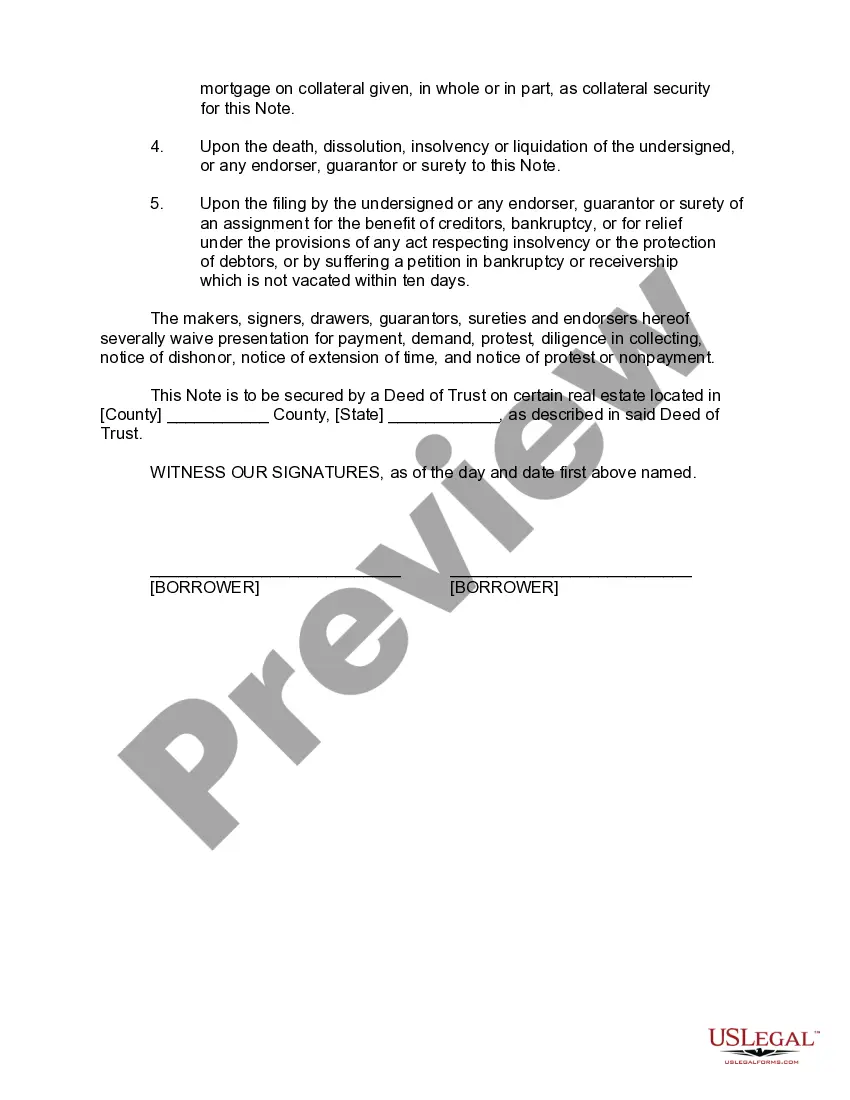

South Dakota Promissory Note — Long Form is a legally binding agreement used to document a borrower's promise to repay a lender a specific sum of money within a specified period. This detailed legal document ensures that both parties are protected and clarifies the terms and conditions surrounding the loan. Keywords: South Dakota, promissory note, long form, agreement, borrower, lender, repayment, terms and conditions. Different types of South Dakota Promissory Note — Long Form: 1. Simple Interest Promissory Note: This version includes a predetermined interest rate that the borrower agrees to pay in addition to the principal amount borrowed. It outlines the repayment schedule, interest calculation method, and any applicable late charges or penalties. Example keywords: simple interest, predetermined interest rate, repayment schedule, late charges, penalties. 2. Balloon Payment Promissory Note: This type of promissory note is structured with lower monthly payments throughout the agreed-upon period, with a larger final payment known as the "balloon payment." Borrowers typically choose this type of note when they anticipate having enough funds to make the significant final payment. Example keywords: balloon payment, lower monthly payments, significant final payment. 3. Secured Promissory Note: In this version, the borrower pledges collateral, such as real estate or a valuable asset, as security for the loan. If the borrower defaults on the loan, the lender can seize the collateral to recover the outstanding amount. Example keywords: secured promissory note, collateral, default, seize assets. 4. Unsecured Promissory Note: Unlike a secured promissory note, this option does not require any collateral from the borrower. Therefore, lenders typically have a higher risk when extending unsecured loans, which may result in higher interest rates or more stringent terms. Example keywords: unsecured promissory note, higher risk, interest rates, stringent terms. 5. Installment Promissory Note: This type of promissory note entails the borrower making a series of fixed monthly payments until the loan is fully repaid. The note details the number of installments, payment amounts, and due dates. Example keywords: installment promissory note, fixed monthly payments, repayment plan. In summary, South Dakota Promissory Note — Long Form is a comprehensive legal document used to establish a borrower's repayment obligations to a lender. It can be customized based on the specific type and terms of the loan, such as a simple interest note, balloon payment note, secured or unsecured note, or an installment note.

South Dakota Promissory Note - Long Form

Description

How to fill out South Dakota Promissory Note - Long Form?

Are you in the placement that you need to have documents for sometimes business or person reasons virtually every time? There are tons of legitimate document templates accessible on the Internet, but locating versions you can trust is not effortless. US Legal Forms gives a huge number of form templates, just like the South Dakota Promissory Note - Long Form, which can be published in order to meet state and federal needs.

If you are previously acquainted with US Legal Forms internet site and possess a merchant account, basically log in. Following that, you are able to down load the South Dakota Promissory Note - Long Form web template.

Unless you provide an accounts and would like to begin to use US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is to the right area/county.

- Utilize the Review switch to check the form.

- Look at the information to ensure that you have selected the correct form.

- If the form is not what you are trying to find, make use of the Look for discipline to obtain the form that meets your requirements and needs.

- Once you get the right form, click on Purchase now.

- Opt for the rates strategy you want, complete the necessary info to create your money, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Select a practical data file file format and down load your version.

Discover each of the document templates you have purchased in the My Forms food selection. You can aquire a extra version of South Dakota Promissory Note - Long Form any time, if required. Just click on the required form to down load or printing the document web template.

Use US Legal Forms, one of the most considerable collection of legitimate kinds, to save time as well as stay away from errors. The support gives appropriately created legitimate document templates which you can use for an array of reasons. Generate a merchant account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Depending on which state you live in, the statute of limitations with regard to promissory notes can vary from three to 15 years. Once the statute of limitations has ended, a creditor can no longer file a lawsuit related to the unpaid promissory note.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

A form of a promissory note to be used when there is no separate loan agreement and the parties are not contemplating a negotiable instrument. This model promissory note includes all the terms of the loan, including payment terms, borrowing mechanics, events of default, remedies, and dispute resolution provisions.

Types of Promissory NotesPersonal Promissory Notes This is a particular loan taken from family or friends.Commercial Here, the note is made when dealing with commercial lenders such as banks.Real Estate This is similar to commercial notes in terms of nonpayment consequences.More items...

A promissory note is a note issued against short- or long-term borrowing. The borrower, or maker, signs a note promising to pay the lender an agreed sum plus interest on a certain date, for value received. The lender may provide value in the form of cash, supplies or equipment.

Types of Promissory NotesSimple promissory note.Demand promissory note.Secured promissory note.Unsecured promissory note.