A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

South Dakota Line of Credit Promissory Note

Description

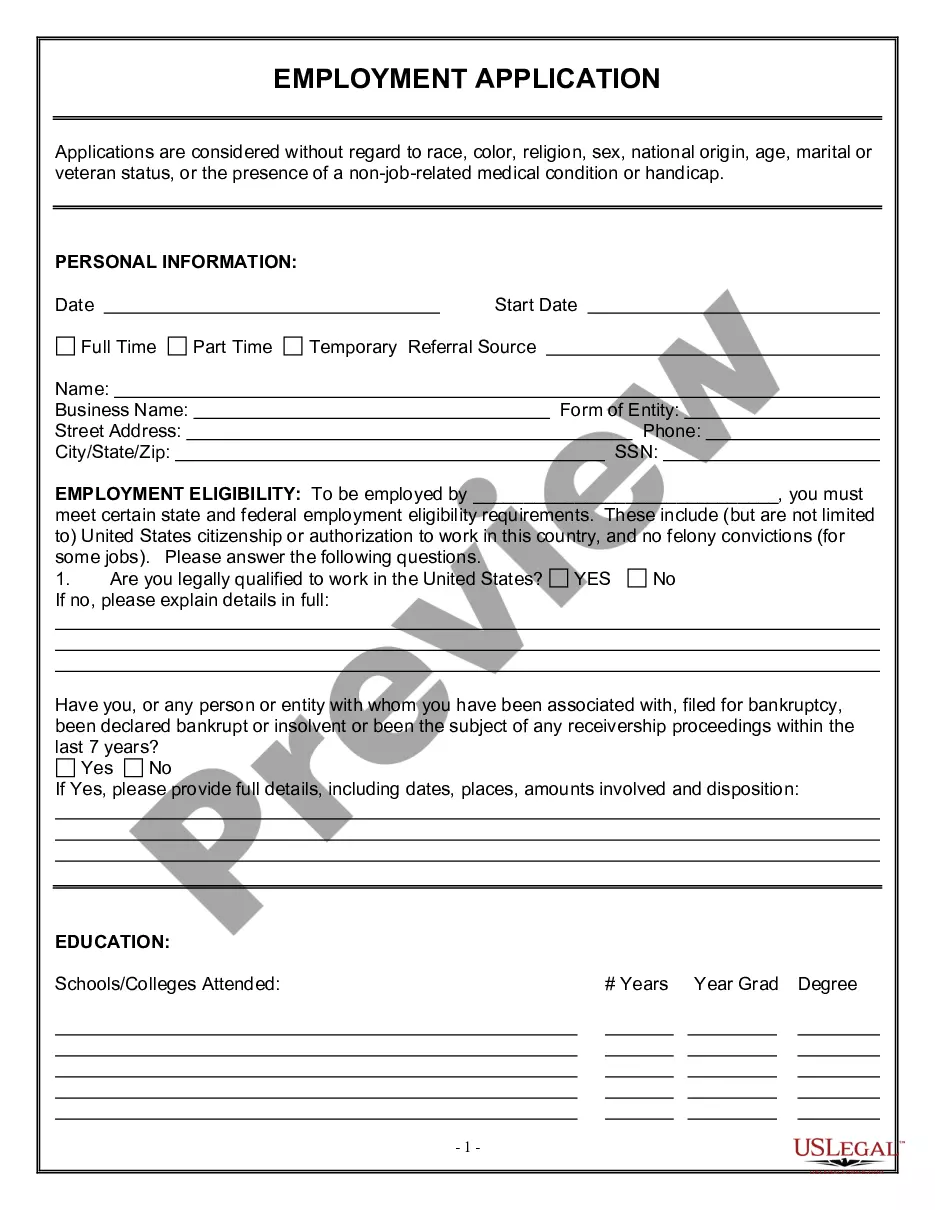

How to fill out Line Of Credit Promissory Note?

It is feasible to spend hours online trying to locate the authentic document template that meets the local and national criteria you require.

US Legal Forms offers a vast array of authentic forms that can be evaluated by specialists.

You can easily obtain or print the South Dakota Line of Credit Promissory Note from our services.

To find another version of the form, use the Search box to locate the template that meets your needs and criteria. Once you have identified the template you wish to use, click on Purchase now to proceed. Select the pricing plan you prefer, enter your details, and register for your account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to pay for the authentic form. Select the format of the document and download it to your device. Make modifications to your document if required. You can complete, edit, and sign and print the South Dakota Line of Credit Promissory Note. Obtain and print numerous document layouts using the US Legal Forms site, which provides the largest collection of authentic forms. Utilize professional and state-specific layouts to address your business or personal requirements.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the South Dakota Line of Credit Promissory Note.

- Every authentic document template you obtain is yours indefinitely.

- To get another copy of any acquired form, go to the My documents tab and click the related button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the region/city that you select.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

You don’t necessarily need a lawyer to create a South Dakota Line of Credit Promissory Note, but consulting one can provide peace of mind. If your financial transaction is complex or involves significant amounts, a lawyer can help ensure your document complies with state laws. Alternatively, US Legal Forms provides templates that are easy to use, allowing you to create a valid note without legal assistance. Choose the option that best fits your situation.

drafted promissory note, such as a South Dakota Line of Credit Promissory Note, typically holds up well in court. Courts generally uphold the terms if the note is clear, enforceable, and compliant with local laws. Thus, investing time in understanding legalities can save you from potential disputes down the line.

Generally, a promissory note is highly enforceable, provided it meets specific legal requirements. This includes having clear repayment terms, parties' signatures, and consideration. Your South Dakota Line of Credit Promissory Note will be more secure when it adheres to these standards, making it a solid option for borrowers and lenders alike.

To record a promissory note, you can visit the local county clerk or recorder's office in South Dakota. Recording a South Dakota Line of Credit Promissory Note provides public notice of the debt, which can protect your rights in case of disputes. Ensure that the document is properly signed and notarized before you record it. For an easy way to manage your documentation, consider using US Legal Forms to streamline the process.

A promissory note itself does not create a public record unless it is recorded with a local government office. However, a South Dakota Line of Credit Promissory Note may affect your credit if it remains unpaid or goes into default. Lenders may report your payment history to credit bureaus, influencing your credit score. Keeping your payments consistent is crucial for maintaining a good credit record.

You typically do not file a promissory note with any government agency; however, you must keep it in a safe place for your records. For a South Dakota Line of Credit Promissory Note, it’s essential to have the original document signed by all parties involved. If you are securing property with the note, consider recording it with the appropriate county clerk or recorder's office to provide public notice. This adds an extra layer of security to your agreement.

To fill out a promissory note, start by entering the date, then the names and addresses of both parties involved. Specify the principal amount, interest rate, and the agreed repayment schedule clearly. When drafting a South Dakota Line of Credit Promissory Note, make sure you outline any additional terms or conditions to protect both the borrower and the lender.

A promissory note for a line of credit is a legal document that allows a borrower to withdraw funds up to a specified limit. This type of note details the amount available for borrowing and the terms of repayment, including interest rates. The South Dakota Line of Credit Promissory Note is designed to provide borrowers flexibility in accessing credit as needed, while keeping the lender's interests protected.

A promissory note should follow a clear format that includes a title, date, the names and addresses of both parties, the principal amount, interest rate, repayment terms, and signatures. For a South Dakota Line of Credit Promissory Note, it's important to also specify any conditions surrounding collateral or other security considerations. This organized format helps prevent misunderstandings later on.

Examples of promissory notes include personal loans, business loans, and the South Dakota Line of Credit Promissory Note. Each type specifies the amount borrowed, interest rate, repayment terms, and whether it is secured or unsecured. These notes serve as legal documents, providing clarity and protection for both the lender and the borrower.