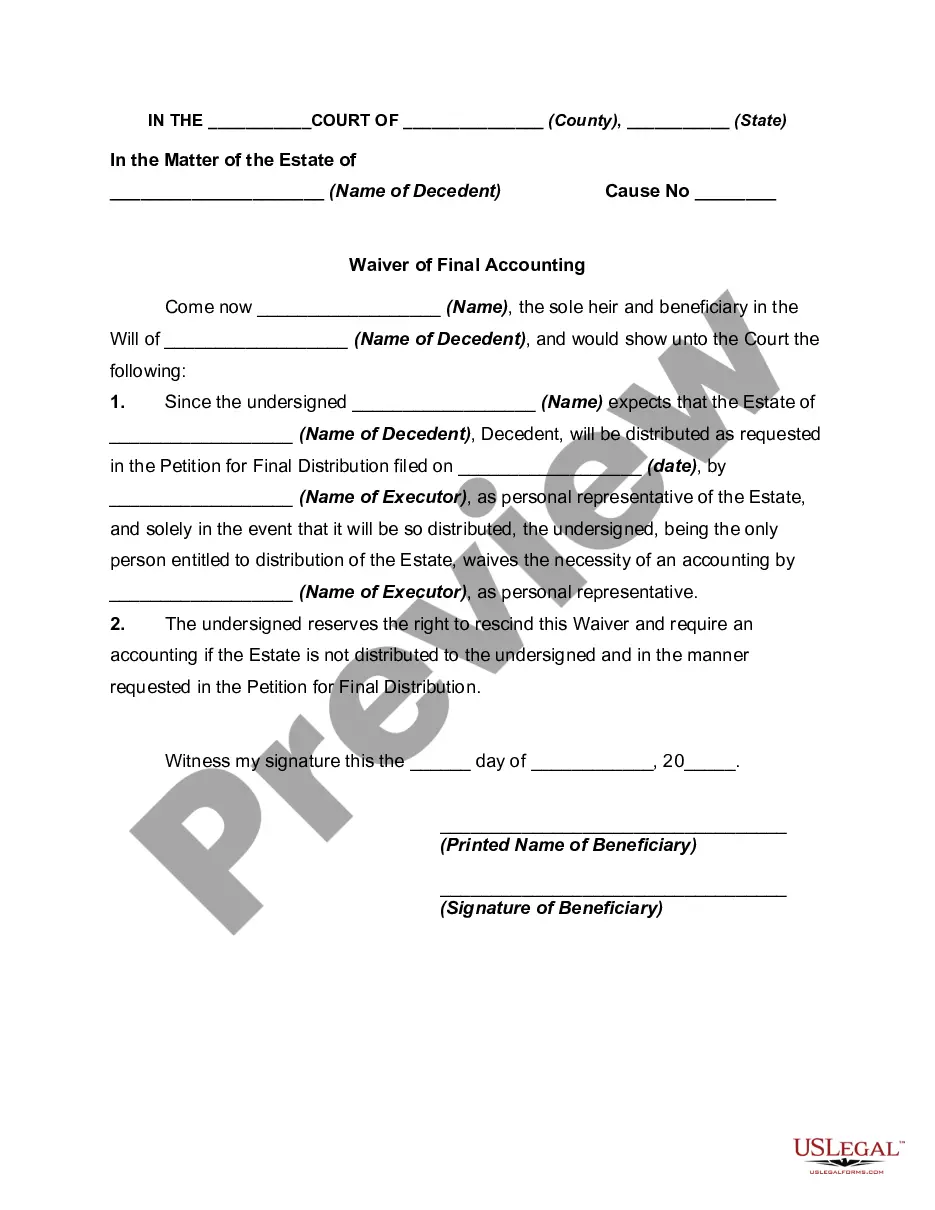

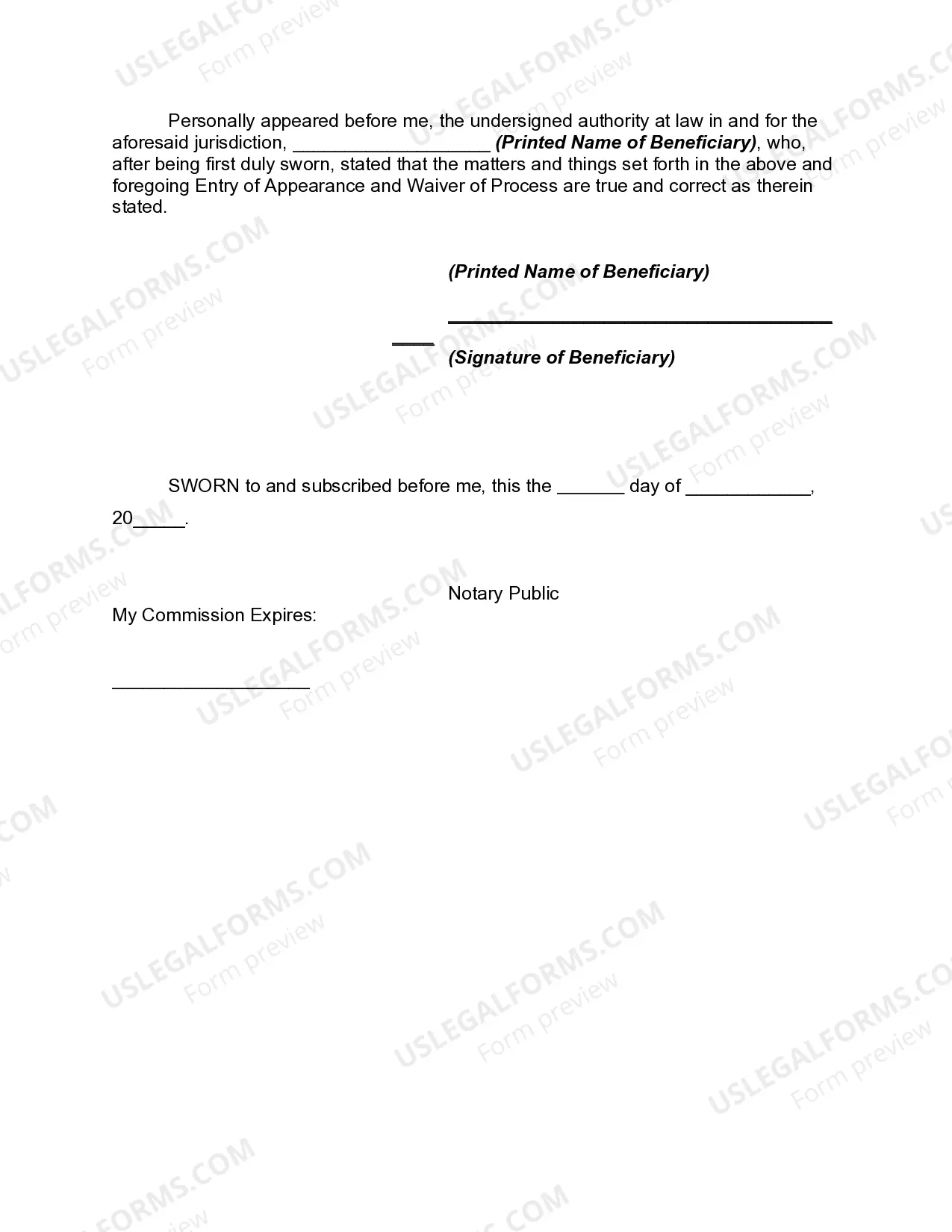

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

South Dakota Waiver of Final Accounting by Sole Beneficiary

Description

How to fill out Waiver Of Final Accounting By Sole Beneficiary?

Have you been inside a situation in which you need to have files for both enterprise or individual functions virtually every time? There are a variety of authorized file web templates available online, but finding types you can rely on isn`t effortless. US Legal Forms gives a large number of form web templates, just like the South Dakota Waiver of Final Accounting by Sole Beneficiary, which are composed to meet federal and state demands.

Should you be presently informed about US Legal Forms web site and have an account, basically log in. Following that, you are able to download the South Dakota Waiver of Final Accounting by Sole Beneficiary web template.

If you do not have an profile and wish to begin to use US Legal Forms, abide by these steps:

- Get the form you need and ensure it is to the proper area/county.

- Make use of the Preview option to review the shape.

- Browse the information to ensure that you have chosen the right form.

- In case the form isn`t what you are searching for, utilize the Search field to obtain the form that meets your needs and demands.

- Whenever you get the proper form, simply click Get now.

- Pick the pricing plan you need, submit the necessary information to generate your money, and pay for an order with your PayPal or bank card.

- Select a handy file file format and download your version.

Find all the file web templates you might have bought in the My Forms food selection. You can get a more version of South Dakota Waiver of Final Accounting by Sole Beneficiary any time, if necessary. Just click on the needed form to download or print out the file web template.

Use US Legal Forms, by far the most substantial variety of authorized kinds, to save lots of time as well as avoid mistakes. The assistance gives expertly created authorized file web templates that can be used for a range of functions. Produce an account on US Legal Forms and commence producing your way of life a little easier.

Form popularity

FAQ

If you die intestate in South Dakota without a spouse but you have children, then your estate goes to your children in equal shares. If you don't have children, then your entire estate goes to your parents, if they are living. If you don't have surviving parents, then your siblings inherit everything.

South Dakota does not have an inheritance tax. Another state's inheritance tax may apply, however, if you receive an inheritance from someone residing in a state that does have an inheritance tax.

To citizens of South Dakota: SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Government entities must provide an exemption certificate to the vendor or the vendor must keep documentation to show the purchase was paid from government funds.

In South Dakota, when a person dies without leaving a will, the surviving spouse is entitled to receive the entire intestate estate unless the decedent was survived by descendants of a prior marriage or other relationship, in which event, the spouse receives $100,000.00 plus half of the remaining estate, plus certain ...

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

Inheritance Rights of Adult and Minor Children Unlike a spouse, an adult child generally has no legally protected right to inherit a deceased parent's property under state intestate succession laws.

The appointment of a guardian or conservator of a protected person does not constitute a general finding of legal incompetence unless the court so orders, and the protected person shall otherwise retain all rights which have not been granted to the guardian or conservator, with the exception of the ability to create an ...