South Dakota Assignment of Shares

Description

How to fill out Assignment Of Shares?

Are you currently inside a placement in which you require documents for sometimes organization or person purposes almost every day time? There are a variety of legitimate document themes accessible on the Internet, but discovering versions you can trust isn`t straightforward. US Legal Forms delivers 1000s of develop themes, much like the South Dakota Assignment of Shares, which can be created in order to meet state and federal needs.

Should you be already acquainted with US Legal Forms site and get a free account, basically log in. Next, it is possible to obtain the South Dakota Assignment of Shares web template.

Should you not have an profile and would like to start using US Legal Forms, adopt these measures:

- Find the develop you want and make sure it is to the correct metropolis/region.

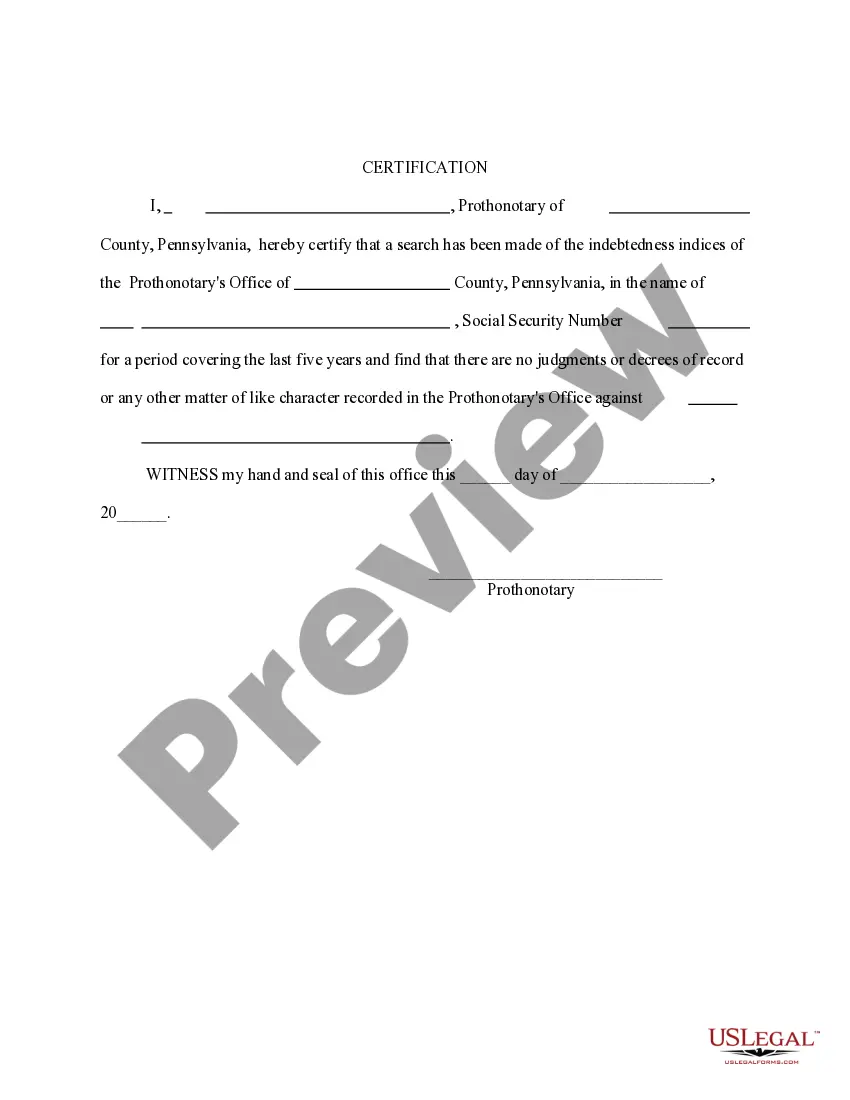

- Use the Preview key to examine the shape.

- Read the description to actually have chosen the correct develop.

- When the develop isn`t what you are looking for, take advantage of the Research discipline to discover the develop that meets your needs and needs.

- Once you find the correct develop, click on Get now.

- Choose the prices program you would like, fill in the desired information to make your bank account, and pay for an order utilizing your PayPal or charge card.

- Decide on a hassle-free data file structure and obtain your version.

Get all of the document themes you may have purchased in the My Forms menu. You can aquire a extra version of South Dakota Assignment of Shares at any time, if possible. Just go through the required develop to obtain or produce the document web template.

Use US Legal Forms, one of the most comprehensive selection of legitimate kinds, to save some time and steer clear of faults. The services delivers professionally produced legitimate document themes that can be used for a variety of purposes. Generate a free account on US Legal Forms and commence generating your life easier.