South Dakota Bank Account Monthly Withdrawal Authorization is an agreement made between a banking customer and their financial institution in South Dakota, which grants permission for the bank to automatically process monthly withdrawals from the customer's account. This authorization enables the bank to deduct specified amounts from the customer's account on a recurring basis, typically for payments such as bills, rent, mortgage, or any other regular expenses. With a South Dakota Bank Account Monthly Withdrawal Authorization, customers can effectively automate their payment process, ensuring that their bills are paid on time without having to manually initiate each transaction. This convenience saves time and effort for customers, as they no longer need to remember due dates or initiate separate payments each month. Additionally, it minimizes the risk of late payments or missed deadlines, thus helping customers maintain a positive credit history. Different types of South Dakota Bank Account Monthly Withdrawal Authorization may include: 1. Regular Bill Payments: This type of authorization is mainly used for paying recurring bills such as utilities (electricity, water, gas), internet and cable services, insurance premiums, and subscription-based services. 2. Loan or Mortgage Payments: Customers can opt for this type of authorization to ensure that their monthly loan or mortgage payments are automatically withdrawn from their bank account on the specified due date. 3. Rent Payments: Landlords or property management companies can request a South Dakota Bank Account Monthly Withdrawal Authorization from tenants, allowing them to deduct the monthly rent directly from the tenant's bank account. 4. Investment Contributions: Individuals who wish to make regular contributions to their investment accounts, such as retirement or education savings plans, can authorize the bank to automatically transfer funds from their account on a monthly basis. By setting up a South Dakota Bank Account Monthly Withdrawal Authorization, customers enjoy the convenience of hassle-free payments and the peace of mind that their financial obligations are being met in a timely manner. It is essential to carefully review and understand the terms and conditions of these authorizations, including the withdrawal amounts, frequencies, and any associated fees or penalties. In conclusion, South Dakota Bank Account Monthly Withdrawal Authorization simplifies the payment process, reduces the chances of late or missed payments, and enables customers to effortlessly manage their financial obligations.

South Dakota Bank Account Monthly Withdrawal Authorization

Description

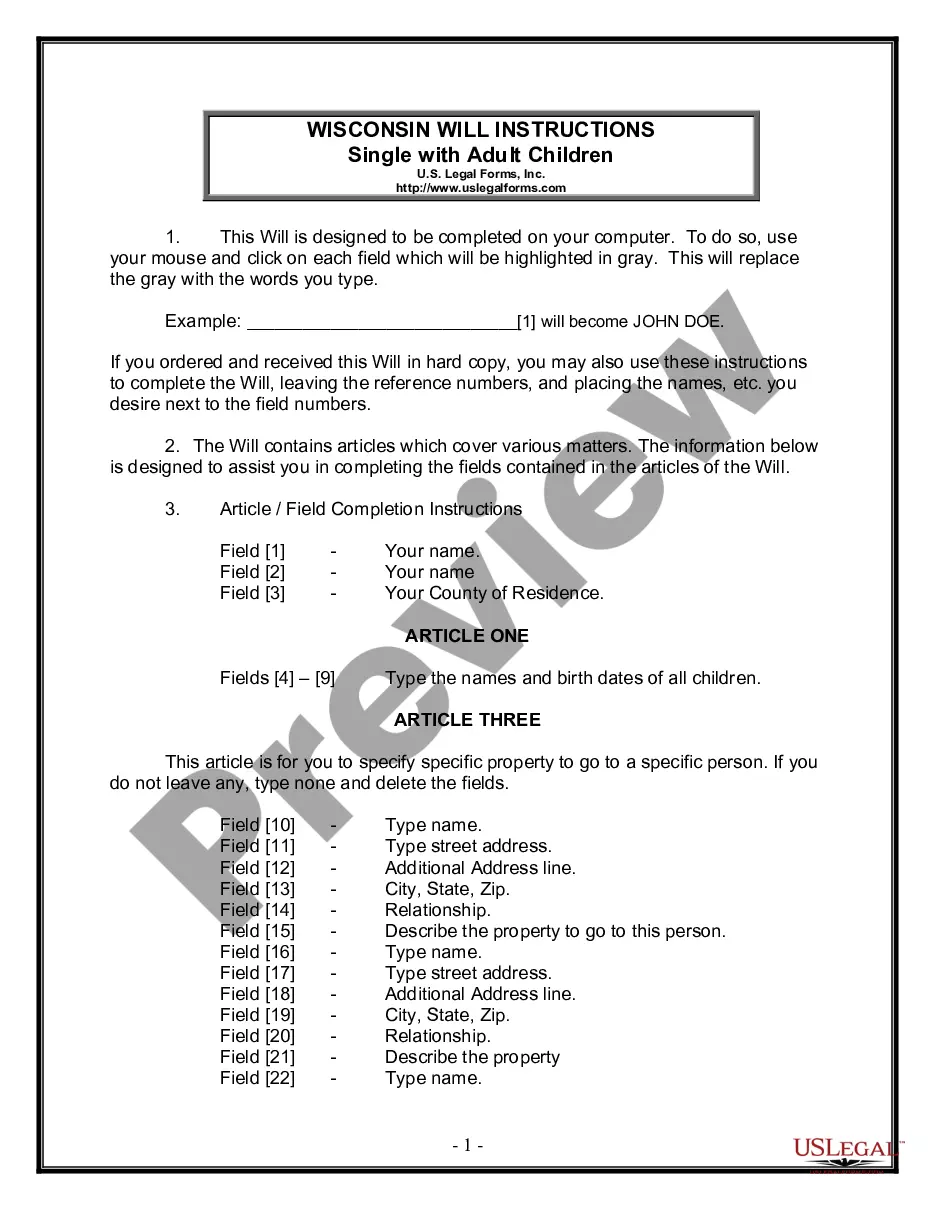

How to fill out South Dakota Bank Account Monthly Withdrawal Authorization?

If you need to full, acquire, or printing legal file layouts, use US Legal Forms, the biggest assortment of legal types, that can be found on the Internet. Make use of the site`s basic and convenient search to discover the documents you want. Various layouts for enterprise and specific reasons are sorted by classes and claims, or key phrases. Use US Legal Forms to discover the South Dakota Bank Account Monthly Withdrawal Authorization in just a couple of mouse clicks.

If you are previously a US Legal Forms consumer, log in to the profile and then click the Down load button to have the South Dakota Bank Account Monthly Withdrawal Authorization. Also you can access types you earlier delivered electronically in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the form to the proper metropolis/land.

- Step 2. Utilize the Preview option to examine the form`s content material. Don`t forget about to see the information.

- Step 3. If you are not happy using the form, make use of the Search discipline near the top of the monitor to discover other types of your legal form format.

- Step 4. Once you have located the form you want, click the Purchase now button. Select the pricing plan you choose and add your accreditations to sign up to have an profile.

- Step 5. Method the transaction. You may use your charge card or PayPal profile to accomplish the transaction.

- Step 6. Choose the formatting of your legal form and acquire it on the gadget.

- Step 7. Complete, change and printing or indicator the South Dakota Bank Account Monthly Withdrawal Authorization.

Each and every legal file format you acquire is the one you have permanently. You might have acces to every form you delivered electronically within your acccount. Click the My Forms area and decide on a form to printing or acquire yet again.

Be competitive and acquire, and printing the South Dakota Bank Account Monthly Withdrawal Authorization with US Legal Forms. There are thousands of professional and status-distinct types you can utilize to your enterprise or specific needs.

Form popularity

FAQ

Your biller could accidentally withdraw the wrong amount or double-charge you. It could even fail to withdraw the money at all. Sometimes, companies continue to withdraw money even after you've canceled services. If you're not checking your account regularly, you might overlook an incorrect charge.

To stop payment, you will need to notify your bank at least three business days before the next payment is scheduled to be made. Notice may be made orally or in writing. However, if the notice is made orally, the bank may require you to follow up with written notice within 14 days.

Electronically withdraw money from your account; on a recurring basis, usually at regular intervals like every month.

An automatic withdrawal occurs when you grant your bank permission to make a payment to a creditor from your bank account. Arrange for automatic withdrawals from your checking account to cover recurring expenses - for example, mortgage loans, utility bills, health club memberships, or insurance premiums.

When you use a debit card, the money is taken out of your checking account immediately. You must have enough money in your account to pay for the purchase.