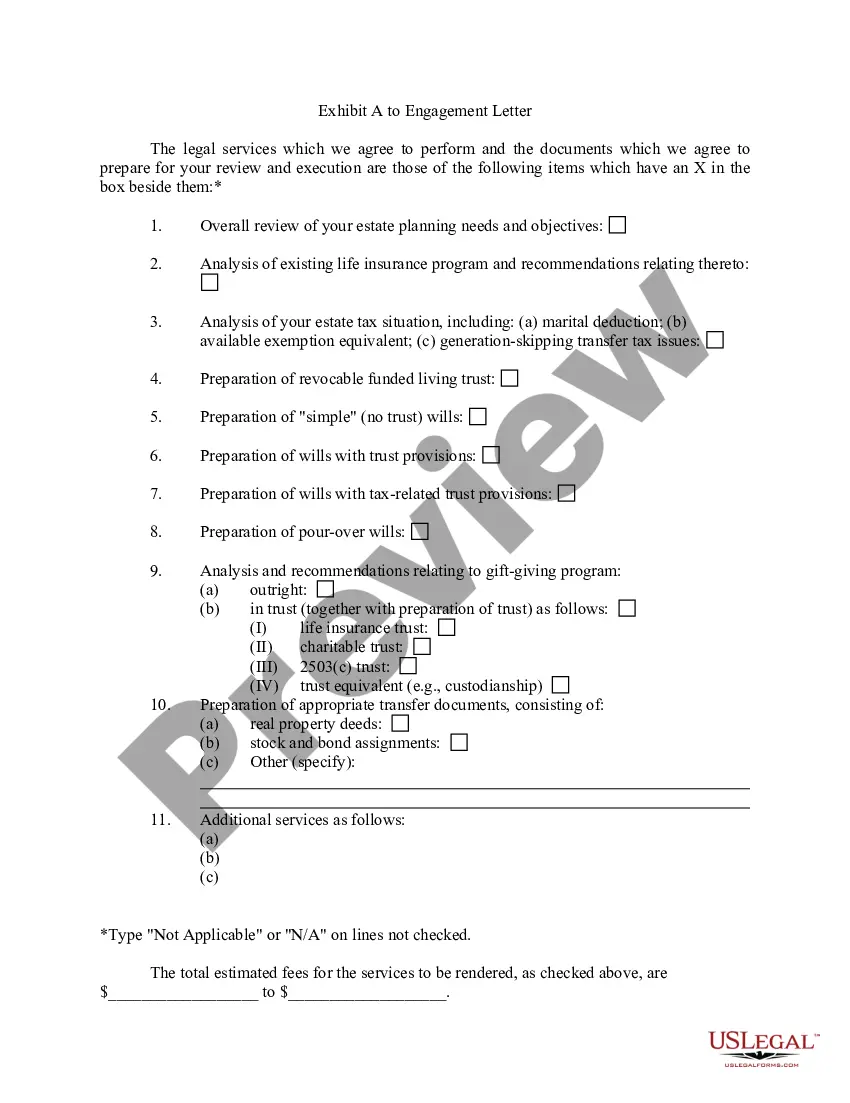

Title: South Dakota Estate Planning Data Letter and Employment Agreement with Client: A Comprehensive Guide Introduction: In South Dakota, estate planning is a crucial aspect of ensuring the orderly distribution of assets and the management of one's affairs after death. To facilitate this process, estate planning data letters and employment agreements with clients serve as valuable legal instruments. This detailed description will explore the purpose, components, and key aspects of South Dakota Estate Planning Data Letters and Employment Agreements, shedding light on their importance in various scenarios. Key Keywords: South Dakota, estate planning, data letter, employment agreement, clients I. South Dakota Estate Planning Data Letters: 1. Overview: A South Dakota Estate Planning Data Letter is a document that captures critical information pertaining to an individual's assets, liabilities, insurance policies, personal representatives, beneficiaries, and specific preferences regarding the distribution of assets upon death. 2. Purpose: Ensures accurate and comprehensive documentation of estate planning details for effective probate and asset distribution procedures. 3. Components: a) Identification Information: Full legal name, address, and contact details of the estate owner. b) Asset Inventory: Detailed listing of all assets, including real estate, investments, bank accounts, business holdings, personal belongings, etc. c) Liability and Debt Information: Debts, mortgages, loans, credit card balances, and any other outstanding obligations. d) Insurance Policies: Details of life insurance policies, including policy numbers, beneficiaries, and coverage amounts. e) Personal Representatives: Designation of personal representatives, including executor(s) and power of attorney holders. f) Beneficiary Designation: Comprehensive list of beneficiaries, inheritances, charitable bequests, or trusts. g) Funeral and Burial Wishes: Specific instructions regarding funeral arrangements, burial/cremation, memorial services, and any religious or cultural preferences. h) Miscellaneous: Any additional information, such as digital asset access, pets' care instructions, or guardian appointment for minor children. II. South Dakota Employment Agreements with Clients: 1. Overview: South Dakota Employment Agreements with Clients involve the engagement of an attorney to provide professional legal services in the domain of estate planning. 2. Purpose: Defines the nature and scope of the attorney-client relationship, ensuring clear communication, ethical practices, and legal obligations from both parties. 3. Components: a) Parties Involved: Identification of the attorney (law firm) and the client (estate owner). b) Scope of Services: A detailed description of the legal services to be provided by the attorney, often encompassing estate planning, trusts, wills, asset protection, and probate matters. c) Compensation: Clear indication of the attorney's fees, billing procedures, payment terms, and any additional expenses involved. d) Confidentiality: A confidentiality clause that protects the client's sensitive information shared during the course of representation. e) Dispute Resolution: Outline of the mechanism for resolving any conflicts or disputes that may arise during the engagement, such as arbitration or mediation. f) Termination Clause: Conditions under which either party can terminate the employment agreement. g) Governing Law: Specification of the jurisdiction and applicable laws governing the agreement. h) Signatures: Execution of the agreement by both the attorney and the client, ensuring its legally binding nature. Conclusion: South Dakota Estate Planning Data Letters and Employment Agreements with Clients play critical roles in the estate planning process. By meticulously documenting all relevant information, individuals can ensure their assets are distributed according to their wishes, and attorneys can establish a clear understanding of their responsibilities as legal representatives. Adhering to the guidelines and utilizing these legal instruments can foster a smooth and legally sound estate planning experience in South Dakota. Additional Keywords: estate planning documents, legal instruments, probate procedures, asset distribution, attorney-client relationship, legal services.

South Dakota Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out South Dakota Estate Planning Data Letter And Employment Agreement With Client?

US Legal Forms - one of many greatest libraries of lawful varieties in America - provides a wide range of lawful document templates you can download or printing. Making use of the site, you can get 1000s of varieties for enterprise and specific purposes, sorted by categories, states, or search phrases.You can find the most up-to-date variations of varieties much like the South Dakota Estate Planning Data Letter and Employment Agreement with Client in seconds.

If you currently have a subscription, log in and download South Dakota Estate Planning Data Letter and Employment Agreement with Client from the US Legal Forms library. The Download option can look on each type you view. You have accessibility to all previously delivered electronically varieties from the My Forms tab of your own bank account.

In order to use US Legal Forms for the first time, here are straightforward directions to obtain began:

- Make sure you have selected the best type to your town/area. Click on the Preview option to review the form`s information. Look at the type information to ensure that you have chosen the correct type.

- In the event the type doesn`t fit your demands, use the Search industry towards the top of the screen to obtain the one which does.

- If you are satisfied with the shape, verify your choice by visiting the Buy now option. Then, opt for the costs strategy you prefer and supply your credentials to sign up for the bank account.

- Procedure the financial transaction. Make use of credit card or PayPal bank account to perform the financial transaction.

- Find the file format and download the shape on your own product.

- Make adjustments. Fill out, edit and printing and sign the delivered electronically South Dakota Estate Planning Data Letter and Employment Agreement with Client.

Every single template you put into your account does not have an expiry time which is your own eternally. So, if you want to download or printing an additional copy, just visit the My Forms segment and click on the type you will need.

Gain access to the South Dakota Estate Planning Data Letter and Employment Agreement with Client with US Legal Forms, the most comprehensive library of lawful document templates. Use 1000s of expert and state-specific templates that meet up with your company or specific requires and demands.