South Dakota Loan Agreement between Stockholder and Corporation

Description

How to fill out Loan Agreement Between Stockholder And Corporation?

If you want to completely acquire, download, or print sanctioned document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the website's straightforward and user-friendly search tool to locate the documents you require.

Various templates for commercial and personal purposes are organized by category and state, or by keywords.

Step 4. After identifying the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to find the South Dakota Loan Contract between Shareholder and Corporation with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Get button to obtain the South Dakota Loan Contract between Shareholder and Corporation.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions outlined below.

- Step 1. Ensure you have selected the form for the appropriate area/state.

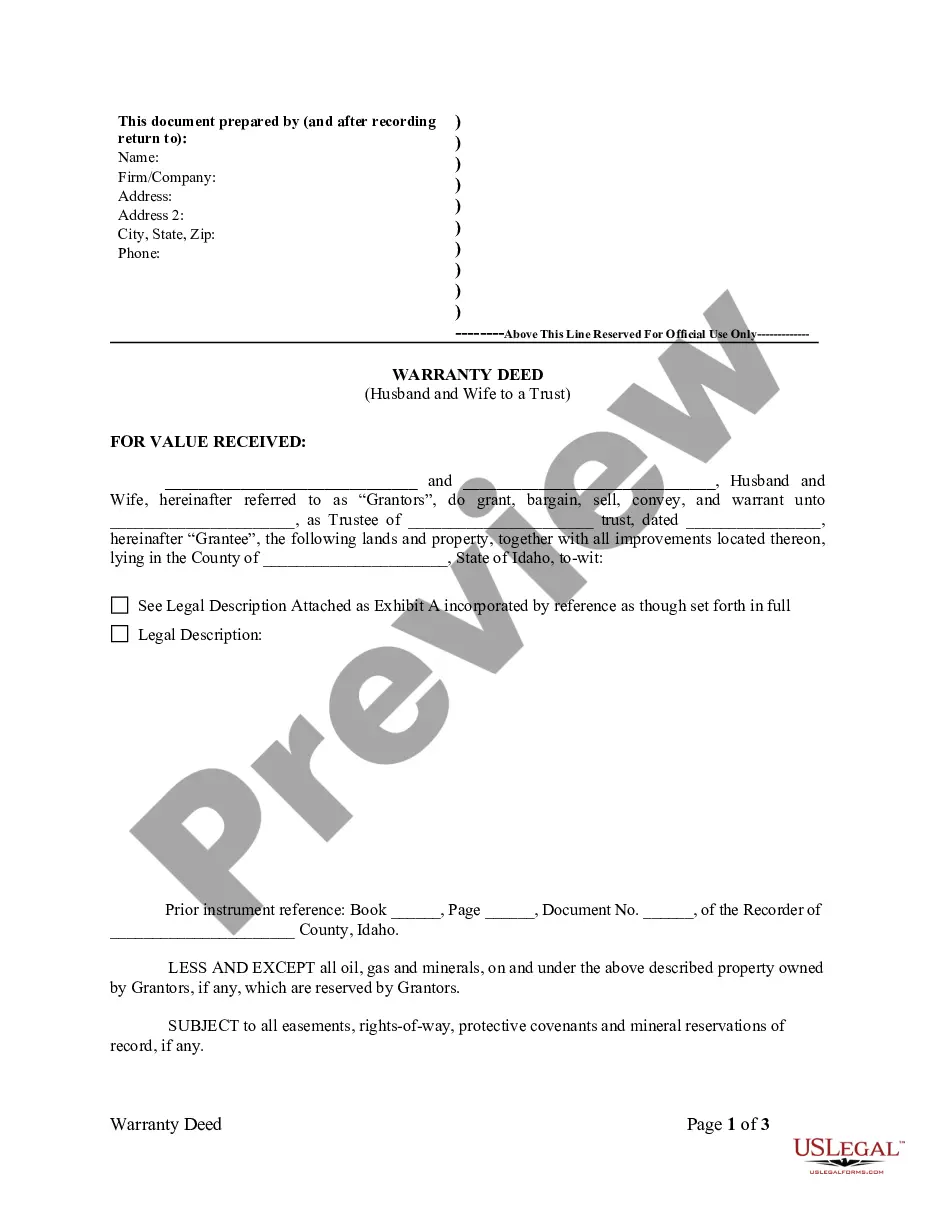

- Step 2. Use the Review option to check the content of the form. Don't forget to read the details.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find different templates of the legal form template.

Form popularity

FAQ

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

An advance of funds to a member can only be considered a loan if the LLC creates a legally enforceable promissory note for the repayment of the loan. The note should include the specific amount of the loan, the interest rate, a repayment schedule and a description of any collateral or guarantees.

Conclusion. Shareholder loans are a hybrid of debt and equity much like preferred stock. They are used by sponsors in transactions as a vehicle to carry the bulk of their investment as they carry a fixed rate of return.

Shareholders may take a loan from the corporation and are not required to report it as personal income on their personal tax return for that fiscal tax year. A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed.

A profitable C corporation may lend money to its shareholders. A loan from your C corporation isn't taxable income to you and doesn't have tax consequences to the corporation. Interest paid by the borrower on the loan is income to the corporation, of course. Shareholder loans must be bona fide.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

How do I create a Shareholder Loan Agreement?Determine how the corporation will make payments.State the term length.Specify the loan amount.Determine the payment details.Provide both parties' information.Address miscellaneous matters.Sign the document.