South Dakota Sample Letter for Dissolution of Corporation

Description

How to fill out Sample Letter For Dissolution Of Corporation?

Finding the right legal record design might be a have difficulties. Of course, there are a variety of themes available on the net, but how do you obtain the legal type you require? Use the US Legal Forms website. The service gives thousands of themes, such as the South Dakota Sample Letter for Dissolution of Corporation, which can be used for company and private needs. All of the forms are examined by pros and meet state and federal specifications.

When you are currently registered, log in to your profile and then click the Acquire button to obtain the South Dakota Sample Letter for Dissolution of Corporation. Make use of profile to search from the legal forms you have ordered previously. Visit the My Forms tab of your own profile and obtain one more backup in the record you require.

When you are a fresh customer of US Legal Forms, listed here are simple recommendations so that you can comply with:

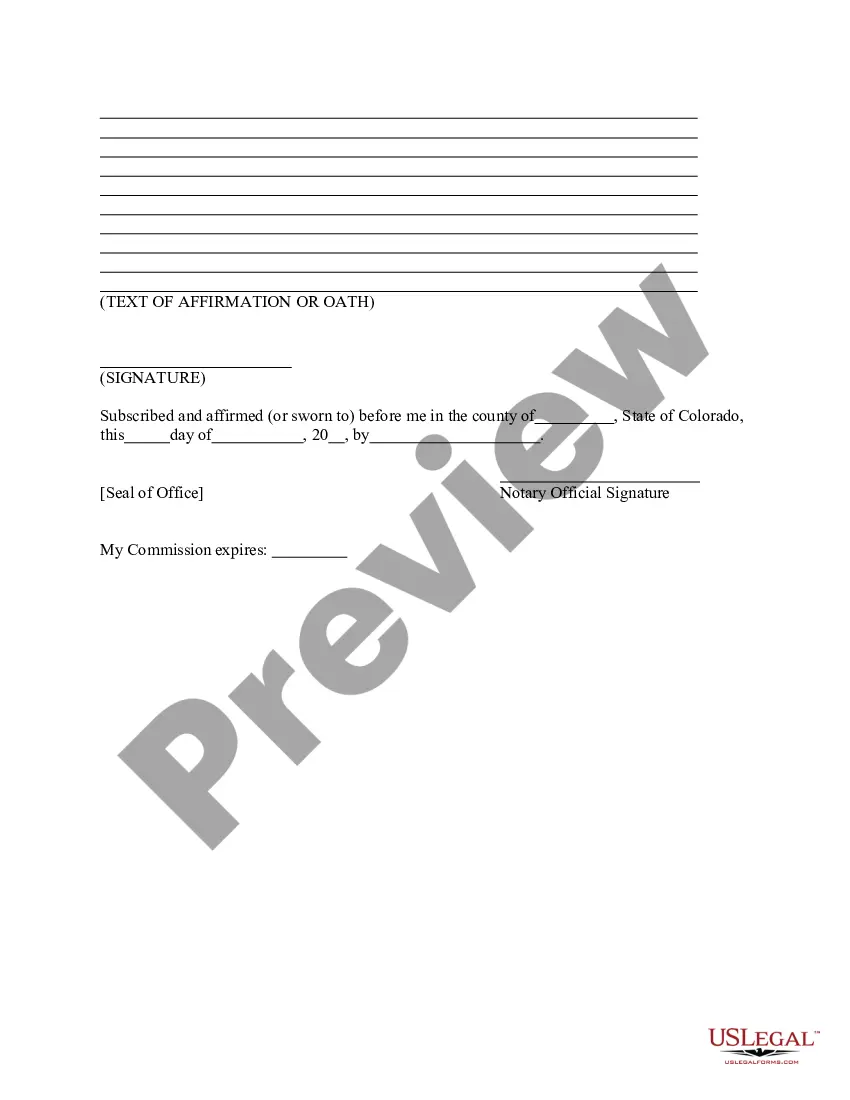

- First, ensure you have selected the appropriate type for your personal city/area. You may look through the form making use of the Review button and study the form explanation to ensure it is the best for you.

- In case the type does not meet your needs, make use of the Seach discipline to get the correct type.

- Once you are positive that the form would work, go through the Buy now button to obtain the type.

- Select the pricing strategy you desire and enter the essential information and facts. Create your profile and buy the order utilizing your PayPal profile or Visa or Mastercard.

- Pick the file structure and obtain the legal record design to your product.

- Full, change and produce and indicator the attained South Dakota Sample Letter for Dissolution of Corporation.

US Legal Forms is the largest collection of legal forms that you can find a variety of record themes. Use the company to obtain skillfully-made documents that comply with state specifications.

Form popularity

FAQ

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

The process of dissolving a company is done by the company's directors by submitting a DS01 form and paying the relevant fee. A notice is then placed in the Gazette stating the company's intention to strike itself from the register. If no objections are received, the company will be dissolved.

Be clear and concise about your intentions for writing the letter, stating that you intend to dissolve the partnership. Next, provide context for why you've made this decision. This could include changes in personal circumstances, differences in goals or values, or simply wanting to pursue different opportunities.

43. (1) Where the partnership is at will, the firm may be dissolved by any partner giving notice in writing to all the other partners of his intention to dissolve the firm.

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

This intent to dissolve should include the following information: A detailed description of the claim. Information regarding the claim, the amount of the claim, and whether it is admitted to or not. A mailing address where any claims can be sent. A deadline: This must be at least 120 days after the written notice date.

How do you dissolve a South Dakota Corporation? To dissolve your corporation in South Dakota, you must submit the completed Articles of Dissolution form by mail or in person, in duplicate, to the Secretary of State along with the filing fee.