South Dakota Contract for the Sale and Purchase of Commercial or Industrial Property

Description

How to fill out Contract For The Sale And Purchase Of Commercial Or Industrial Property?

Are you currently in a situation where you need documents for either business or personal use nearly every working day.

There are many legal document templates available online, but locating reliable versions is not easy.

US Legal Forms offers a vast array of form templates, including the South Dakota Contract for the Sale and Purchase of Commercial or Industrial Property, which can be completed to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment for the order using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the South Dakota Contract for the Sale and Purchase of Commercial or Industrial Property template.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Obtain the form you require and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you seek, use the Search section to find the form that meets your needs.

- When you find the appropriate form, click on Get now.

Form popularity

FAQ

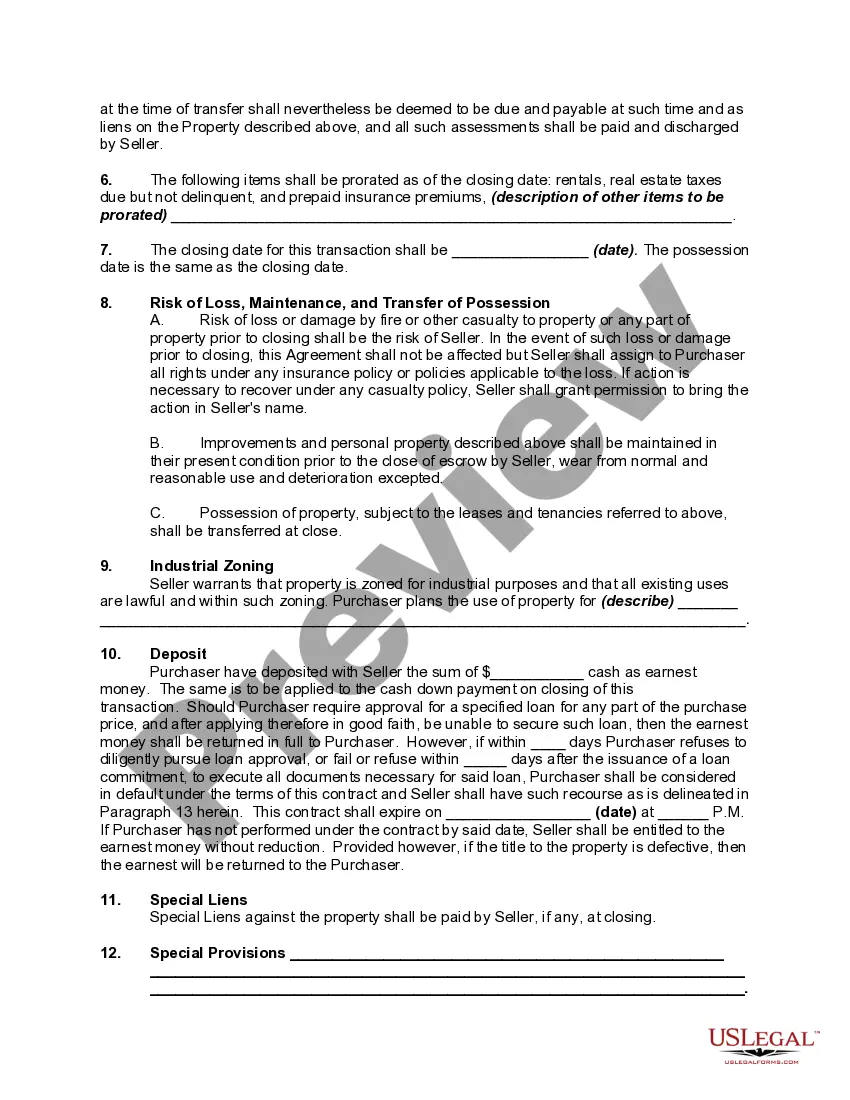

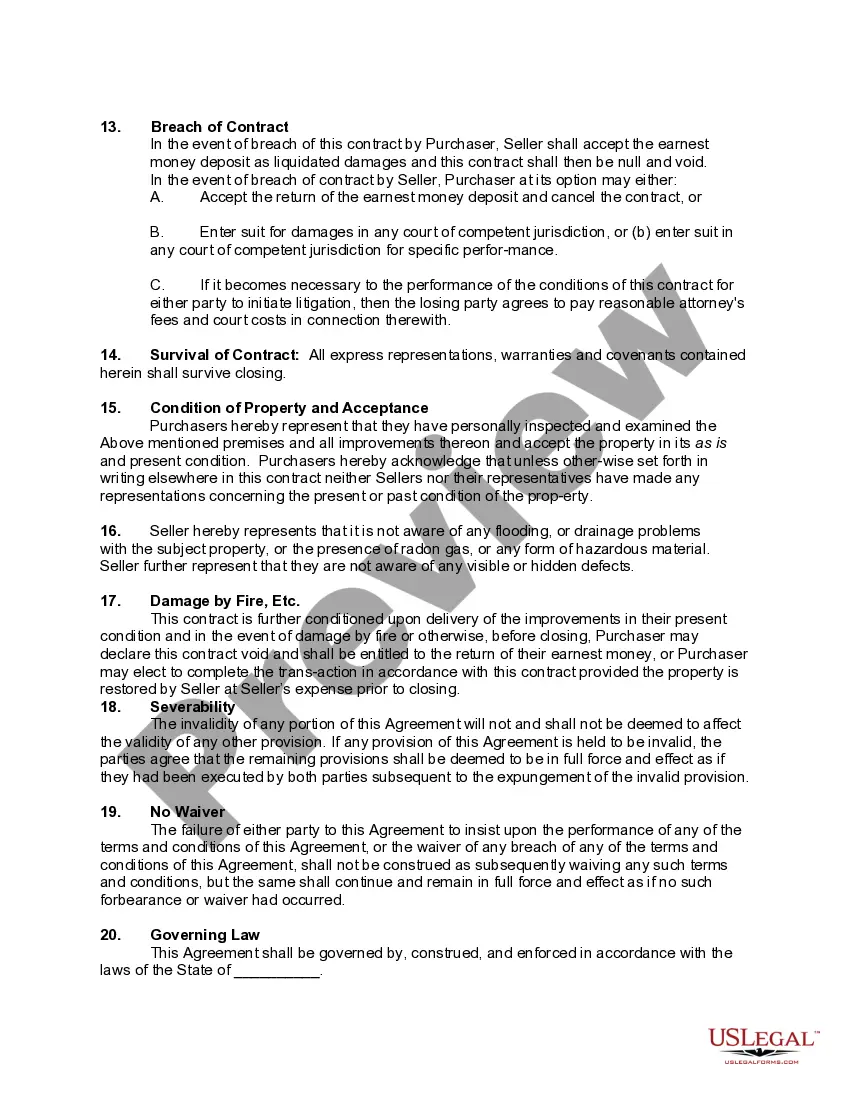

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

Real Estate Terms GlossaryBorrower.Broker.Buyer's agent/listing agent.Buyer's market/seller's market.Co-borrower.Commission.Eminent domain.Exclusive listing.More items...?

Contract of sale in business law is an agreement to show the terms and conditions of a transaction, sometimes called a sales and purchase agreement or just a sales agreement. The agreement is more detailed than a bill of sale or a basic sales receipt. It can include conditions that are imposed on the parties involved.

There are essentially four types of real estate contracts: purchase agreement contracts, contracts for deed, lease agreements, and power of attorney contracts.

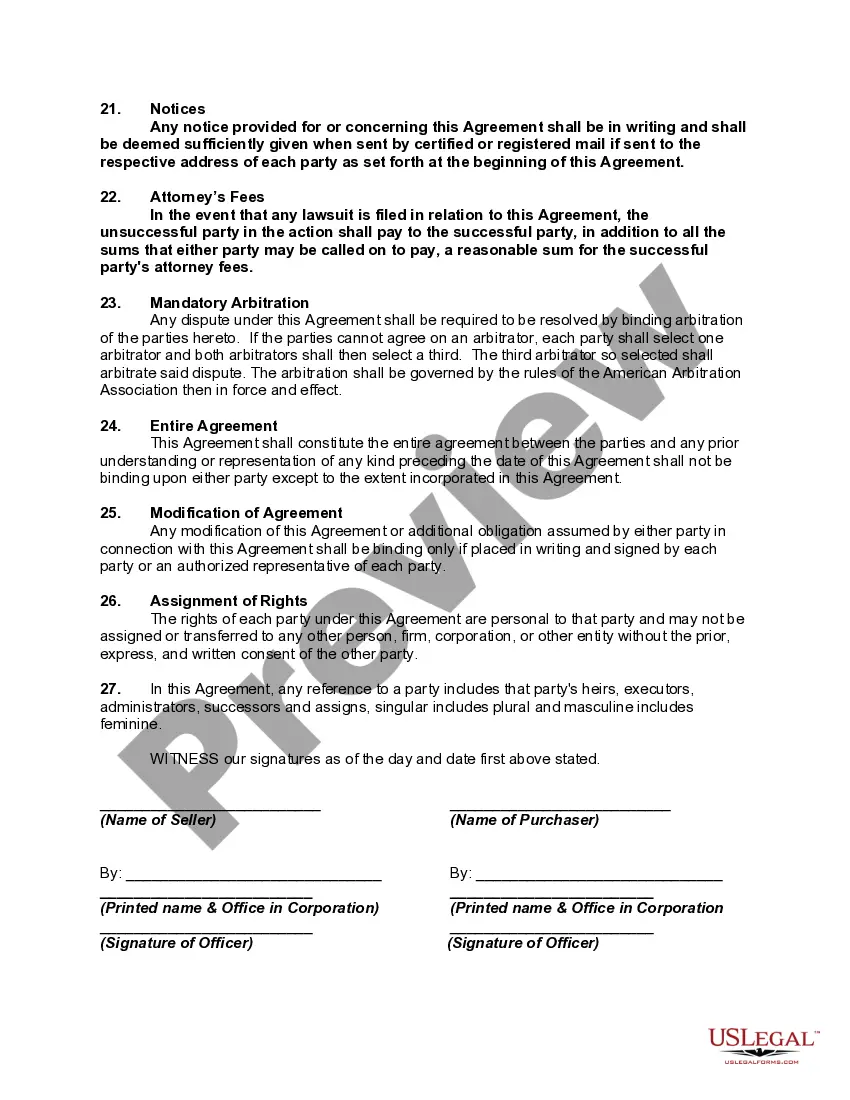

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

The Five Elements of a ContractOffer.Acceptance.Consideration.Capacity.Lawful Purpose.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

An agreement of sale is a legal document that outlines the terms of a real estate transaction. It lists the price and other details of the transaction, and is signed by the seller and the buyer. An agreement of sale is also known as the contract of purchase, contract for sale, contract agreement or sale agreement.

Definition: in the case where the seller agrees with the buyer to transfer the title of ownership on a future date upon satisfying a certain condition is called as 'Agreement to Sale'. Example: 'X' sold 10 bags of Rice to 'Y' against payment of Rs. 5,000. Example: 'X' agrees to sell 10 bags of Rice to 'Y' for Rs.