South Dakota Storage Agreement of Products of Manufacturer

Description

How to fill out Storage Agreement Of Products Of Manufacturer?

Have you ever found yourself in a situation where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding versions you can trust isn't straightforward.

US Legal Forms provides thousands of document templates, including the South Dakota Storage Agreement of Manufacturer's Products, designed to comply with federal and state regulations.

When you find the correct document, click on Buy now.

Select the pricing plan you prefer, fill in the required details to create your account, and complete the purchase using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Storage Agreement of Manufacturer's Products template.

- If you don’t have an account and want to start using US Legal Forms, follow these steps.

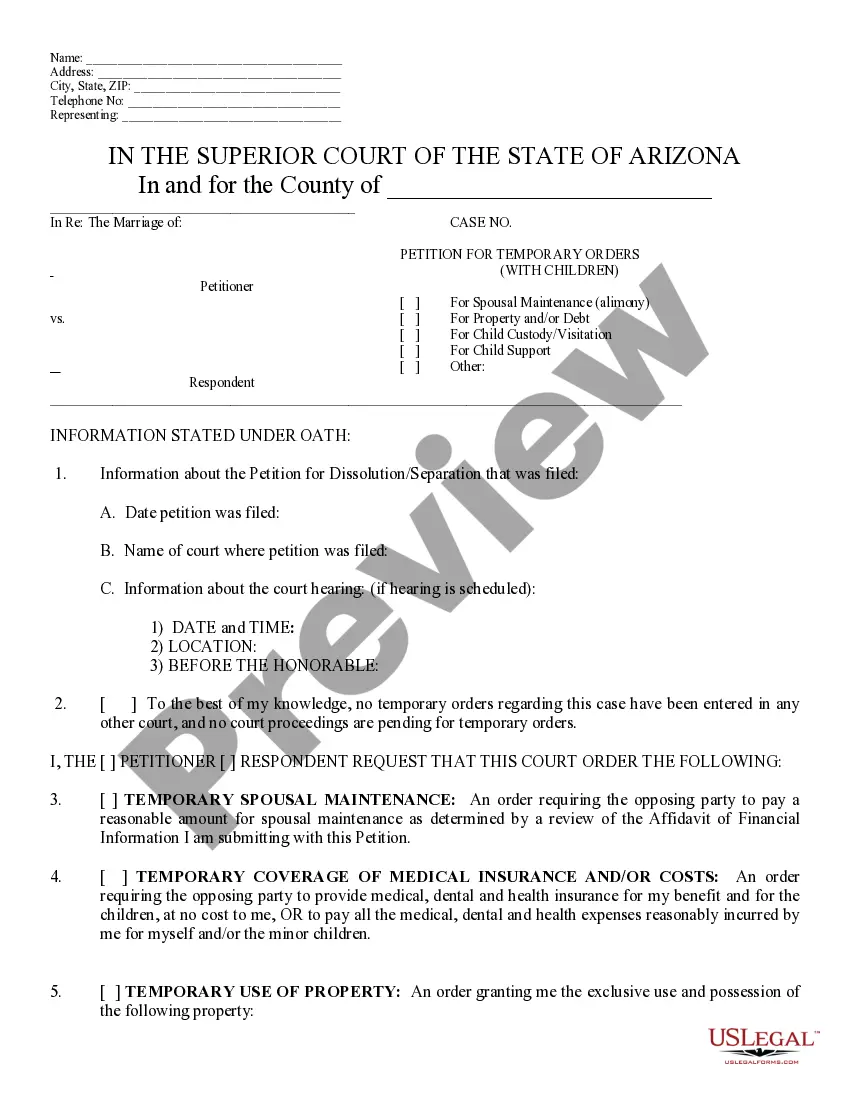

- Find the document you need and ensure it is for the correct jurisdiction/state.

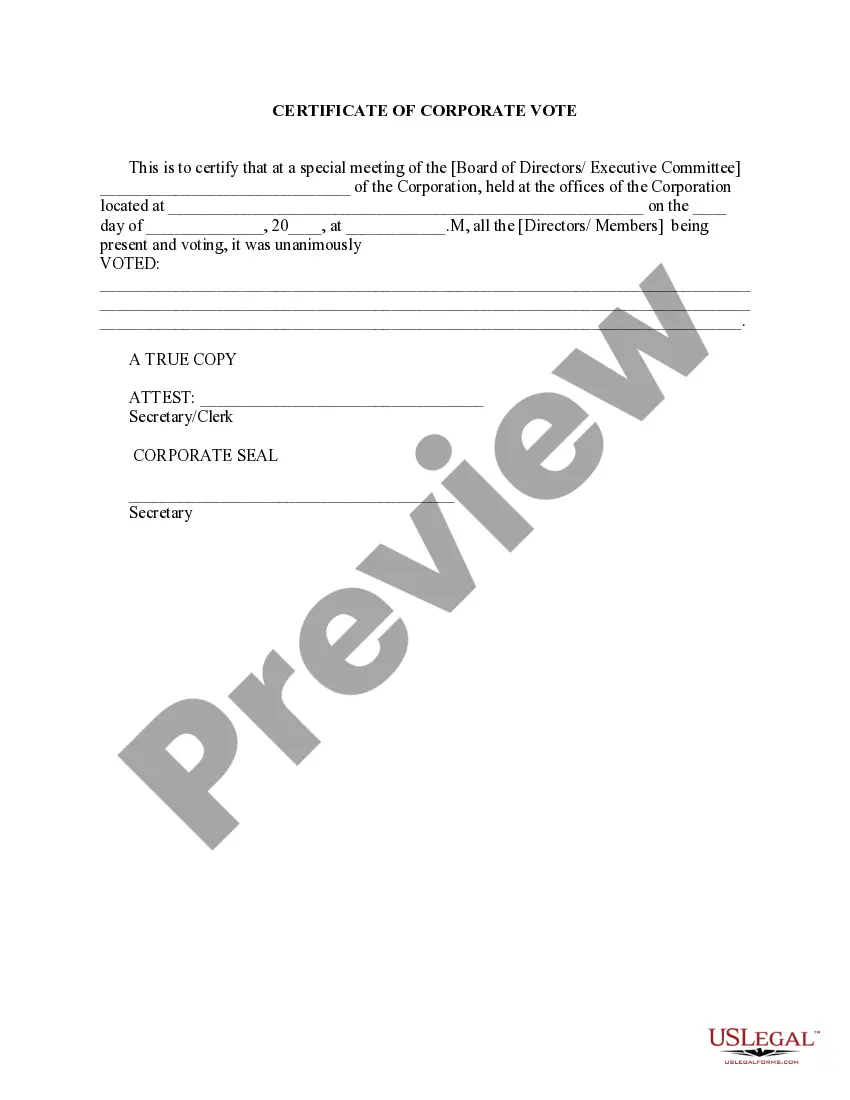

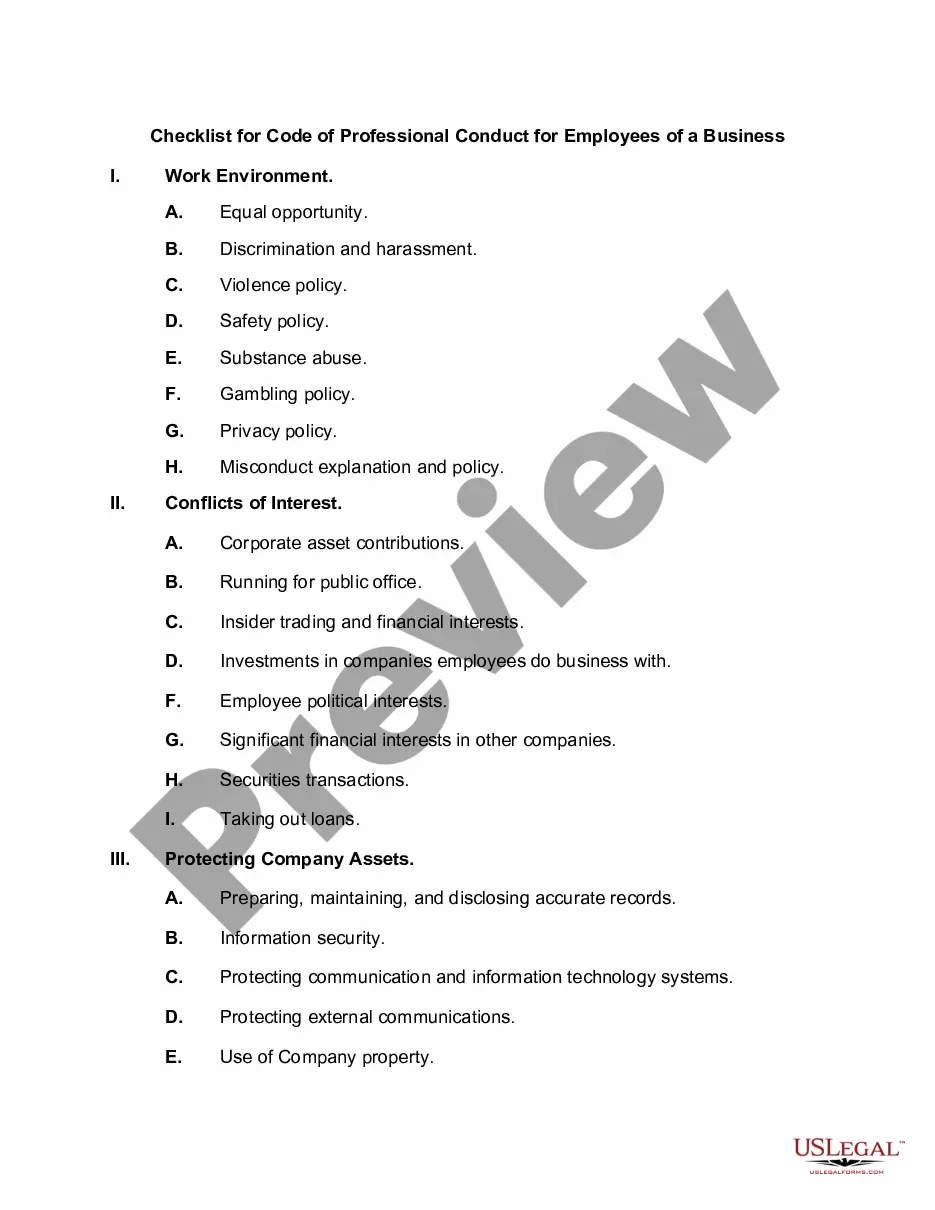

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the right document.

- If the document isn’t what you’re looking for, use the Search field to find a template that meets your needs.

Form popularity

FAQ

Fabricated Equipment: A manufacturer owes use tax on the cost of material used when they fabricate their own equipment. If the equipment is fabricated out-of-state and brought into South Dakota, then use tax is due on the cost of the material when it enters the state.

Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

In the state of South Dakota, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. Several examples of of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

Accordingly, when the partial exemption applies, the sales or use of the qualifying tangible personal property is taxed at a rate of 3.3125 percent (7.25 percent current statewide tax rate 3.9375 percent partial exemption rate) plus any applicable district taxes.

Exempt sales are based on the business or entity making the purchase. This means that the business or entity making the purchase is exempt from paying sales tax.

Only Alabama, Mississippi, and South Dakota still tax groceries at the full state sales tax rate. Sales taxes worsen income and racial inequalities.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.