Attachment in legal terminology means a preliminary legal seizure of property to force compliance with a decision which may be obtained in a pending suit. Before a final judgment is issued, the court may order the sheriff or other proper officer to seize any property; credit, or right, belonging to the defendant, in whatever hands the same may be found, to satisfy the claim which the plaintiff has against him. In some states, an order of attachment can only be issued when a debtor is shown to be fleeing or concealing themselves from the legal process, so that the attached property can satisfy a judgment that may be awarded in the complainant's favor. In criminal law practice, it may refer to a writ requiring a sheriff to apprehend a particular person, who has been guilty of a contempt of court, and to bring the offender before the court.

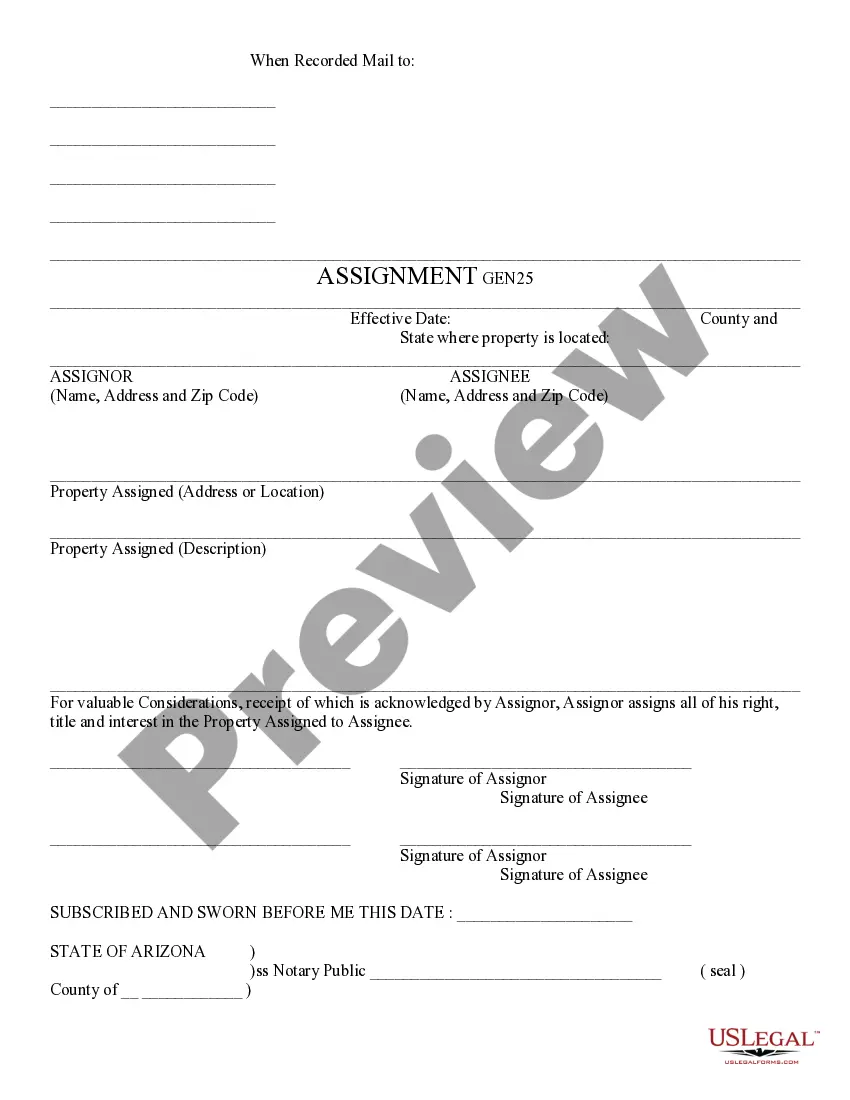

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: South Dakota Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached Keywords: South Dakota, motion for release of property, levy, attachment proceeding, excess amount attached Description: A South Dakota Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached is a legal document specifically used in South Dakota to request the court to release property that has been subjected to a levy in an attachment proceeding. This motion is filed when the amount attached exceeds the debt owed or the value of the attached property. Types of South Dakota Motion for Release of Property from Levy in Attachment Proceeding Due to Excess Amount Attached: 1. Motion for Release of Property from Levy: This type of motion is filed by the debtor or their attorney when they believe that the amount attached to their property exceeds the actual debt owed. The motion aims to request the court to release the excess amount and restore the seized property. 2. Motion for Alternative Relief: In some cases, rather than releasing the entire property, the debtor may file a motion for alternative relief. This motion requests the court to consider alternative forms of relief, such as reducing the amount attached or substituting the property with other assets of equal value. 3. Motion for Expedited Hearing: If the debtor believes that immediate action is necessary due to the excessive amount attached, they may file a motion for an expedited hearing. This motion requests the court to prioritize the hearing and make a decision quickly to prevent further financial hardship. 4. Motion for Stay of Levy: In situations where the debtor faces extreme financial hardship or significant loss if the attached property is not released, a motion for a stay of levy can be filed. This motion aims to temporarily pause the implementation of the levy until the court makes a decision on the excess amount. 5. Motion for Hearing to Determine Amount Attached: When there is a dispute regarding the actual amount attached to the property in question, the debtor can request a hearing to determine the correct amount. This motion seeks to present evidence and arguments to convince the court to reevaluate the amount attached and potentially release the excess. In summary, South Dakota provides various types of motions for the release of property from levy in attachment proceedings due to an excess amount attached. By filing these motions, debtors can seek relief from excessive financial burden and protect their property. It is essential to consult with an attorney experienced in South Dakota laws to ensure proper submission and presentation of the motion.