effectively.

Transferring assets to a revocable trust involves changing the titles of the assets so that they reflect ownership by the South Dakota Revocable Trust Agreement Regarding Coin Collection. This process can include updating deeds for real estate, re-titling bank accounts, and changing beneficiaries on insurance policies. It’s advisable to seek legal assistance to ensure all transfers are executed properly and in accordance with applicable laws.

One potential downside of a revocable trust is that it does not provide asset protection from creditors, as the assets are still considered part of your estate. Additionally, creating a trust can involve upfront legal costs, and it requires ongoing management. However, investing in a South Dakota Revocable Trust Agreement Regarding Coin Collection can yield long-term benefits by simplifying the transfer of assets after your passing.

Yes, assets in a revocable trust can be subject to creditors' claims. Since a revocable trust allows the creator to maintain control over the assets, creditors may have access during litigation or bankruptcy. However, employing a South Dakota Revocable Trust Agreement Regarding Coin Collection can offer some benefits, such as avoiding probate. Consult with a financial advisor to understand your specific situation regarding creditor claims.

Writing a trust agreement starts with outlining your intentions clearly in the South Dakota Revocable Trust Agreement Regarding Coin Collection. It's crucial to include details such as the trust's purpose, the assets involved, and the responsibilities of the trustees. To ensure the agreement stands up legally, you should consider using a trusted service like uslegalforms that can help you draft a comprehensive and legally binding document.

Placing your assets in a revocable trust begins with identifying which assets you want to include in your South Dakota Revocable Trust Agreement Regarding Coin Collection. Next, you will need to title the assets in the name of the trust. This can involve changing titles on properties, updating beneficiary designations, and more. A legal expert can guide you in this process to ensure everything is completed correctly.

To effectively move all your assets into a trust, you will need to change the title of each asset to the name of your South Dakota Revocable Trust Agreement Regarding Coin Collection. Start with financial accounts, real estate, and personal possessions, and ensure all paperwork is completed. Additionally, you might want to consult with a legal professional to ensure compliance with laws and regulations, making the process seamless.