South Dakota Agreement to Partners to Incorporate Partnership

Description

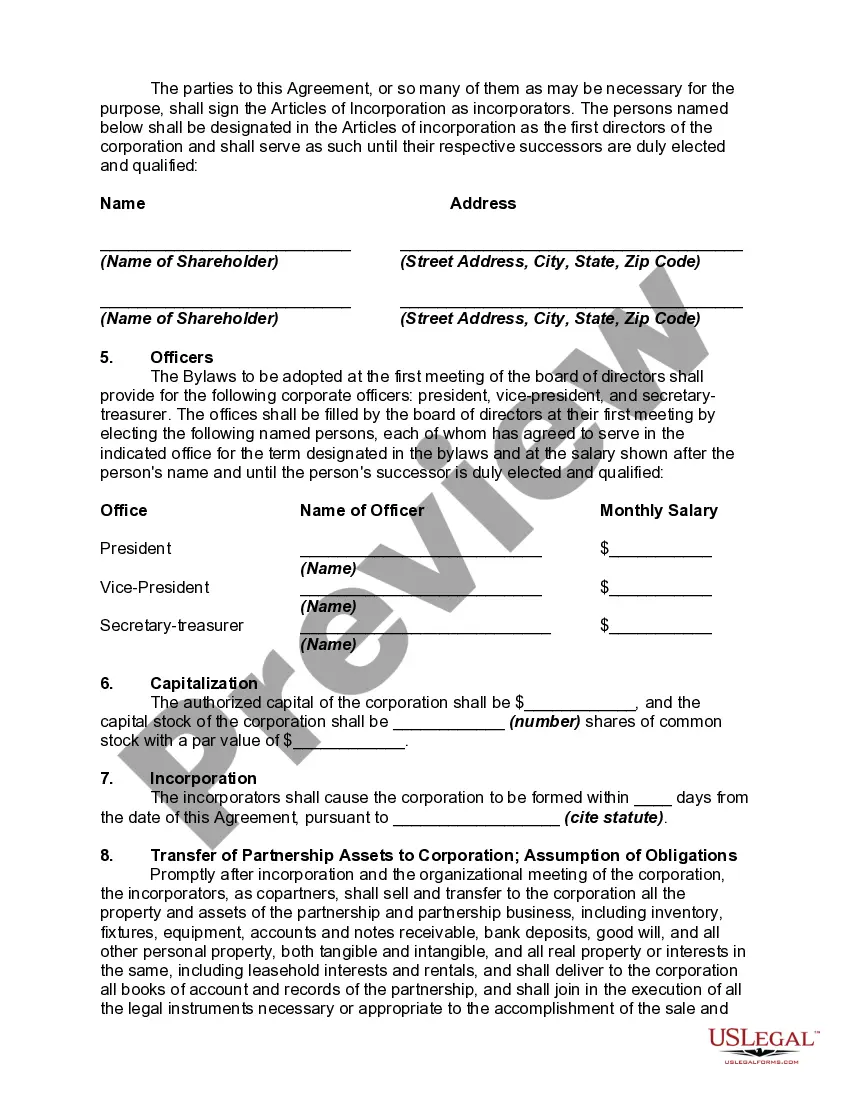

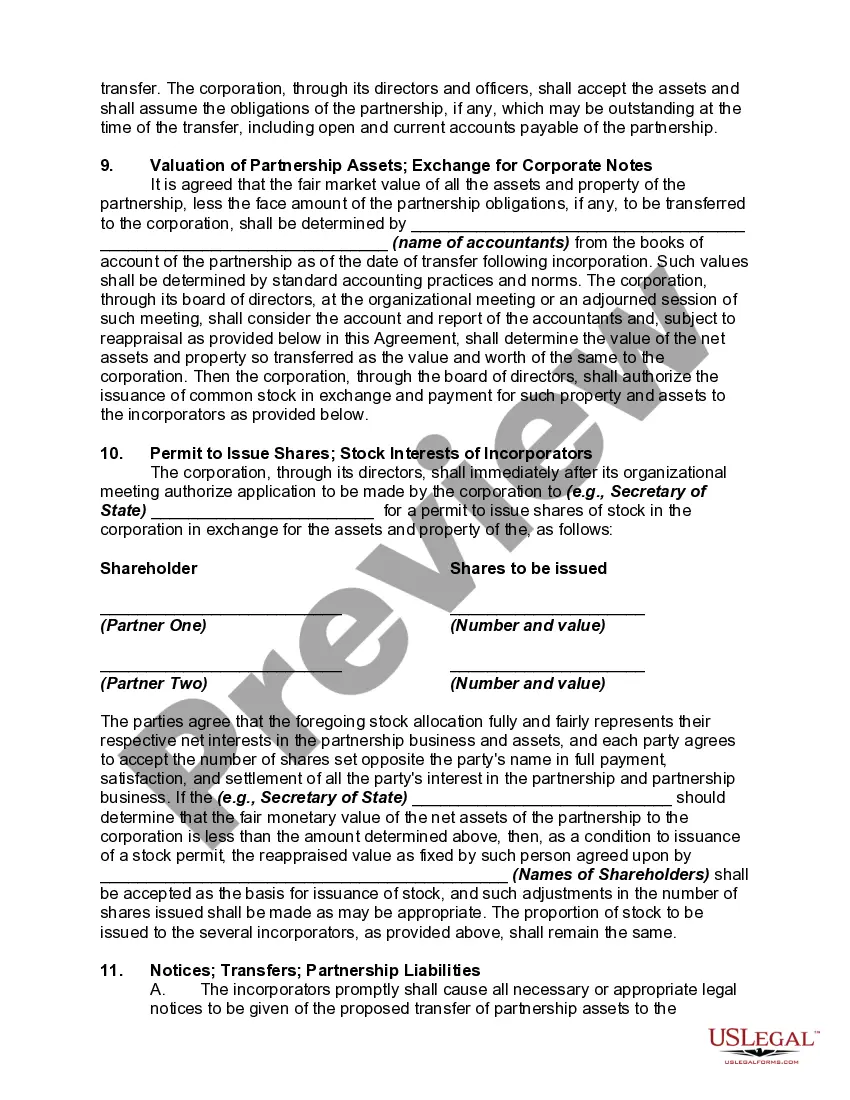

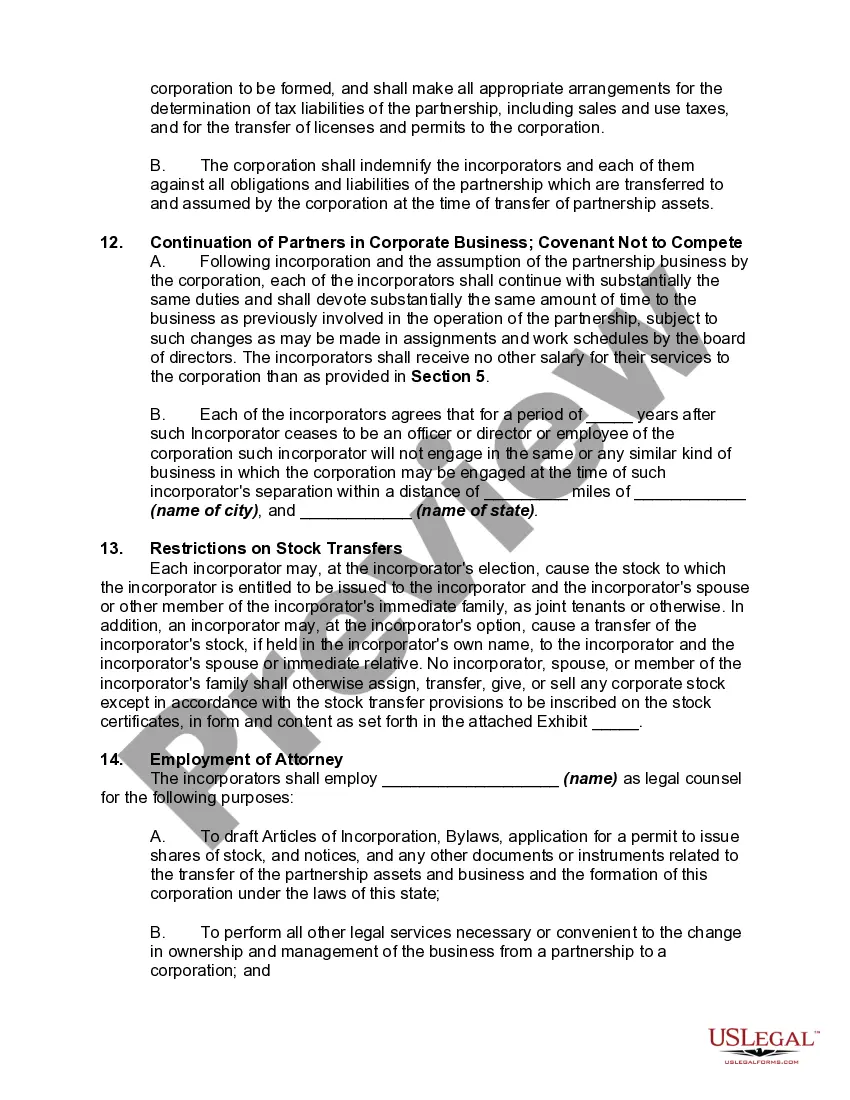

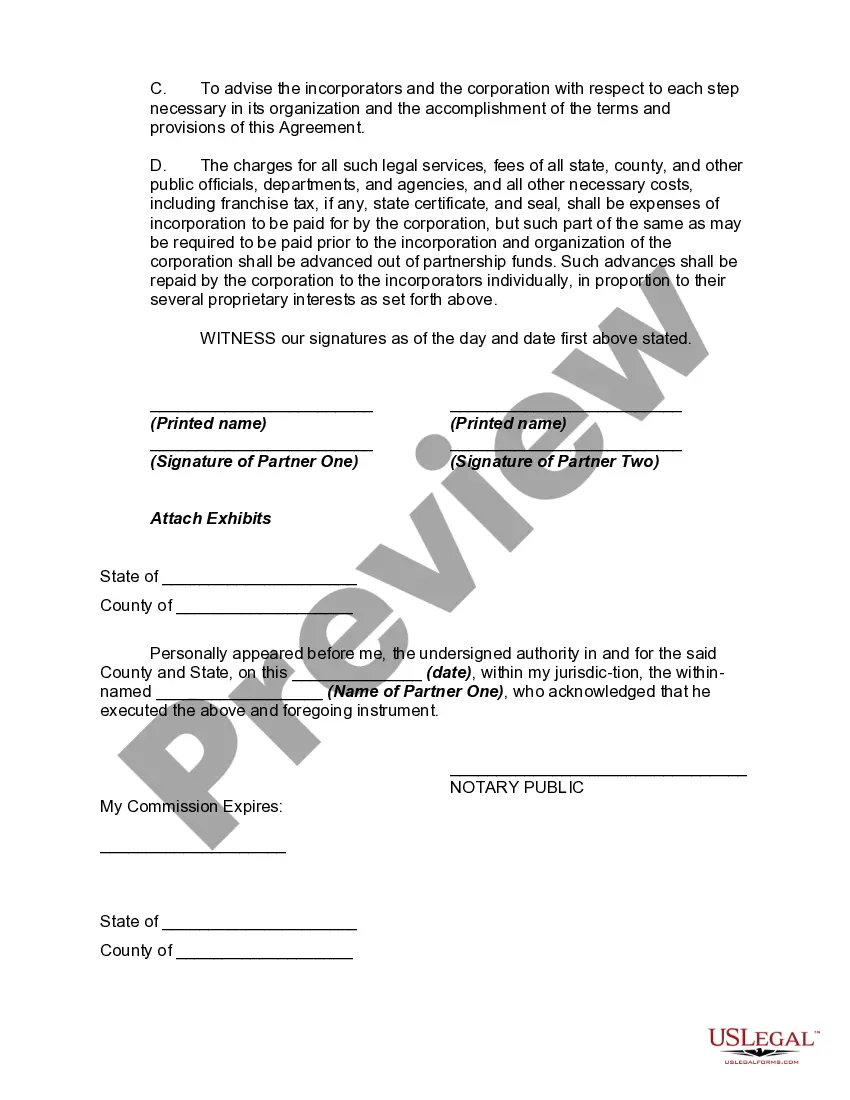

The articles of incorporation is a document that must be filed with a state in order to incorporate. Information typically required to be included are the name and address of the corporation, its general purpose and the number and type of shares of stock to be issued.

How to fill out Agreement To Partners To Incorporate Partnership?

Have you ever been in a situation where you need documents for either business or personal reasons on a daily basis.

There are numerous official document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of template designs, including the South Dakota Agreement to Partners to Incorporate Partnership, which are created to comply with both federal and state requirements.

Once you find the correct form, click on Purchase now.

Choose the payment plan you prefer, complete the necessary information to create your account, and pay for your order using PayPal or credit card. Select a convenient document format and download your copy. You can find all the document templates you’ve purchased in the My documents menu. You can obtain an additional copy of the South Dakota Agreement to Partners to Incorporate Partnership anytime, if necessary. Just select the required form to download or print the document template. Use US Legal Forms, the most extensive collection of official forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- Next, you can download the South Dakota Agreement to Partners to Incorporate Partnership template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

- Use the Preview feature to review the document.

- Read the description to confirm you have chosen the correct form.

- If the form is not what you are looking for, utilize the Lookup field to find a form that fits your needs.

Form popularity

FAQ

To add a partner to your partnership firm, you must revisit your existing partnership agreement and agree on the new partner's terms. Discuss changes in profit sharing, roles, and responsibilities with all current partners. The South Dakota Agreement to Partners to Incorporate Partnership provides a framework to document these changes officially. Once the agreement is updated and signed by all partners, your new partner can join the firm seamlessly.

Structuring a partnership agreement involves outlining the partnership's purpose, management roles, and how profits or losses will be shared. Include provisions for resolving disputes and withdrawing from the partnership. Utilizing a South Dakota Agreement to Partners to Incorporate Partnership template can streamline this process and ensure that you cover all critical aspects effectively. Remember, clarity in your agreement can lead to a more harmonious partnership.

Creating a partnership agreement begins with identifying the roles and contributions of each partner. It's essential to detail profit distribution, responsibilities, and decision-making processes. You can use a South Dakota Agreement to Partners to Incorporate Partnership template to ensure compliance with state laws and clearly outline your partnership's structure. Additionally, consider consulting a legal professional to make sure all bases are covered.

To fill a partnership form, begin by reading each section carefully to understand what information is required. Provide accurate details about the partners, the partnership name, and the nature of the business. Using a South Dakota Agreement to Partners to Incorporate Partnership template from platforms such as US Legal Forms can streamline this process and ensure that all necessary information is captured accurately.

Yes, South Dakota does not impose a state income tax on partnerships, making it an appealing choice for many business partners. This tax structure allows partners to retain more of their earnings, enhancing business growth potential. When creating a South Dakota Agreement to Partners to Incorporate Partnership, this information is vital, as it affects financial planning and profit distribution.

To complete a partnership agreement, gather all necessary information about each partner and their contributions. Clearly outline the terms of the partnership, including profit distribution and management roles. Consider utilizing resources like US Legal Forms to access a South Dakota Agreement to Partners to Incorporate Partnership template that simplifies this process and ensures legal adherence.

Filling out a partnership agreement involves providing information such as partner names, contributions, profit-sharing ratios, and responsibilities. Be sure to include provisions for dispute resolution and partner withdrawal. A well-structured South Dakota Agreement to Partners to Incorporate Partnership can assist you in organizing this information effectively.

Yes, you can write your own partnership agreement, but it is crucial to ensure it addresses all necessary details. It should cover the roles, contributions, and dispute resolution processes among partners. For guidance in drafting a comprehensive South Dakota Agreement to Partners to Incorporate Partnership, you can use templates from platforms like US Legal Forms, which streamline the process.

The four types of partnerships are general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has different levels of liability and involvement for partners. Understanding these distinctions is essential when creating a South Dakota Agreement to Partners to Incorporate Partnership, as it helps define how partners will operate and share responsibilities.

An example of a partnership agreement is a document that outlines the roles, responsibilities, and profit-sharing arrangements between partners in a business. It serves as a foundation for understanding how decisions will be made and disputes will be resolved among partners. Using a South Dakota Agreement to Partners to Incorporate Partnership ensures compliance with local laws and provides clarity for all parties involved.