South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms

Description

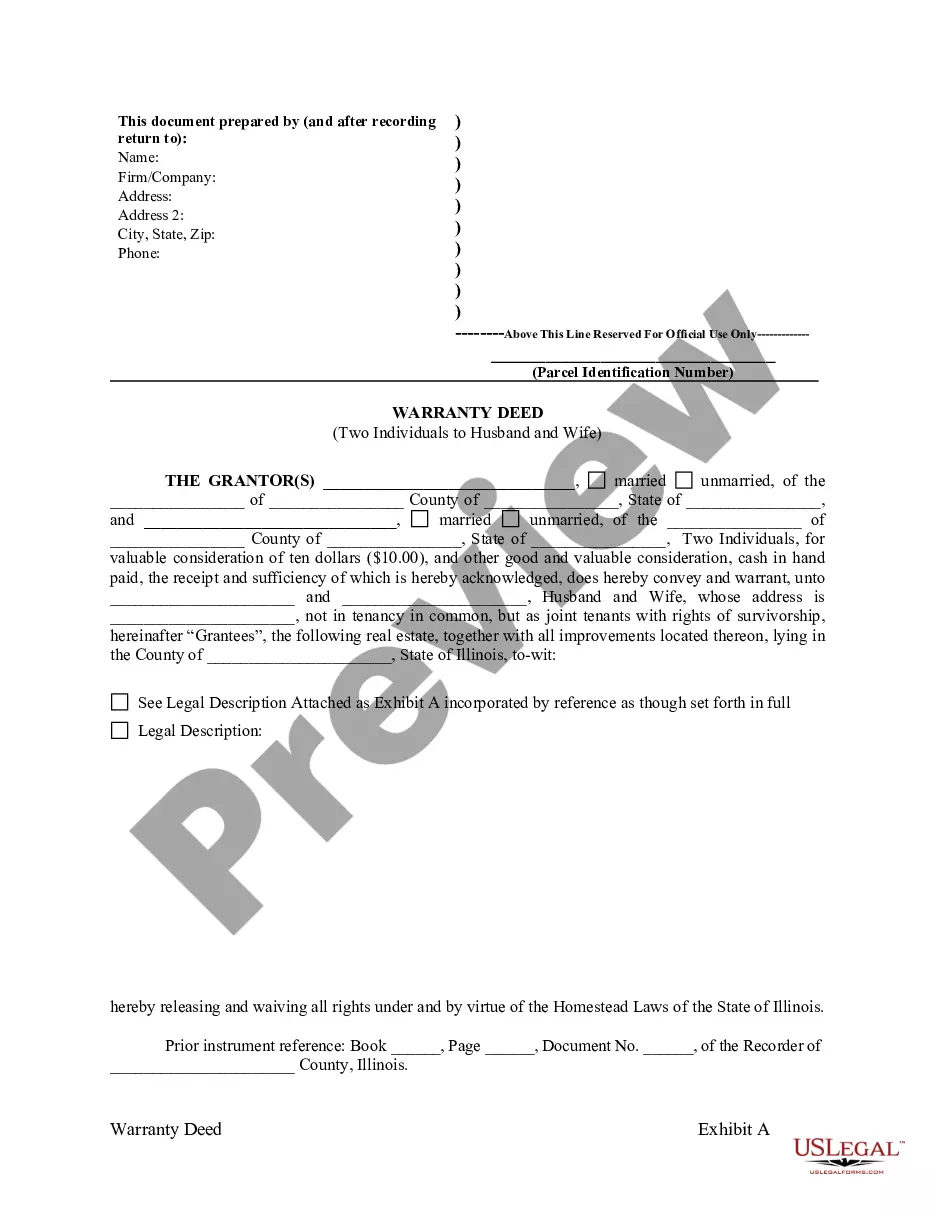

How to fill out Sample Letter For Letter Requesting Extension To File Business Tax Forms?

US Legal Forms - one of the most extensive collections of legal templates in the United States - offers a broad selection of legal document templates that you can download or create.

On the website, you'll find thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms such as the South Dakota Sample Letter for Requesting an Extension to File Business Tax Forms within minutes.

Examine the form details to confirm you have chosen the correct document.

If the form doesn't meet your requirements, use the Search field at the top of the screen to locate one that does.

- If you have a subscription, Log In and download the South Dakota Sample Letter for Requesting an Extension to File Business Tax Forms from your US Legal Forms library.

- The Download button will appear on every document you view.

- You will have access to all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the right form for your area.

- Click the Review button to check the contents of the form.

Form popularity

FAQ

To write a letter of explanation for not filing taxes, begin by clearly stating your reason for the delay. Include important details, such as your name, business information, and tax identification number. Make sure to express your intention to file and your understanding of the legal requirements. Using a South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms can provide you with a solid framework to ensure your letter meets all necessary requirements and conveys your determination to resolve the issue.

Requesting an extension for filing requires a clear and professional approach. Using a South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms can streamline this process for you. This sample letter provides a solid framework to express your reasons for the extension and ensures you meet the necessary guidelines. By utilizing this resource, you can confidently submit your request and alleviate concerns about missing the filing deadline.

To obtain a tax extension letter, you can start by visiting the US Legal Forms platform. There, you will find a South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms that guides you through the process. This sample letter simplifies the task of drafting your request, ensuring you include all necessary details. Following the provided template helps you communicate your need for an extension clearly and effectively.

Filing a business tax extension for an LLC in South Dakota requires submitting the proper form to the state tax agency. You will need to include your LLC's information and indicate the reason for your request. To make this process simpler, consider using the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms as a model for your submission.

To request a business tax extension, submit the required form or letter to the South Dakota Department of Revenue. Include all relevant business details, estimated taxes owed, and any supporting documentation. Using the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms can help you present a clear and formal request.

Yes, you can request a tax extension online in South Dakota. This method is often faster and more efficient than traditional paper methods. Check the South Dakota Department of Revenue's website for the online system they have in place, and ensure you have all the necessary details ready. Consider the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms for guidance.

Yes, you can ask for an extension on your business taxes. Many business owners utilize this option to secure additional time for accurate filings. In South Dakota, you can use the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms as a template to formalize your request and assist you in this process.

Filling out a tax extension form involves providing key information such as your business details, estimated tax liability, and the reasons for your extension request. It is important to follow the guidelines specified by the South Dakota Department of Revenue closely. Utilizing the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms can help ensure you include all necessary information.

To ask for an extension on your taxes, you typically need to complete a specific form or send a request to the appropriate tax authority. In South Dakota, using the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms can streamline this process. Ensure you submit your request before the tax deadline to avoid penalties.

Yes, South Dakota accepts federal extensions for business taxes. If you file for a federal extension, it generally applies to your South Dakota tax obligations as well. However, it’s essential to ensure you meet the criteria set by the state. For a clear understanding, refer to the South Dakota Sample Letter for Letter Requesting Extension to File Business Tax Forms.