An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

Another factor to be considered is the connection and regularity of business between the independent contractor and the hiring party. Important factors to be considered are separate advertising, procurement of licensing, maintenance of a place of business, and supplying of tools and equipment by the independent contractor. If the service rendered is to be completed by a certain time, as opposed to an indefinite time period, a finding of an independent contractor status is more likely.

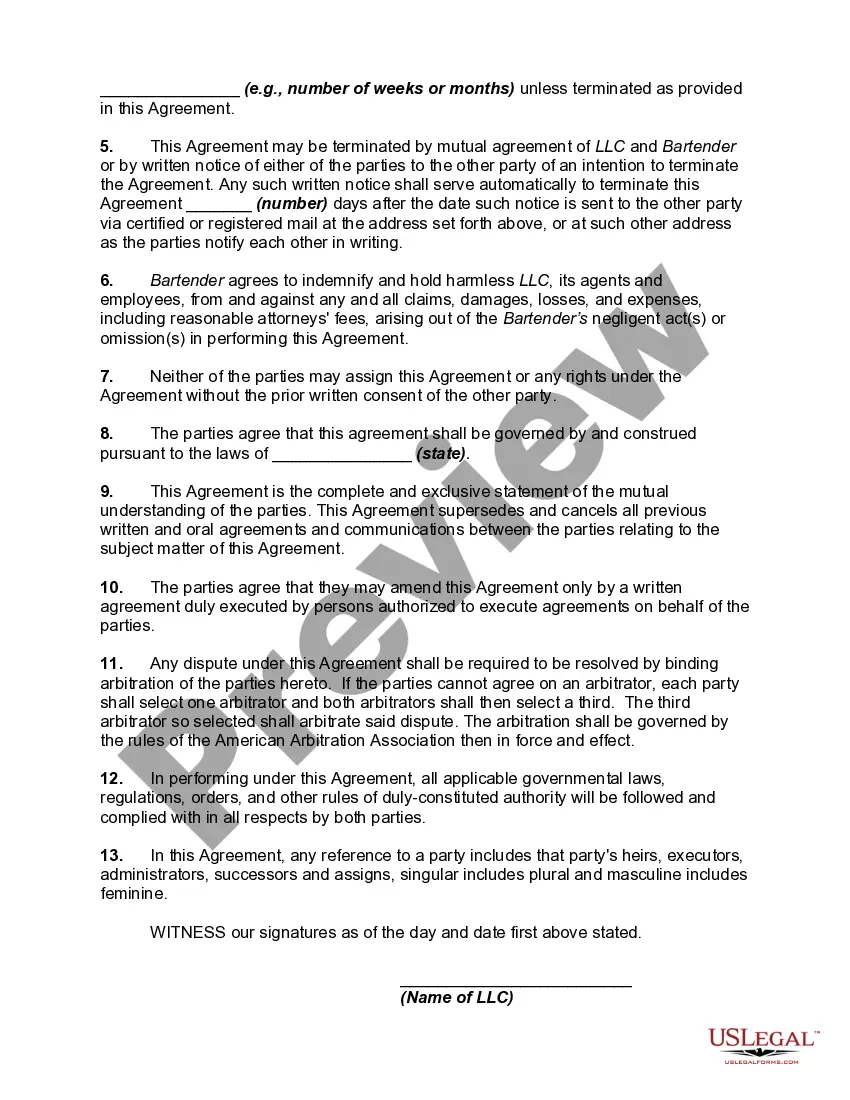

Title: South Dakota Agreement Between a Bartender — IndependenContractto— - and a Business Supplying Bartenders to Parties and Special Events Introduction: In South Dakota, an agreement between a bartender as an independent contractor and a business that supplies bartenders to parties and special events lays the foundation for a successful working relationship. This agreement ensures clarity, legal compliance, and defines the rights, responsibilities, and compensation terms of both parties involved. Below, we outline the key components and types of South Dakota agreements in this domain. Key Components of a South Dakota Agreement: 1. Parties Involved: This section identifies the independent contractor bartender and the business that provides bartenders' services for parties and special events. It includes their legal names, addresses, contact details, and any relevant licenses or certifications required by state law. 2. Scope of Work: Here, the agreement describes the specific bartending services the contractor will provide, such as mixing and serving drinks, interacting with guests, and maintaining cleanliness during events. It may also cover additional duties, such as inventory management or training other bartenders. 3. Duration: This section outlines the agreement's start date and the anticipated duration or specific period in which the bartender will be engaged by the business to provide services. It may also include provisions for termination or renewal of the agreement. 4. Compensation: The agreement should clearly define how the bartender will be compensated for their services. It may include hourly rates, tips distribution, and any additional bonuses or gratuities. Also, include how, when, and by whom the payment will be made, ensuring compliance with state labor laws. 5. Independent Contractor Relationship: To establish the bartender as an independent contractor, this section highlights that the individual is not an employee of the business but operates as an independent entity responsible for their tax obligations, insurance, and licenses. It clarifies that the independent contractor is not entitled to employee benefits or worker's compensation. 6. Confidentiality and Non-Disclosure: To protect the business's proprietary information and trade secrets, the agreement should include clauses prohibiting the independent contractor bartender from disclosing any confidential details about the business, its clients, or event attendees. 7. Indemnity and Insurance: This component highlights the responsibility of the bartender to maintain liability insurance covering any damages or injuries arising from their services. It also clarifies that the bartender will be solely liable for their actions or misconduct during events. Types of South Dakota Agreements for Bartenders: 1. Event-Specific Agreement: This agreement type is designed for bartenders hired for a particular party, wedding, or special event. It outlines the venue, date, time, and specific requirements for the event, ensuring both the bartender and the business are aware of their roles and responsibilities. 2. Long-Term Agreement: For ongoing partnerships, a long-term agreement may be established. It covers multiple events or a specific duration during which the bartender will be available whenever their services are required. This agreement allows for a more stable working relationship and a better understanding of expectations. Conclusion: A South Dakota Agreement Between a Bartender — IndependenContractto— - and a Business that Supplies Bartenders to Parties and Special Events is essential for establishing a clear understanding between the parties involved. By encompassing the key components mentioned above and tailoring the agreement to specific event requirements, both the bartender and the business can maintain a successful working relationship while ensuring compliance and mutual satisfaction.Title: South Dakota Agreement Between a Bartender — IndependenContractto— - and a Business Supplying Bartenders to Parties and Special Events Introduction: In South Dakota, an agreement between a bartender as an independent contractor and a business that supplies bartenders to parties and special events lays the foundation for a successful working relationship. This agreement ensures clarity, legal compliance, and defines the rights, responsibilities, and compensation terms of both parties involved. Below, we outline the key components and types of South Dakota agreements in this domain. Key Components of a South Dakota Agreement: 1. Parties Involved: This section identifies the independent contractor bartender and the business that provides bartenders' services for parties and special events. It includes their legal names, addresses, contact details, and any relevant licenses or certifications required by state law. 2. Scope of Work: Here, the agreement describes the specific bartending services the contractor will provide, such as mixing and serving drinks, interacting with guests, and maintaining cleanliness during events. It may also cover additional duties, such as inventory management or training other bartenders. 3. Duration: This section outlines the agreement's start date and the anticipated duration or specific period in which the bartender will be engaged by the business to provide services. It may also include provisions for termination or renewal of the agreement. 4. Compensation: The agreement should clearly define how the bartender will be compensated for their services. It may include hourly rates, tips distribution, and any additional bonuses or gratuities. Also, include how, when, and by whom the payment will be made, ensuring compliance with state labor laws. 5. Independent Contractor Relationship: To establish the bartender as an independent contractor, this section highlights that the individual is not an employee of the business but operates as an independent entity responsible for their tax obligations, insurance, and licenses. It clarifies that the independent contractor is not entitled to employee benefits or worker's compensation. 6. Confidentiality and Non-Disclosure: To protect the business's proprietary information and trade secrets, the agreement should include clauses prohibiting the independent contractor bartender from disclosing any confidential details about the business, its clients, or event attendees. 7. Indemnity and Insurance: This component highlights the responsibility of the bartender to maintain liability insurance covering any damages or injuries arising from their services. It also clarifies that the bartender will be solely liable for their actions or misconduct during events. Types of South Dakota Agreements for Bartenders: 1. Event-Specific Agreement: This agreement type is designed for bartenders hired for a particular party, wedding, or special event. It outlines the venue, date, time, and specific requirements for the event, ensuring both the bartender and the business are aware of their roles and responsibilities. 2. Long-Term Agreement: For ongoing partnerships, a long-term agreement may be established. It covers multiple events or a specific duration during which the bartender will be available whenever their services are required. This agreement allows for a more stable working relationship and a better understanding of expectations. Conclusion: A South Dakota Agreement Between a Bartender — IndependenContractto— - and a Business that Supplies Bartenders to Parties and Special Events is essential for establishing a clear understanding between the parties involved. By encompassing the key components mentioned above and tailoring the agreement to specific event requirements, both the bartender and the business can maintain a successful working relationship while ensuring compliance and mutual satisfaction.