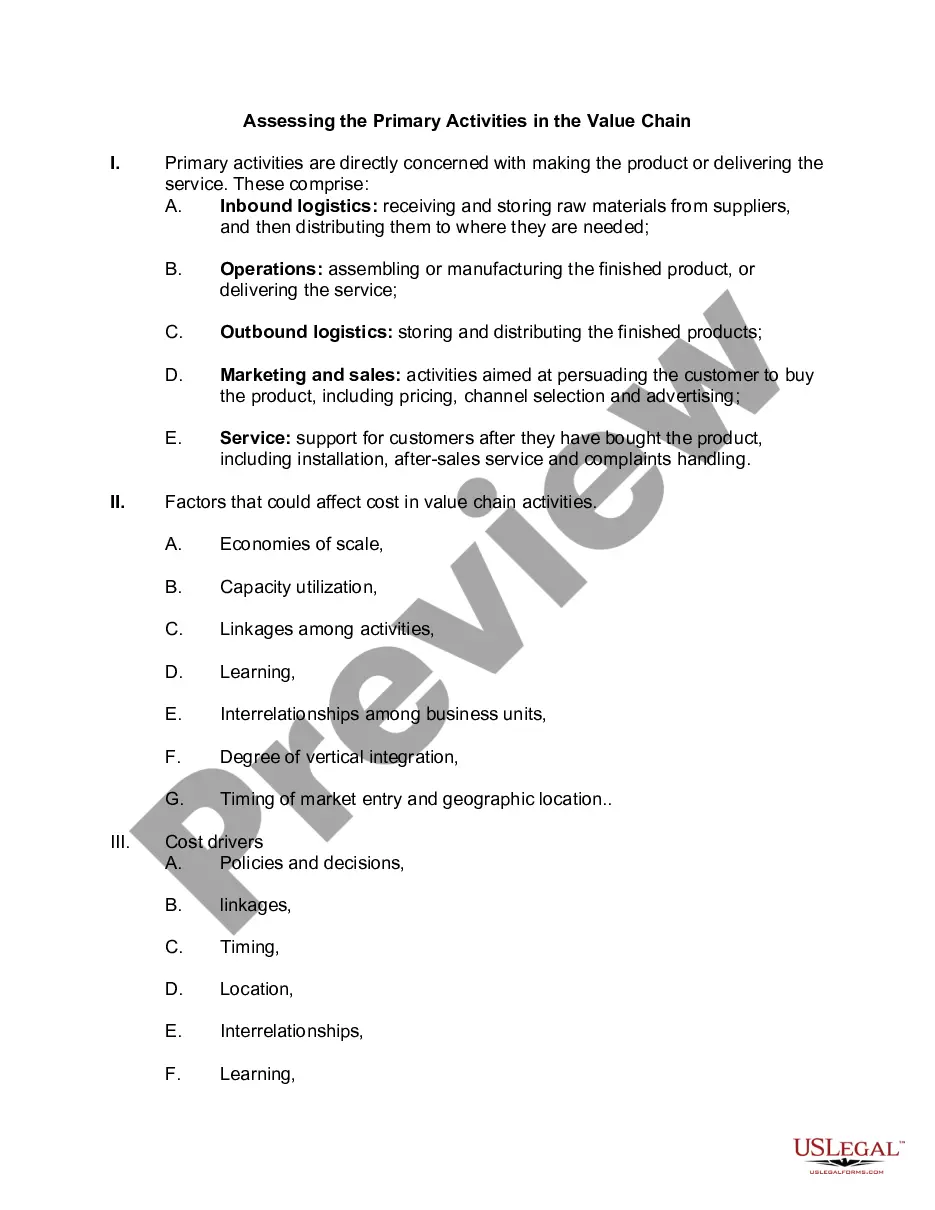

South Dakota Assessing the Primary Activities in the Value Chain

Description

How to fill out Assessing The Primary Activities In The Value Chain?

Are you currently in a position where you require documents for both business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding those you can trust isn't easy.

US Legal Forms offers thousands of form templates, such as the South Dakota Assessing the Primary Activities in the Value Chain, designed to meet federal and state regulations.

Once you find the right form, simply click Get now.

Select the pricing plan you desire, complete the required details to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the South Dakota Assessing the Primary Activities in the Value Chain template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review button to scrutinize the form.

- Examine the information to confirm you have selected the right form.

- If the form isn’t what you’re seeking, utilize the Search box to find the form that meets your needs.

Form popularity

FAQ

The discretionary formula in South Dakota determines how certain properties are assessed for tax purposes. This formula allows flexibility based on property type and its use in the community. Understanding the discretionary formula is vital when evaluating the South Dakota assessing the primary activities in the value chain for tax planning or investment decisions. For detailed guidance, consider using resources from uslegalforms to simplify this complex process.

The sunshine law in South Dakota promotes transparency in government by ensuring that meetings and records are accessible to the public. It requires that certain public bodies hold open meetings and keep accurate minutes. Understanding this law is crucial for residents interested in South Dakota assessing the primary activities in the value chain, as it can influence how local governance operates and makes decisions. Accessing legal resources through uslegalforms can help you navigate these laws effectively.

To find the assessed value of your home in South Dakota, visit your county's official website or your local assessor's office. They provide access to property records that reflect the assessed values. Additionally, online resources like uslegalforms can assist you in understanding the assessment process and obtaining necessary documents. Knowing the assessed value is essential when you are assessing the primary activities in the value chain of your property.

South Dakota does not completely eliminate property taxes; rather, it has a unique system with certain exemptions and tax structures. This allows for funding schools and local services without placing a heavy burden on property owners. Exploring how South Dakota Assessing the Primary Activities in the Value Chain can clarify how these local policies function. For comprehensive assistance, consider using US Legal Forms to access the necessary documentation.

Property taxes in South Dakota can vary widely depending on the county and local tax rate. Generally, South Dakota has a reputation for lower property taxes compared to many other states. It's beneficial to examine the specifics of your area's assessments and local tax rates. This knowledge is crucial for understanding South Dakota Assessing the Primary Activities in the Value Chain.

Yes, seniors in South Dakota may qualify for property tax reductions through various programs. These programs often include exemptions based on income levels and age. By connecting with the local assessor's office, seniors can learn about specific benefits available to them. It's important to explore how South Dakota Assessing the Primary Activities in the Value Chain can enhance your understanding of these discounts.

To find the tax assessed value of a property in South Dakota, you can start by checking your local county assessor's website. They typically provide property records that include assessed values. Additionally, you can visit the South Dakota Department of Revenue's website for statewide assessment data. Understanding South Dakota Assessing the Primary Activities in the Value Chain helps you navigate this process effectively.

The director of equalization in Brown County is responsible for managing property assessments within the county. This individual ensures that property values are fairly established and aligned with market conditions. Understanding who holds this position can be vital for homeowners seeking to appeal assessments or inquire about property taxes. Engaging with local resources will often tie back to South Dakota Assessing the Primary Activities in the Value Chain.

Property taxes do not automatically decrease after age 65, but eligible seniors can apply for exemptions. These exemptions can help lower the tax burden for those on a fixed income. It's crucial for seniors to explore their options and take action to qualify for these savings. Knowing the details surrounding South Dakota Assessing the Primary Activities in the Value Chain is beneficial in this context.

Property taxes in South Dakota are assessed based on the appraised value of real estate. County assessors evaluate properties annually, taking into account factors like market trends and property features. The assessment helps establish the taxable amount. Understanding South Dakota Assessing the Primary Activities in the Value Chain will help you grasp how these assessments can impact your property taxes.