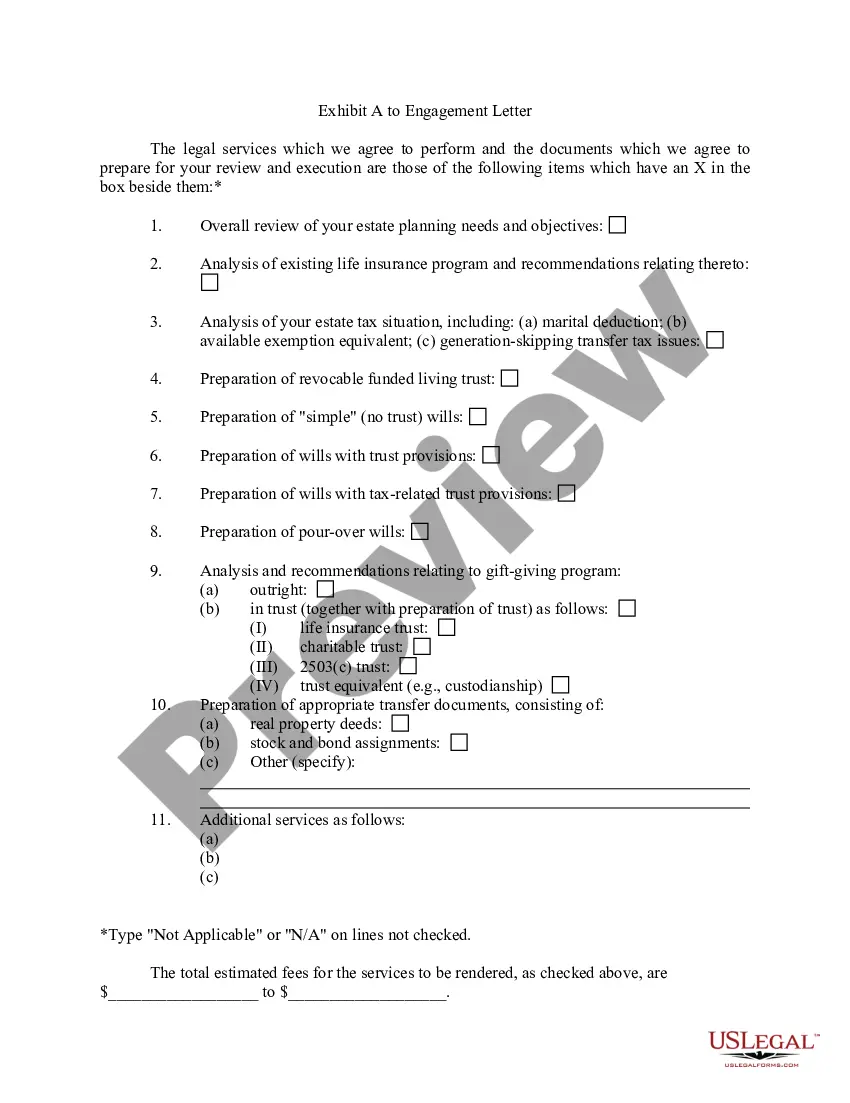

Title: South Dakota Estate Planning Data Letter and Employment Agreement with Client: A Comprehensive Guide Introduction: In South Dakota, estate planning is a crucial aspect of ensuring the orderly distribution of assets and the management of one's affairs after death. To facilitate this process, estate planning data letters and employment agreements with clients serve as valuable legal instruments. This detailed description will explore the purpose, components, and key aspects of South Dakota Estate Planning Data Letters and Employment Agreements, shedding light on their importance in various scenarios. Key Keywords: South Dakota, estate planning, data letter, employment agreement, clients I. South Dakota Estate Planning Data Letters: 1. Overview: A South Dakota Estate Planning Data Letter is a document that captures critical information pertaining to an individual's assets, liabilities, insurance policies, personal representatives, beneficiaries, and specific preferences regarding the distribution of assets upon death. 2. Purpose: Ensures accurate and comprehensive documentation of estate planning details for effective probate and asset distribution procedures. 3. Components: a) Identification Information: Full legal name, address, and contact details of the estate owner. b) Asset Inventory: Detailed listing of all assets, including real estate, investments, bank accounts, business holdings, personal belongings, etc. c) Liability and Debt Information: Debts, mortgages, loans, credit card balances, and any other outstanding obligations. d) Insurance Policies: Details of life insurance policies, including policy numbers, beneficiaries, and coverage amounts. e) Personal Representatives: Designation of personal representatives, including executor(s) and power of attorney holders. f) Beneficiary Designation: Comprehensive list of beneficiaries, inheritances, charitable bequests, or trusts. g) Funeral and Burial Wishes: Specific instructions regarding funeral arrangements, burial/cremation, memorial services, and any religious or cultural preferences. h) Miscellaneous: Any additional information, such as digital asset access, pets' care instructions, or guardian appointment for minor children. II. South Dakota Employment Agreements with Clients: 1. Overview: South Dakota Employment Agreements with Clients involve the engagement of an attorney to provide professional legal services in the domain of estate planning. 2. Purpose: Defines the nature and scope of the attorney-client relationship, ensuring clear communication, ethical practices, and legal obligations from both parties. 3. Components: a) Parties Involved: Identification of the attorney (law firm) and the client (estate owner). b) Scope of Services: A detailed description of the legal services to be provided by the attorney, often encompassing estate planning, trusts, wills, asset protection, and probate matters. c) Compensation: Clear indication of the attorney's fees, billing procedures, payment terms, and any additional expenses involved. d) Confidentiality: A confidentiality clause that protects the client's sensitive information shared during the course of representation. e) Dispute Resolution: Outline of the mechanism for resolving any conflicts or disputes that may arise during the engagement, such as arbitration or mediation. f) Termination Clause: Conditions under which either party can terminate the employment agreement. g) Governing Law: Specification of the jurisdiction and applicable laws governing the agreement. h) Signatures: Execution of the agreement by both the attorney and the client, ensuring its legally binding nature. Conclusion: South Dakota Estate Planning Data Letters and Employment Agreements with Clients play critical roles in the estate planning process. By meticulously documenting all relevant information, individuals can ensure their assets are distributed according to their wishes, and attorneys can establish a clear understanding of their responsibilities as legal representatives. Adhering to the guidelines and utilizing these legal instruments can foster a smooth and legally sound estate planning experience in South Dakota. Additional Keywords: estate planning documents, legal instruments, probate procedures, asset distribution, attorney-client relationship, legal services.

South Dakota Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of templates for business and personal use, organized by categories, regions, or keywords.

You can find the most current versions of documents such as the South Dakota Estate Planning Information Letter and Employment Agreement with Client within moments.

Review the template information to confirm that you have chosen the accurate document.

If the template does not meet your requirements, utilize the Search field located at the top of the screen to find one that does.

- If you already have a subscription, Log In and download the South Dakota Estate Planning Information Letter and Employment Agreement with Client from the US Legal Forms library.

- The Download option will appear on each template you view.

- You have access to all previously downloaded documents from the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you select the correct template for your location.

- Click on the Preview option to examine the document's details.

Form popularity

FAQ

The most important part of estate planning is ensuring your wishes are clearly documented and legally binding. This clarity prevents disputes among family members in the future. Using a South Dakota Estate Planning Data Letter and Employment Agreement with Client not only solidifies your intentions but also provides a structured approach to your entire estate plan.

The two main components of estate planning typically involve the distribution of assets and healthcare directives. It's crucial to decide how you want your assets to be allocated after your passing while also making arrangements for your medical care if you become incapacitated. A South Dakota Estate Planning Data Letter and Employment Agreement with Client can help cover these aspects comprehensively.

The first step in the estate planning process often involves assessing your assets and liabilities. This evaluation allows you to understand what you will be planning and distributing. After this assessment, incorporating a South Dakota Estate Planning Data Letter and Employment Agreement with Client simplifies the planning process further.

Some of the most important legal documents to have include a will, power of attorney, and health care directive. Each of these documents plays a critical role in ensuring your wishes are respected. Moreover, a South Dakota Estate Planning Data Letter and Employment Agreement with Client can serve as a foundational framework for organizing your estate plan effectively.

The two key documents typically used to prepare an estate plan are a will and a power of attorney. A will directs how your assets will be distributed, while a power of attorney grants someone authority to make decisions on your behalf. When combined with a South Dakota Estate Planning Data Letter and Employment Agreement with Client, these documents create a robust estate plan.

An estate planning letter is a personal document that complements your will by detailing your final wishes. This letter can specify how you want your assets managed and provide insights for your family on your preferences. Utilizing a South Dakota Estate Planning Data Letter and Employment Agreement with Client can enhance the clarity of your estate plan, making your intentions clear.

An estate letter, often referred to as a letter of instruction, is a document that provides guidance regarding your estate after your death. This letter can contain personal wishes, asset distribution instructions, and other relevant information. Including a South Dakota Estate Planning Data Letter and Employment Agreement with Client in your planning can help streamline this process.

An important document you need for estate planning is a will. A will outlines how you wish your assets to be distributed after your passing. In conjunction with a South Dakota Estate Planning Data Letter and Employment Agreement with Client, it ensures your wishes are clearly communicated and legally upheld.

To effectively create an estate plan in South Dakota, you will need several essential documents. These typically include a will, power of attorney, and a health care directive. Additionally, consider utilizing a South Dakota Estate Planning Data Letter and Employment Agreement with Client to clarify roles and responsibilities during the planning process.

Yes, you can write a will on a piece of paper in South Dakota, as long as it meets the necessary legal requirements. However, it's advisable to follow a structured format and include critical details, such as the appointment of an executor and asset distribution instructions. To enhance clarity and effectiveness, consider using a South Dakota Estate Planning Data Letter and Employment Agreement with Client to provide an organized and comprehensive estate plan.