South Dakota Storage Agreement for Manufacturer's Products is a legally binding contract between a manufacturer and a storage facility located in South Dakota. This agreement outlines the terms and conditions under which the storage facility will store and maintain the manufacturer's products. The primary purpose of this agreement is to define the responsibilities and obligations of both parties involved in the storage arrangement. It ensures that the manufacturer's products are handled, stored, and secured appropriately throughout their stay at the storage facility. The South Dakota Storage Agreement for Manufacturer's Products typically includes the following key provisions: 1. Parties Involved: The agreement begins by identifying the manufacturer and the storage facility by their legal names and addresses. 2. Stored Products: It specifies the types of products that will be stored, such as raw materials, finished goods, equipment, or any other items relevant to the manufacturer's business. 3. Storage Period: The agreement should clearly state the duration of the storage period, including the start and end dates of the agreement. It may also include provisions for renewal or termination. 4. Storage Fees: This section outlines the fees and payment terms associated with the storage services. It should specify whether the fees are fixed or variable and how frequently they will be invoiced (monthly, quarterly, etc.). 5. Maintenance and Security: The agreement should detail the storage facility's responsibility to maintain the manufacturer's products, including any necessary cleaning, repairs, or pest control measures. It should also address security measures, such as surveillance systems, restricted access, or insurance coverage. 6. Liability and Insurance: This section clarifies the extent of liability on the part of the storage facility in case of damage, loss, or theft of the manufacturer's products. It may also require the storage facility to maintain insurance coverage to protect against such risks. 7. Confidentiality: If the stored products contain proprietary or sensitive information, the agreement may include provisions requiring the storage facility to maintain confidentiality and prevent unauthorized access. 8. Termination and Dispute Resolution: This part outlines the circumstances and procedures for terminating the agreement. Additionally, it may include a dispute resolution clause, specifying the preferred method (e.g., mediation, arbitration) to resolve any disagreements between the parties. Different types of South Dakota Storage Agreements for Manufacturer's Products can be classified based on specific industry requirements or storage conditions. These variations may include: — Temperature-controlled Storage Agreement: This agreement caters to manufacturers dealing with perishable or temperature-sensitive products, ensuring that the storage facility maintains an appropriate climate-controlled environment. — Hazardous Materials Storage Agreement: For manufacturers handling hazardous materials, this agreement deals with the specific regulations and safety measures required for storing such products safely and legally. — Bonded Storage Agreement: Companies engaging in international trade may opt for a bonded storage agreement, which allows storing goods imported from foreign countries without the immediate payment of customs duties. In summary, the South Dakota Storage Agreement for Manufacturer's Products serves as a comprehensive document that governs the storage relationship between a manufacturer and a storage facility. It defines the expectations and obligations of both parties, ensuring the safekeeping and proper handling of the manufacturer's products.

South Dakota Storage Agreement for Manufacturer's Products

Description

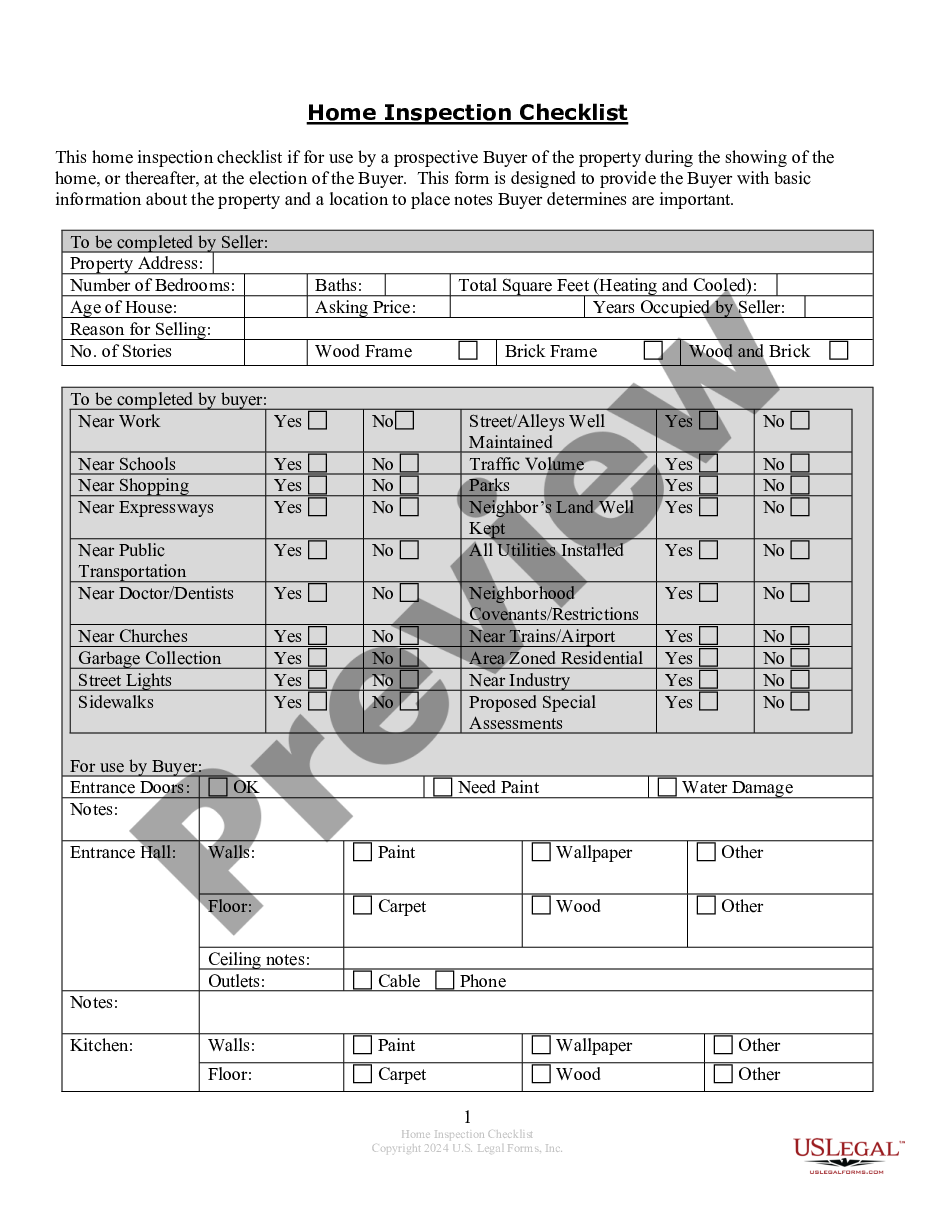

How to fill out South Dakota Storage Agreement For Manufacturer's Products?

You can invest time on the Internet attempting to find the legal document web template that fits the federal and state requirements you will need. US Legal Forms offers a huge number of legal types that happen to be evaluated by experts. You can actually down load or print the South Dakota Storage Agreement for Manufacturer's Products from the assistance.

If you currently have a US Legal Forms profile, you may log in and click the Download key. Following that, you may full, change, print, or sign the South Dakota Storage Agreement for Manufacturer's Products. Every single legal document web template you get is your own forever. To obtain one more duplicate associated with a acquired form, visit the My Forms tab and click the related key.

If you work with the US Legal Forms web site the first time, stick to the simple directions beneath:

- First, make sure that you have selected the proper document web template for the county/city of your choice. Browse the form information to ensure you have selected the appropriate form. If available, take advantage of the Preview key to check with the document web template too.

- In order to find one more version from the form, take advantage of the Search industry to get the web template that meets your needs and requirements.

- When you have found the web template you need, click on Acquire now to carry on.

- Find the costs prepare you need, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal profile to pay for the legal form.

- Find the formatting from the document and down load it for your device.

- Make changes for your document if needed. You can full, change and sign and print South Dakota Storage Agreement for Manufacturer's Products.

Download and print a huge number of document templates while using US Legal Forms web site, that provides the greatest selection of legal types. Use specialist and express-distinct templates to tackle your company or personal requires.

Form popularity

FAQ

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

Traditional Goods or Services Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

"Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

If you have any questions, please contact the South Dakota Department of Revenue. Machinery, tools, bolts, and other equipment sold to a manufacturer or producer are subject to sales tax.

Sales of janitorial services are subject to sales tax in South Dakota.

Use tax applies to all goods and services that are used, stored, or consumed in South Dakota. The purchaser or con- sumer is responsible for reporting and remitting the 4% state use tax, plus applicable municipal use tax in the filing period in which the purchaser receives or is invoiced for the goods or services.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.