South Dakota Extended Date for Performance

Description

How to fill out Extended Date For Performance?

You can spend time online searching for the valid document template that complies with the federal and state regulations you require.

US Legal Forms offers thousands of valid forms that have been assessed by experts.

You can easily download or print the South Dakota Extended Date for Performance from my services.

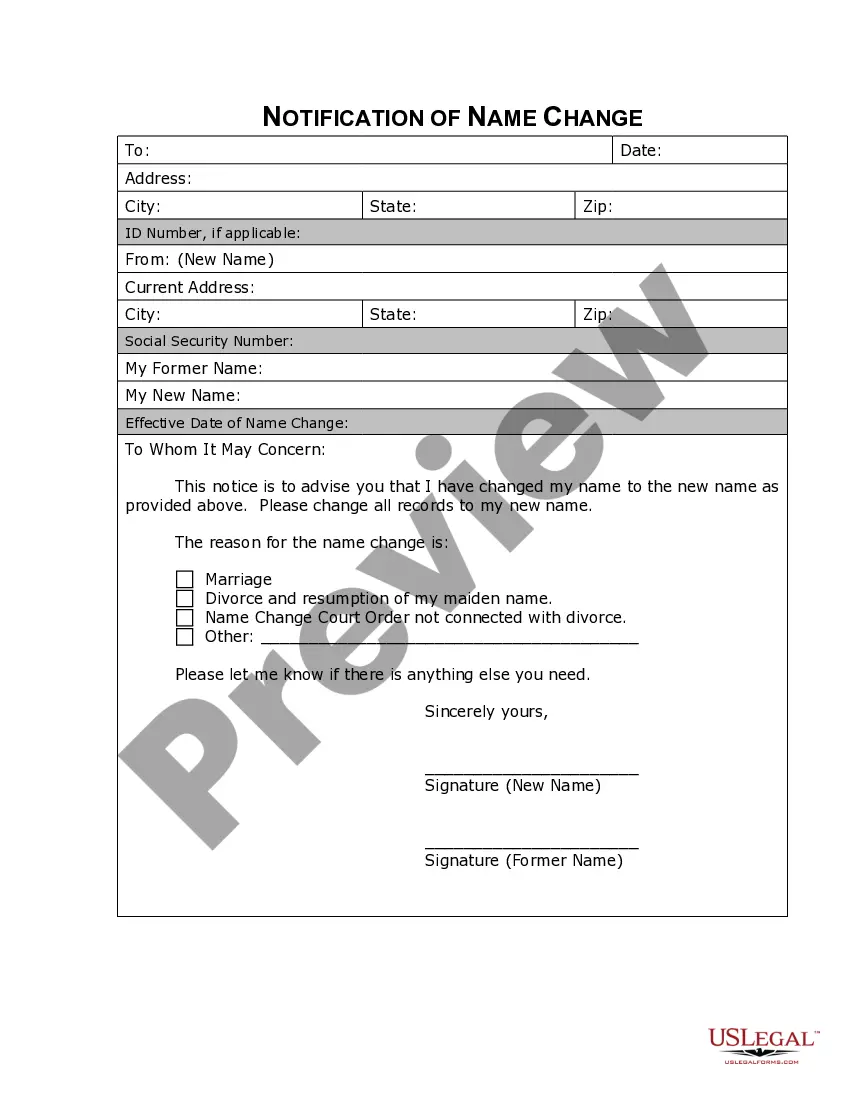

If available, utilize the Preview option to review the document template at the same time.

- If you have a US Legal Forms account, you can Log In and click on the Download option.

- After that, you can fill out, edit, print, or sign the South Dakota Extended Date for Performance.

- Each valid document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click on the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, confirm that you have selected the appropriate document template for the state/city of your choice.

- Review the form description to ensure you have chosen the right template.

Form popularity

FAQ

The bereavement policy in South Dakota varies by organization and can cover various aspects such as leave and support services. It's important to consult with your employer or social services to understand the specific regulations. Understanding these policies can help during difficult times, especially in light of the South Dakota Extended Date for Performance.

Subscriptions are generally taxable in South Dakota, especially if they include access to taxable content or services. However, there may be exceptions based on specific subscription types. Awareness of these rules is essential, particularly concerning the South Dakota Extended Date for Performance.

The taxability of membership benefits in South Dakota depends on what those benefits entail. If the benefits are linked to taxable services, you may face tax liabilities. For those navigating these concerns, it's vital to understand how the South Dakota Extended Date for Performance can impact your obligations.

In South Dakota, opting out of state testing typically applies to certain education requirements. However, parents often need to follow specific procedures to ensure their children's educational needs are met. It's essential to stay informed about policies as they may relate to the South Dakota Extended Date for Performance.

The bid factor for excise tax in South Dakota is determined by multiple elements related to project types and costs. Knowing this factor is crucial for accurate budgeting and financial planning. Additionally, any changes related to the South Dakota Extended Date for Performance can affect how you calculate these costs.

Memberships can be taxable in South Dakota, but it largely depends on the specific organization or service. For instance, memberships that provide access to taxable services may lead to tax obligations. Understanding these regulations helps ensure compliance, particularly when you need to adhere to the South Dakota Extended Date for Performance.

In South Dakota, certain services and products are exempt from taxation. For example, necessities such as groceries, prescription drugs, and farming equipment typically do not incur sales tax. This exemption can be beneficial when navigating financial obligations, especially regarding the South Dakota Extended Date for Performance.

The Rule of 85 in South Dakota retirement enables individuals to retire without incurring penalties when their age and years of service add up to 85. This rule is designed to enhance retirement options for long-serving employees. Knowing this rule helps in making informed decisions regarding your retirement planning. For additional insights and documentation, US Legal Forms can serve as a helpful resource.

While a traditional teaching degree is the standard requirement to teach in South Dakota, alternative options exist for those with significant experience or expertise in specific subjects. These alternatives can lead to a temporary teaching certificate, allowing you to enter the profession swiftly. It's important to stay informed about the specific requirements and options available. US Legal Forms offers resources that can assist you in this process.

The 85 Point Rule is another way to refer to the Rule of 85, indicating that when your age plus years of service equals 85, you are eligible for full retirement benefits without penalties. This rule encourages long-term career commitment while providing flexibility in retirement timing. Familiarizing yourself with this rule is crucial for your retirement strategy. Consider using resources like US Legal Forms for comprehensive guidelines and documentation assistance.