South Dakota Lease of Hotel: A Comprehensive Guide to Hotel Leasing in the State Introduction: A South Dakota Lease of Hotel is a legally binding agreement between a property owner (lessor) and a hotel operator (lessee) that allows the lessee to operate and manage a hotel property owned by the lessor. This lease agreement provides a framework that governs the rights, responsibilities, and obligations of both parties involved. It is crucial for both lessors and lessees to understand the key aspects and types of hotel leases available in South Dakota to navigate the process smoothly. Types of South Dakota Lease of Hotel: 1. Triple Net Lease A Triple Net Lease is a common type of hotel lease where the lessee is responsible for paying all operating expenses, including property taxes, insurance, and maintenance costs. This type of lease offers the lessor a passive ownership role while providing the lessee with operational control over the hotel. 2. Gross Lease Alternatively, a Gross Lease involves the lessee paying a fixed rental amount, while the lessor covers most or all of the operating expenses. This lease type offers simplicity for both parties as the lessee does not have to worry about variable operational costs. 3. Percentage Leases A Percentage Lease combines a base rental rate with a percentage of the hotel's gross revenue. This lease structure creates a partnership between the lessor and lessee, as the lessee's rental payment is directly linked to the hotel's financial performance. Key Provisions in a South Dakota Lease of Hotel: 1. Duration: Specifies the lease term, including the start and end date, along with any renewal or termination provisions. 2. Rental Terms: Outlines the rent amount and payment schedule, including any escalation clauses that adjust the rent over time. 3. Maintenance Responsibilities: Defines the maintenance and repair obligations of both the lessor and lessee, including regular upkeep, structural repairs, and compliance with building codes. 4. Insurance: Addresses insurance requirements, such as liability coverage, property insurance, and workers' compensation policies. 5. Use of Premises: Sets out the authorized use of the hotel property, ensuring compliance with local zoning regulations and any restrictions imposed by the lessor. 6. Operating Expenses: Specifies how operating expenses, such as utilities, property taxes, and common area maintenance fees, will be allocated between the lessor and lessee. 7. Default and Termination: Outlines the consequences and procedures in case of lease violations, non-payment, or default, as well as the conditions under which either party can terminate the lease agreement. Keyword List: — SoutDakotasaoooooh ohoho metete— - hotel lease agreement — hotel leasing in SoutDakotaot— - South Dakota hotel lease types — Triple Net Leas— - Gross Lease - Percentage Lease — leasdurationio— - rental terms - maintenance responsibilities — insurance requirement— - authorized use of premises — South Dakota hotel lease provision— - operating expenses allocation — default and terminatioprocedureeeeeees.BS.

South Dakota Lease of Hotel

Description

How to fill out South Dakota Lease Of Hotel?

US Legal Forms - one of the greatest libraries of legitimate types in the States - provides a wide array of legitimate document layouts you are able to download or print out. While using website, you can get a large number of types for organization and person uses, categorized by classes, says, or keywords.You will discover the latest models of types just like the South Dakota Lease of Hotel in seconds.

If you currently have a membership, log in and download South Dakota Lease of Hotel in the US Legal Forms library. The Down load button will show up on each kind you perspective. You get access to all earlier saved types from the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, listed below are easy directions to obtain began:

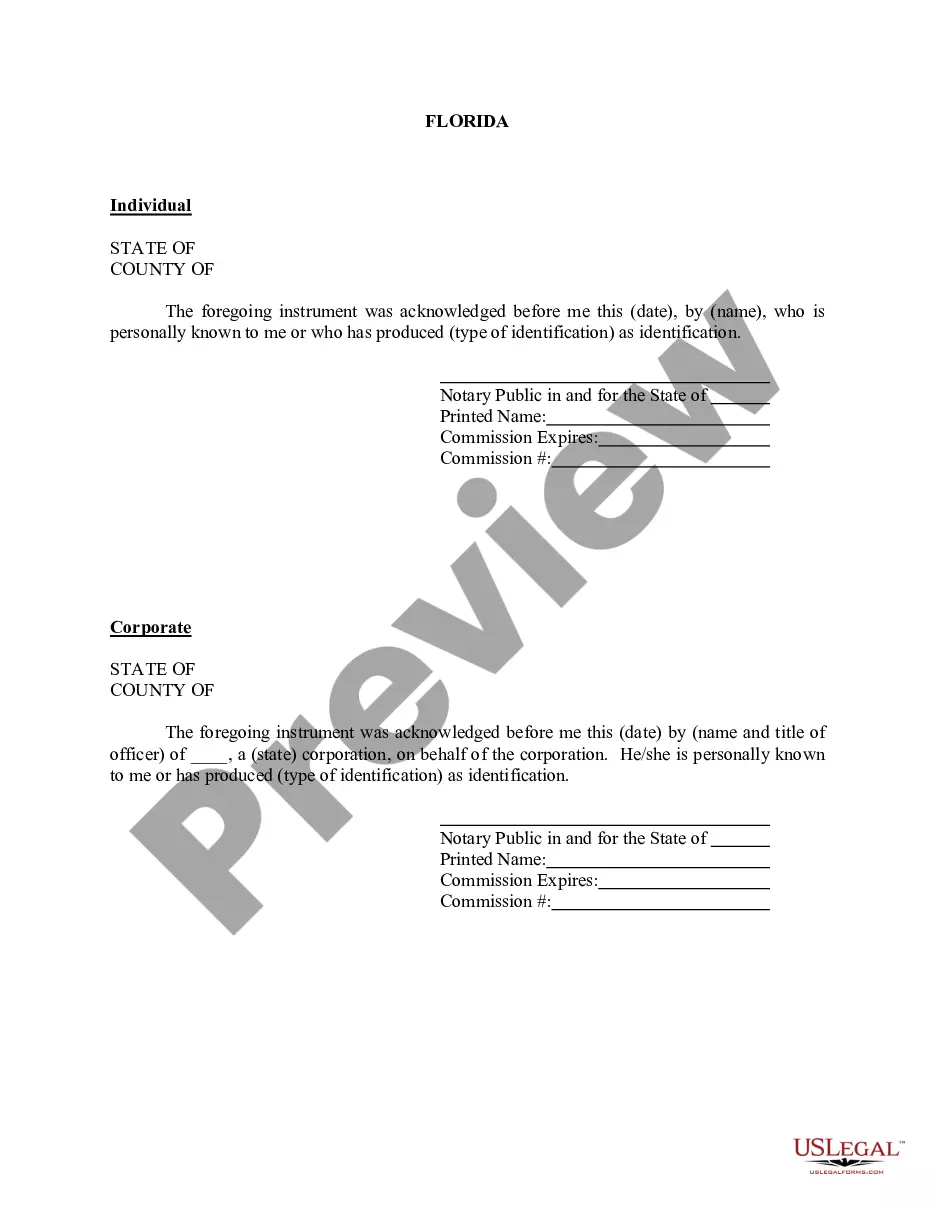

- Be sure you have picked out the proper kind to your town/region. Go through the Preview button to review the form`s content. Read the kind description to ensure that you have selected the right kind.

- In the event the kind doesn`t satisfy your needs, utilize the Search area towards the top of the monitor to discover the one which does.

- If you are content with the shape, validate your choice by clicking the Purchase now button. Then, select the prices prepare you want and supply your accreditations to sign up for the profile.

- Process the purchase. Make use of your credit card or PayPal profile to complete the purchase.

- Choose the file format and download the shape on the system.

- Make alterations. Load, modify and print out and indicator the saved South Dakota Lease of Hotel.

Every single web template you included in your money lacks an expiry day which is the one you have forever. So, in order to download or print out one more version, just check out the My Forms portion and click about the kind you require.

Get access to the South Dakota Lease of Hotel with US Legal Forms, by far the most extensive library of legitimate document layouts. Use a large number of expert and express-specific layouts that satisfy your organization or person requirements and needs.

Form popularity

FAQ

Yes, rentals, including hotel stays, are generally subject to taxation in South Dakota. When you enter a South Dakota Lease of Hotel, you will encounter taxes like sales tax and hotel tax, which together contribute to the overall expense of your stay. Familiarizing yourself with these taxes can aid in budgeting effectively for your lodging needs.

The sales tax on hotel rooms varies by state; in South Dakota, the state sales tax rate of 4.5% applies to hotel accommodations. Additionally, local taxes may apply, making it essential to clarify these charges before entering a South Dakota Lease of Hotel. Always check for the specific tax rates in the region where you plan to stay.

Renters in South Dakota have specific rights that protect them, especially when engaging in agreements like a South Dakota Lease of Hotel. Tenants have the right to a habitable living space, privacy, and proper notice before eviction. Moreover, they can withhold rent if the landlord fails to maintain the property according to local lease laws.

The South Dakota tax rate for business operations, including a South Dakota Lease of Hotel, encompasses both state and local taxes. Generally, the state sales tax rate is 4.5%, but local jurisdictions can impose additional taxes, which may vary. It's essential to check specific locality rates for accurate calculations, especially if you're entering into a hotel lease.

You can write your own lease, including a South Dakota Lease of Hotel, by outlining all necessary terms and conditions. Ensure that your document includes essential elements like names, rental amounts, and property details. If you're unsure, consider using templates or guidance available from platforms like US Legal Forms, which can help confirm that your lease meets legal requirements.

To write a good lease, start by outlining clear terms, including rental amounts, duration, and property maintenance responsibilities. Be concise and avoid ambiguous language to prevent misunderstandings. Utilize resources from US Legal Forms to craft a well-structured South Dakota Lease of Hotel that protects both parties.

When writing a letter of lease agreement, begin with a formal greeting, followed by an introduction stating the intention to lease the property. Include all relevant details such as lease terms, property address, and contact information. Close with a request for confirmation, ensuring both parties are on the same page regarding the South Dakota Lease of Hotel.

To write a handwritten lease agreement, start with the date and the names of both parties. Clearly write out the terms of the lease, including rent amount and duration, in clear language. Finally, ensure both parties sign the document to make it valid; this can be a straightforward option for a South Dakota Lease of Hotel.

Yes, you can write your own lease agreement, including a South Dakota Lease of Hotel, as long as it covers the essential elements required by law. Make sure to include the property details, payment schedule, and the rights and obligations of both parties. Consider using templates available on platforms like US Legal Forms to simplify the process.

Examples of lease terms in a South Dakota Lease of Hotel include the duration of the lease, security deposit amount, and the amount of monthly rent. You might also include terms regarding maintenance responsibilities and what happens in case of default. These terms set clear expectations for both parties.

More info

See Also All.