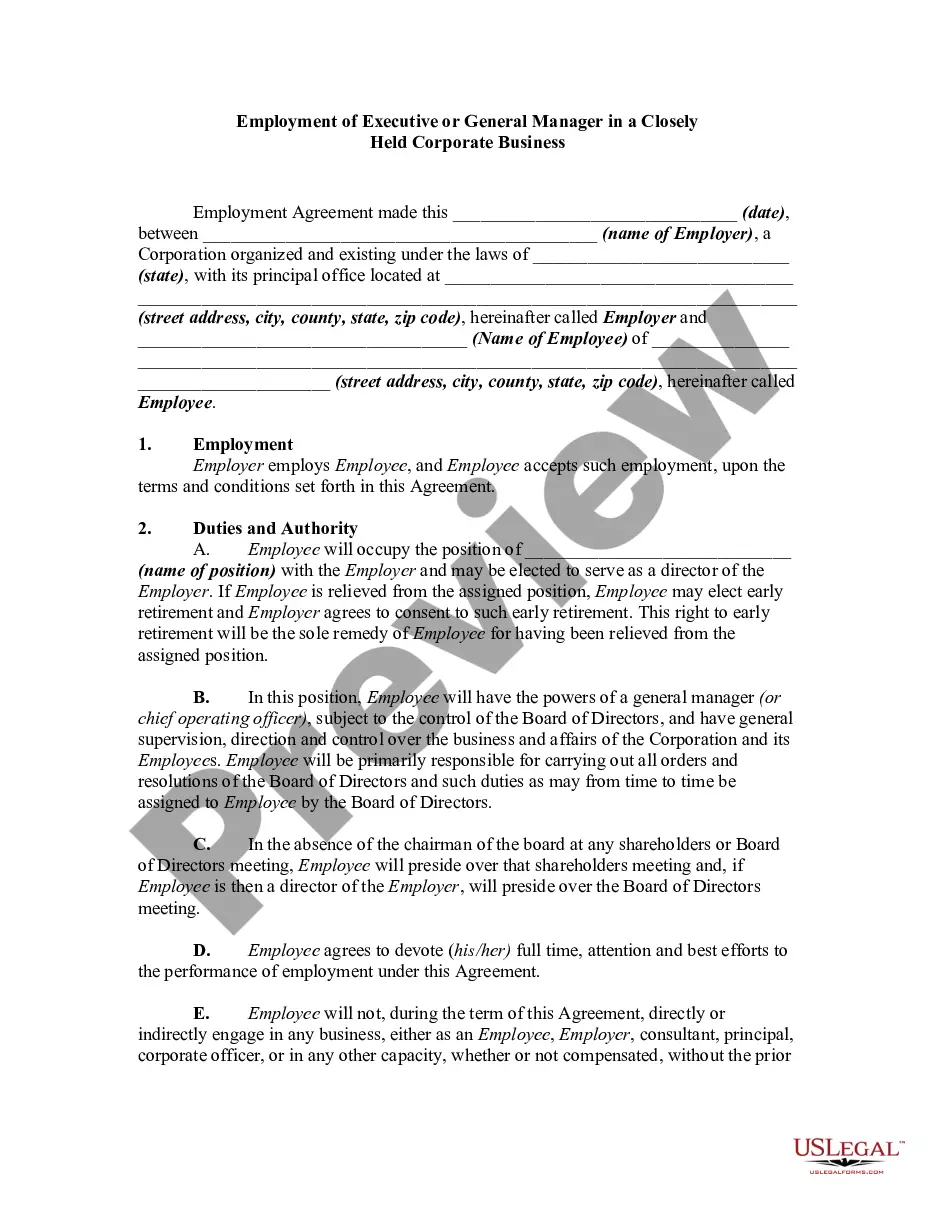

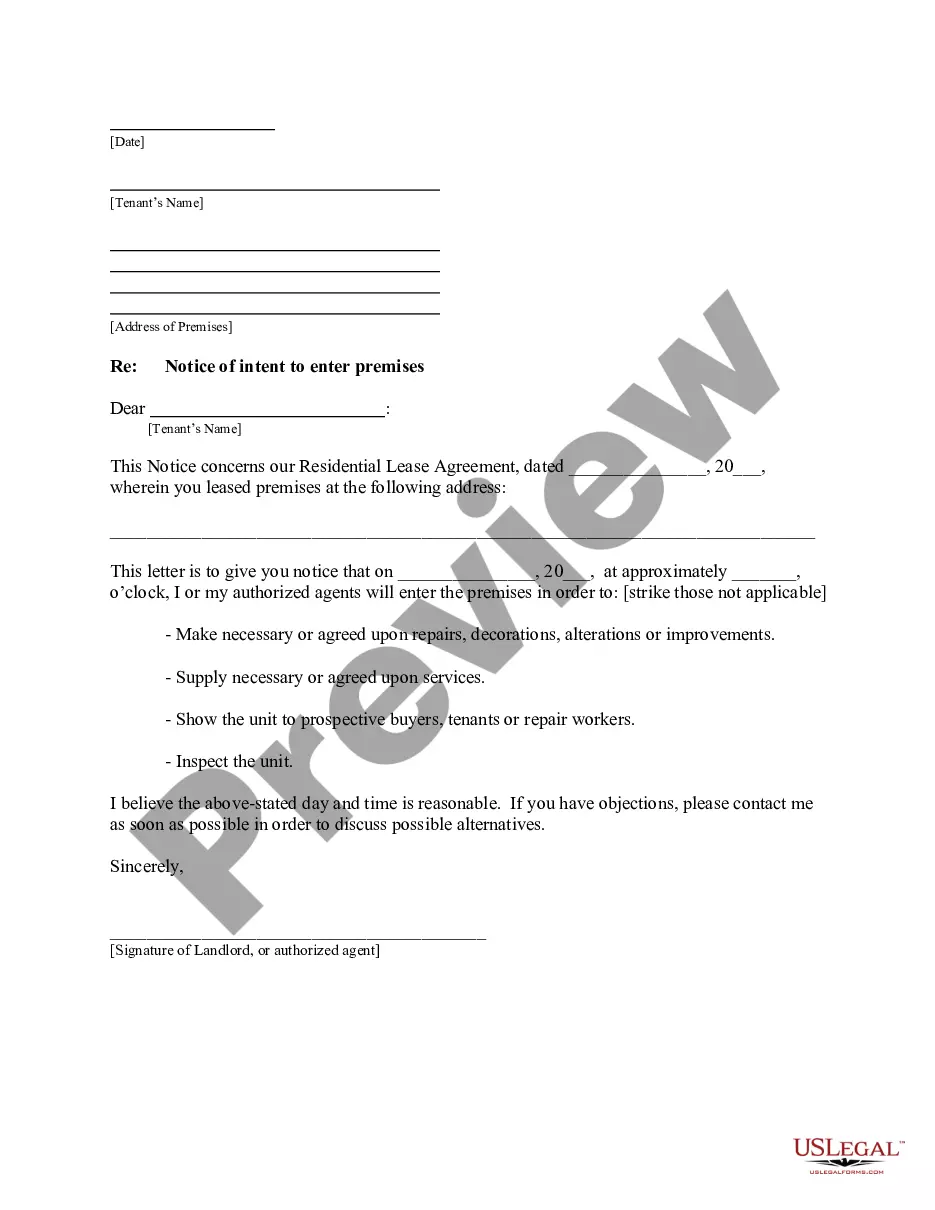

South Dakota Review of Loan Application

Description

How to fill out Review Of Loan Application?

US Legal Forms - one of many largest libraries of lawful forms in the States - offers a wide array of lawful papers themes you may down load or printing. Making use of the website, you can find 1000s of forms for business and individual functions, categorized by groups, says, or keywords.You will discover the most up-to-date variations of forms just like the South Dakota Review of Loan Application in seconds.

If you currently have a monthly subscription, log in and down load South Dakota Review of Loan Application from your US Legal Forms library. The Acquire option will show up on each type you look at. You get access to all earlier saved forms inside the My Forms tab of the accounts.

If you want to use US Legal Forms the first time, listed below are basic recommendations to obtain started:

- Make sure you have chosen the proper type to your town/area. Click on the Review option to review the form`s information. See the type description to ensure that you have chosen the right type.

- When the type does not satisfy your needs, make use of the Lookup field on top of the display to obtain the one which does.

- Should you be pleased with the shape, confirm your selection by clicking the Buy now option. Then, opt for the prices plan you like and give your qualifications to register on an accounts.

- Procedure the deal. Utilize your charge card or PayPal accounts to accomplish the deal.

- Find the file format and down load the shape on the device.

- Make changes. Complete, change and printing and indication the saved South Dakota Review of Loan Application.

Each and every web template you included with your account does not have an expiration date and it is your own property permanently. So, if you wish to down load or printing one more duplicate, just visit the My Forms portion and click on on the type you require.

Obtain access to the South Dakota Review of Loan Application with US Legal Forms, the most substantial library of lawful papers themes. Use 1000s of specialist and state-certain themes that meet up with your organization or individual demands and needs.

Form popularity

FAQ

Loan application volume (how many mortgages a lender is processing at once) The complexity of your loan profile (for example, someone with issues in their credit history might take longer to approve than someone with an ultra-clean credit report)

By understanding the different types of loans available, reviewing the loan terms and conditions, and working with a financial advisor, you can ensure that you're getting the best loan for your needs. Remember to review your credit report and prepare the necessary documents before applying for a loan.

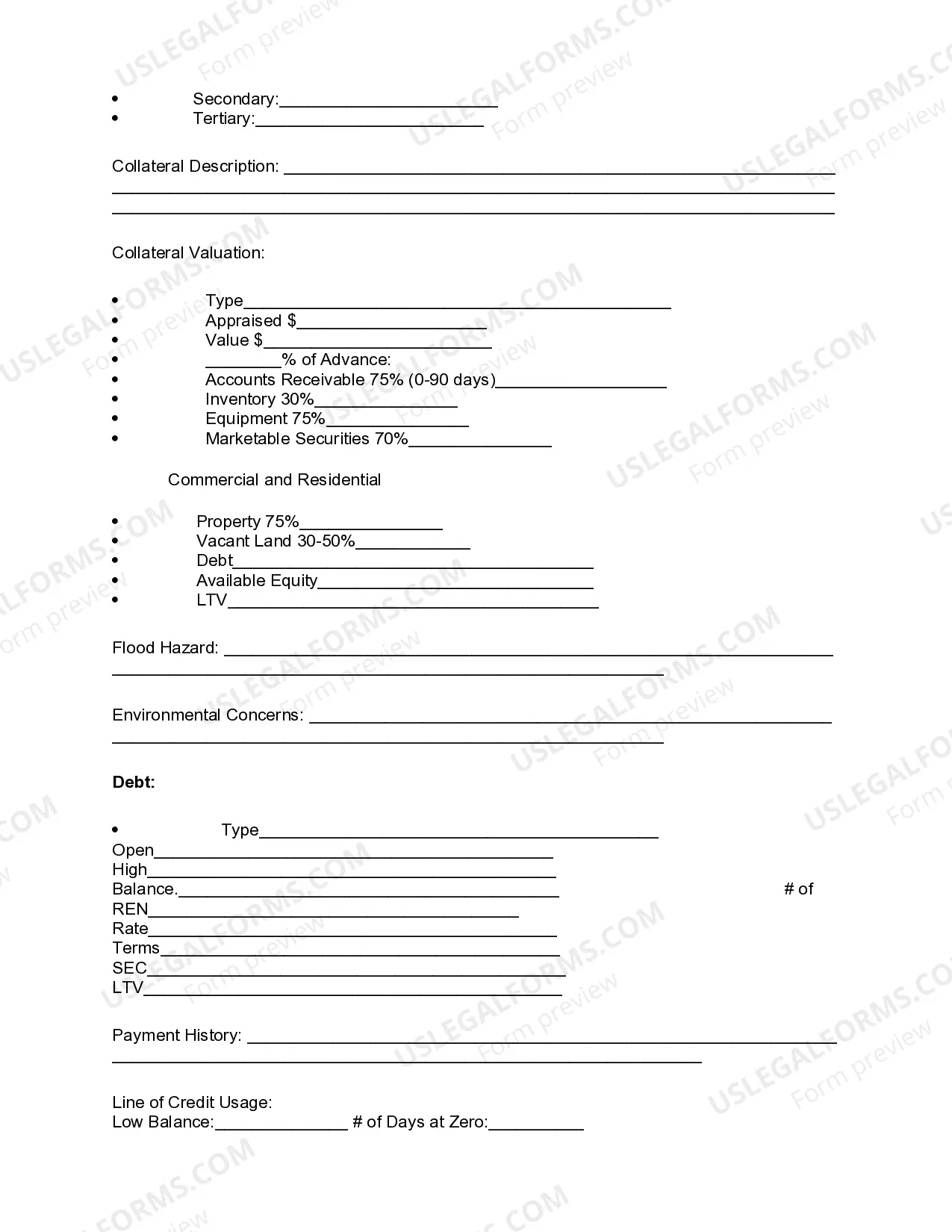

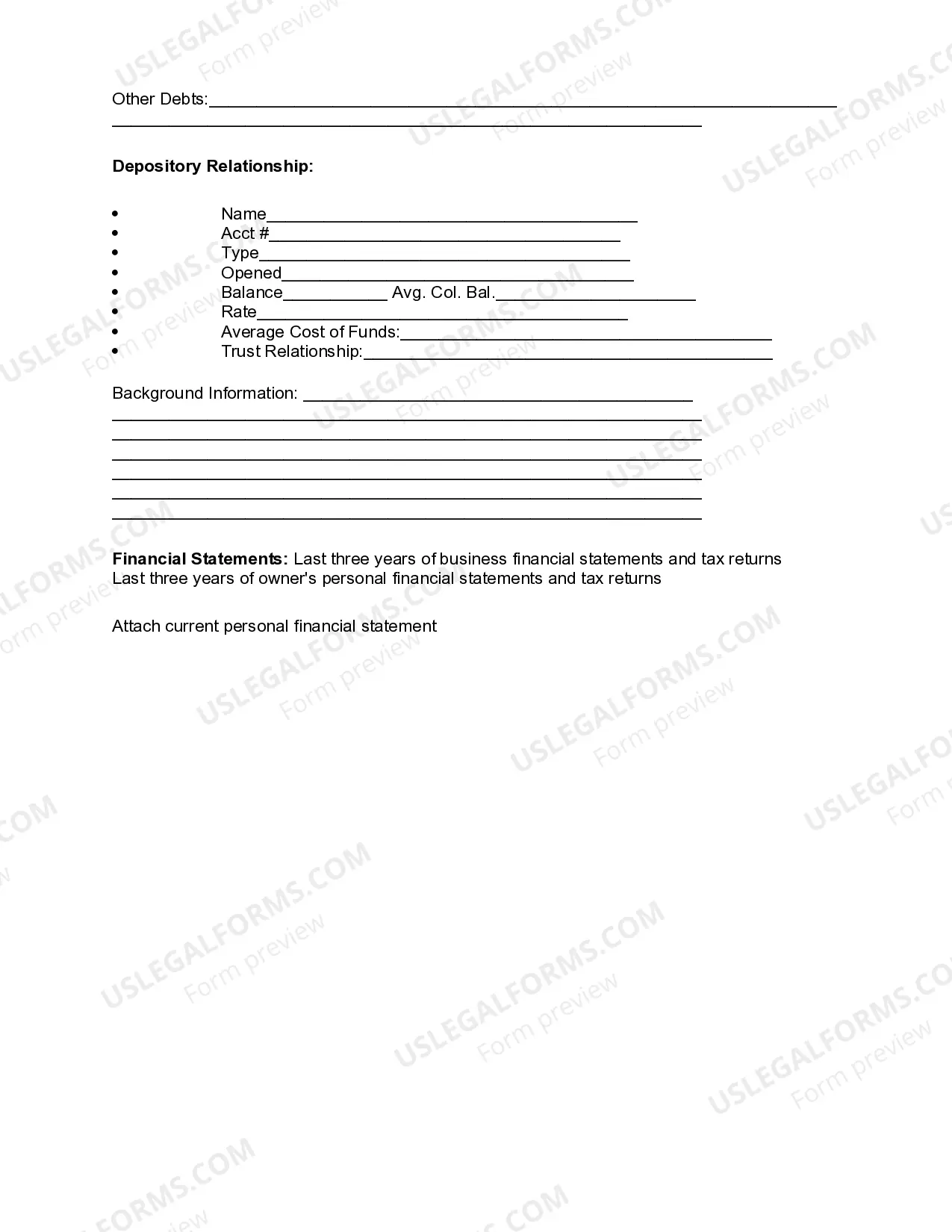

What Should I Look for When Reviewing Loan Documents? Principal loan Amount. ... Loan duration. ... Interest rate. ... Repayment terms : Every loan agreement should have a repayment schedule that provides the borrower with clear instructions on how to repay the loan. ... Fees and charges. ... Collateral. ... Default. ... Collection procedures.

When reviewing a bank loan, there are several factors you need to consider to ensure that the loan is suitable for you. Interest Rates - The interest rate is the amount of money the lender charges for borrowing the funds. ... Repayment Terms - The repayment term is the length of time you have to repay the loan.

The loan review will consist of meetings with lending staff including loan administration to understand the lending process and procedures from intake to closing. The loan review team will also be reviewing underwriting and collateral files to ascertain the underwriting, monitoring, and documentation practices.

Under review means that your application has been received and is in the screening or background check process.

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.

A loan review provides an assessment of the overall quality of a loan portfolio. Specifically, a loan review: ? Assesses individual loans, including repayment risks.