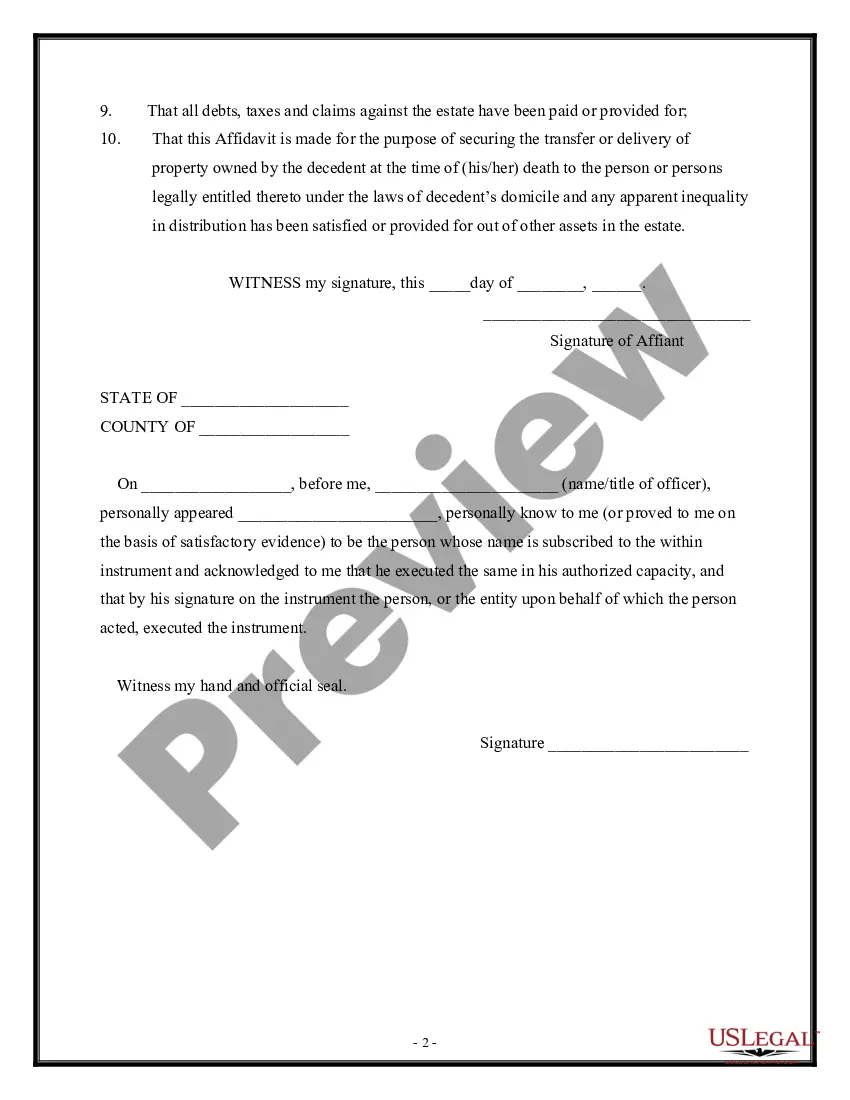

The South Dakota Affidavit of Domicile for Deceased is a legal document that serves to establish the primary residence or domicile of a deceased individual in South Dakota. This affidavit is typically required by financial institutions, government agencies, and other entities involved in the administration of the deceased person's estate. The purpose of the South Dakota Affidavit of Domicile for Deceased is to provide evidence to these parties regarding the decedent's domicile at the time of their death. This information is crucial in determining the proper jurisdiction for probate, taxation, and distribution of assets. In South Dakota, there are two main types of Affidavits of Domicile for Deceased that may be used, depending on the circumstances: 1. Standard South Dakota Affidavit of Domicile for Deceased: This is the most commonly used version of the document and is applicable when the decedent was a permanent resident of South Dakota at the time of their death. This affidavit helps establish South Dakota as their primary place of residence for legal, tax, and estate purposes. 2. Special South Dakota Affidavit of Domicile for Deceased: This version of the affidavit is used in special cases where the decedent may have had multiple residences in different states or circumstances that complicate the determination of their domicile. It is essential to consult an attorney or legal professional when dealing with these complex scenarios. When completing a South Dakota Affidavit of Domicile for Deceased, specific keywords are helpful to include: — Domicile: This term refers to the legal concept of a person's primary residence or where they consider their permanent home. — Deceased: Indicates that the individual in question has passed away. — South Dakota: Specifies the location within the United States where the affidavit is relevant. — Estate Administration: Refers to the overall process of managing and distributing the deceased person's assets and obligations. — Probate: The legal process through which a deceased person's estate is settled and distributed. — Asset Distribution: The allocation of the deceased person's property, possessions, or monetary value among beneficiaries or heirs. — Taxation: Pertains to the assessment and collection of taxes related to the deceased person's estate. It is crucial to note that legal requirements may vary, and it is always advisable to consult an attorney or legal professional when dealing with the South Dakota Affidavit of Domicile for Deceased to ensure compliance with local regulations.

South Dakota Affidavit of Domicile for Deceased

Description

How to fill out South Dakota Affidavit Of Domicile For Deceased?

US Legal Forms - one of several largest libraries of legitimate forms in the States - provides an array of legitimate papers layouts you can down load or produce. Using the site, you can find 1000s of forms for enterprise and specific reasons, categorized by groups, says, or keywords.You can find the newest models of forms like the South Dakota Affidavit of Domicile for Deceased within minutes.

If you already possess a membership, log in and down load South Dakota Affidavit of Domicile for Deceased from the US Legal Forms catalogue. The Down load option can look on every form you look at. You gain access to all in the past saved forms in the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed below are straightforward guidelines to help you started out:

- Ensure you have picked the proper form for your area/area. Go through the Preview option to examine the form`s content material. Browse the form outline to ensure that you have selected the proper form.

- In the event the form doesn`t match your specifications, use the Look for area near the top of the display screen to get the one which does.

- In case you are pleased with the form, validate your option by visiting the Purchase now option. Then, opt for the rates program you favor and provide your qualifications to sign up to have an profile.

- Method the financial transaction. Use your charge card or PayPal profile to perform the financial transaction.

- Find the file format and down load the form on your device.

- Make alterations. Complete, edit and produce and sign the saved South Dakota Affidavit of Domicile for Deceased.

Every single template you included with your account lacks an expiry date and is your own eternally. So, if you wish to down load or produce yet another copy, just visit the My Forms section and click on on the form you want.

Get access to the South Dakota Affidavit of Domicile for Deceased with US Legal Forms, by far the most extensive catalogue of legitimate papers layouts. Use 1000s of professional and status-certain layouts that meet your company or specific requirements and specifications.

Form popularity

FAQ

A South Dakota transfer-on-death deed?often called a TOD deed?is a written legal document that transfers property to one or more beneficiaries named in the document on the death of the owner. South Dakota TOD deeds were first authorized by the South Dakota Real Property Transfer on Death Act in 2014.

10 tips to avoid probate Give away property. Establish joint ownership for real estate. Joint ownership for other property. Pay-on-death financial accounts. Transfer-on-death securities. Transfer on death for motor vehicles. Transfer on death for real estate. Living trusts.

One of the most common ways to avoid probate is to create a living trust. Through a living trust, the person writing the trust (grantor) must "fund the trust" by putting the assets they choose into it. The grantor retains control over the trust's property until their death or incapacitation.

However, it is possible to skip probate in South Dakota if the entire value of an estate is less than $50,000. In that case, the estate would pass through what's called a simplified probate process.

A South Dakota small estate affidavit is a document that can help a person using it, known as an ?affiant,? avoid traditional probate proceedings.

No. In South Dakota, not all your property may have to go through probate. The assets that do go through probate make up your probate estate. These are usually assets that are titled solely in your name and come under the control of your personal representative (formerly known as an executor).

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

It involves proving the will is valid, identifying and inventorying the deceased person's property, having the property appraised, paying debts and taxes, and distributing the remaining property as the will directs. In South Dakota, the cost for probate can range from $2,700 to $6,950 or more.