South Dakota Contract of Sale of Commercial Property with No Broker Involved

Description

A person licensed to arrange the buying and selling of real estate for a fee. A real estate broker acts as an intermediary between the parties selling and buying the real estate. Real estate brokers can also be called real estate salespersons, and the people who assist them (who are generally not required to be licensed) are generally called real estate agents.

How to fill out Contract Of Sale Of Commercial Property With No Broker Involved?

You can dedicate several hours online seeking the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal forms that are examined by professionals.

It is easy to download or print the South Dakota Contract of Sale of Commercial Property with No Broker Involved from your services.

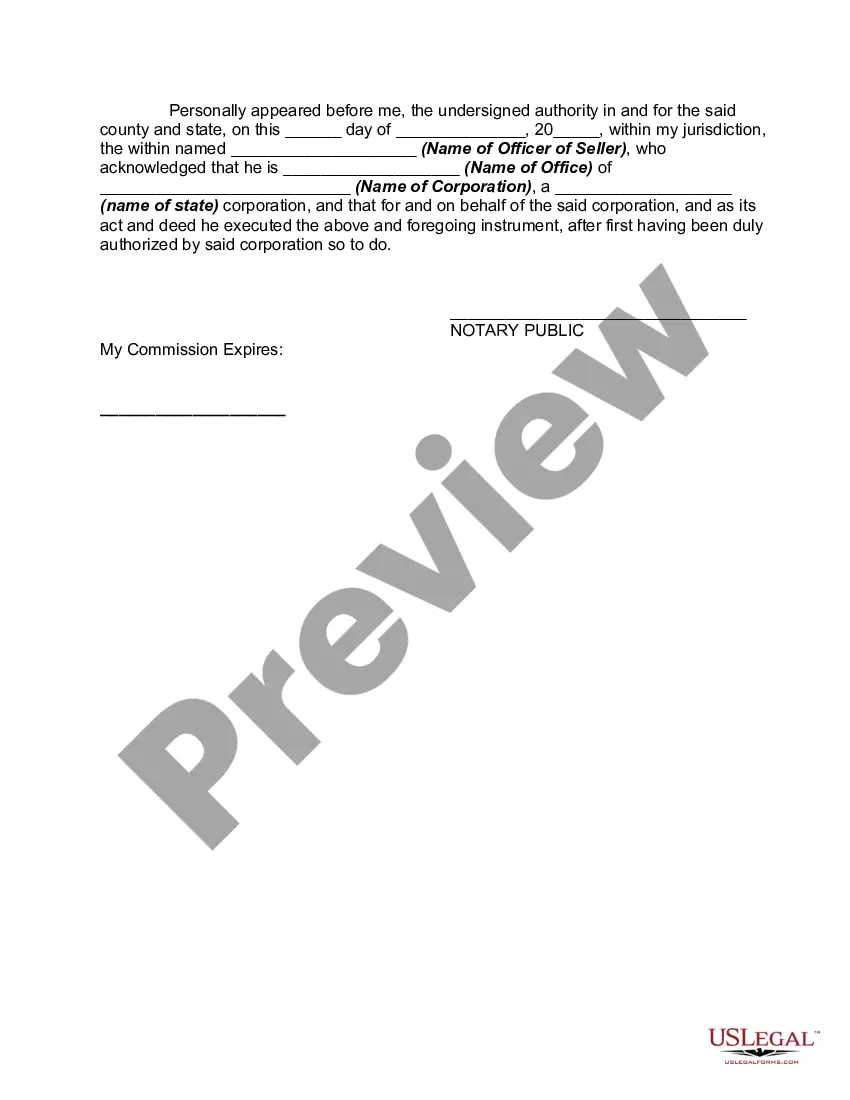

If available, use the Preview button to review the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the South Dakota Contract of Sale of Commercial Property with No Broker Involved.

- Every legal document template you acquire is yours indefinitely.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/city of choice. Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

exclusive broker agreement allows a property owner to work with multiple brokers simultaneously without committing to just one. These agreements can provide flexibility and broaden your reach when selling your property. When utilizing a South Dakota Contract of Sale of Commercial Property with No Broker Involved, ensure you understand any implications of a nonexclusive arrangement. For guidance, uslegalforms offers resources to navigate these agreements effectively.

To sell your house in South Dakota without a realtor, you first need to prepare your property for listing. Next, create a South Dakota Contract of Sale of Commercial Property with No Broker Involved, which helps outline the terms of your sale clearly. You should also market your property actively through online listings and social media. Lastly, consider why using a platform like uslegalforms can simplify the process by providing necessary legal forms.

exclusive agreement means that you are not restricted to just one broker or agent. You can engage multiple brokers to market your South Dakota Contract of Sale of Commercial Property with No Broker Involved. This type of agreement often suits sellers looking for greater control over their property sale process.

exclusive brokerage agreement provides flexibility, allowing you to work with multiple brokers simultaneously. This can be beneficial, especially when dealing with a South Dakota Contract of Sale of Commercial Property with No Broker Involved, as it increases your chances of finding a buyer quickly. With this agreement, you retain the right to sell the property yourself without owing a commission.

An exclusive agency agreement allows one broker to represent you in the sale of your South Dakota Contract of Sale of Commercial Property with No Broker Involved. This means that only that broker can earn a commission if the property sells. In contrast, a non-exclusive agreement permits multiple brokers to represent the same property, allowing you to sell directly without paying a commission if you find a buyer.

Yes, you can write your own South Dakota Contract of Sale of Commercial Property with No Broker Involved. Many property owners choose to create a custom agreement to fit their specific needs. However, ensure you include all essential terms and comply with state laws to protect your interests. If you need assistance, US Legal Forms offers templates and resources to help you draft a comprehensive contract.

To sell a commercial property without a broker, begin by researching the market and preparing your property for sale. Utilize online platforms to list your property and connect with potential buyers directly. The South Dakota Contract of Sale of Commercial Property with No Broker Involved can make it easier to handle the legal aspects, ensuring a smooth transaction while you focus on promoting your property.

In most cases, you do need a real estate license to sell commercial property in South Dakota. However, you can sell your property without a broker if you manage the transaction yourself. By using the South Dakota Contract of Sale of Commercial Property with No Broker Involved, you can navigate the requirements and legalities while ensuring a compliant sale.

The listing agreement you’re referring to is called an exclusive right to sell agreement. In this type of contract, the broker earns a commission regardless of who sells the property, even if the seller finds a buyer independently. If you want to avoid such agreements, consider using the South Dakota Contract of Sale of Commercial Property with No Broker Involved to manage your sale directly.

The best way to sell commercial property involves understanding your local market and preparing your property for sale. Listing your property with clear, engaging information and high-quality images can attract potential buyers. If you prefer to avoid using a broker, you can utilize tools like the South Dakota Contract of Sale of Commercial Property with No Broker Involved to streamline the process and ensure compliance.