South Dakota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of

Description

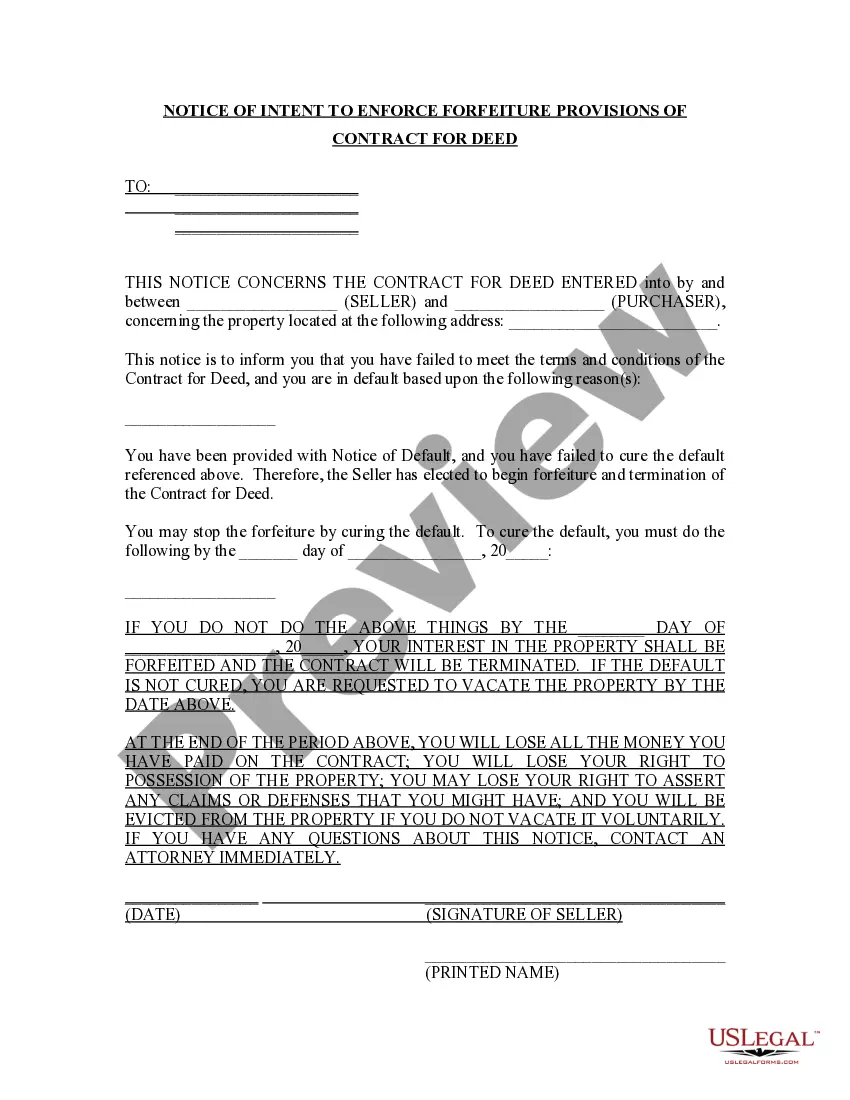

How to fill out Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice Of?

US Legal Forms - among the most significant libraries of authorized types in the USA - offers an array of authorized papers themes you can acquire or print. Using the internet site, you can find a huge number of types for enterprise and individual purposes, sorted by categories, says, or search phrases.You will discover the latest versions of types much like the South Dakota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of in seconds.

If you already possess a registration, log in and acquire South Dakota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of from your US Legal Forms library. The Obtain option can look on every develop you perspective. You have accessibility to all in the past acquired types within the My Forms tab of your profile.

If you wish to use US Legal Forms for the first time, allow me to share straightforward instructions to help you started off:

- Make sure you have picked out the best develop to your area/region. Select the Preview option to review the form`s content material. Read the develop outline to actually have selected the proper develop.

- In case the develop does not fit your demands, make use of the Search area towards the top of the monitor to obtain the one which does.

- If you are satisfied with the form, confirm your choice by visiting the Get now option. Then, choose the costs plan you want and offer your accreditations to sign up for an profile.

- Method the financial transaction. Make use of credit card or PayPal profile to complete the financial transaction.

- Pick the structure and acquire the form in your gadget.

- Make changes. Fill up, modify and print and indication the acquired South Dakota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of.

Each and every format you included in your account lacks an expiry time which is your own eternally. So, if you want to acquire or print another version, just check out the My Forms segment and click on the develop you want.

Obtain access to the South Dakota Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice of with US Legal Forms, one of the most substantial library of authorized papers themes. Use a huge number of expert and status-distinct themes that meet up with your business or individual demands and demands.

Form popularity

FAQ

Most foreclosures on Iowa property take about 5 or 6 months to complete. Iowa is a judicial foreclosure state. Therefore, all foreclosures occur through the judicial system so the time frame can vary ing to the court's schedule and orders in a particular case.

44-8-26. Collateral real estate mortgages. A mortgage which contains the following statement in printed or typed capital letters: THE PARTIES AGREE THAT THIS MORTGAGE CONSTITUTES A COLLATERAL REAL ESTATE MORTGAGE PURSUANT TO SDCL 44-8-26, is subject to the provisions of this section.

Indiana foreclosures have four basic parts. The (1) initial ?behind-in-payments? period, (2) the foreclosure lawsuit, (3) the foreclosure judgment, and (4) the sheriff's sale. This entire process from start to finish usually takes about 8-10 months in Indiana.

In general, the borrower gets one year to redeem the home after a South Dakota foreclosure sale. (S.D. Codified Laws § 21-52-11). But if the mortgage is a short-term redemption mortgage, the redemption period is 180 days after the purchaser from the foreclosure sale records a certificate of sale in the land records.

Which state has the longest foreclosure process? The state with the longest foreclosure process is Hawaii, followed by Louisiana, Kentucky, Nevada, and Connecticut.

In general, the borrower gets one year to redeem the home after a South Dakota foreclosure sale. (S.D. Codified Laws § 21-52-11). But if the mortgage is a short-term redemption mortgage, the redemption period is 180 days after the purchaser from the foreclosure sale records a certificate of sale in the land records.

Notice of Default ? Foreclosure starts when your lender records a Notice of Default against your property with the Registrar Recorder's office. The Notice of Default tells you the total amount you owe including missed payments and foreclosure fees.

The nonjudicial process is pretty straightforward: The lender serves the borrower a notice of sale at least 21 days before the sale date and publishes the notice in a newspaper once a week for four weeks. (S.D. Codified Laws § 21-48-6.1, § 21-48-6). Then the lender can sell the property at a foreclosure sale.