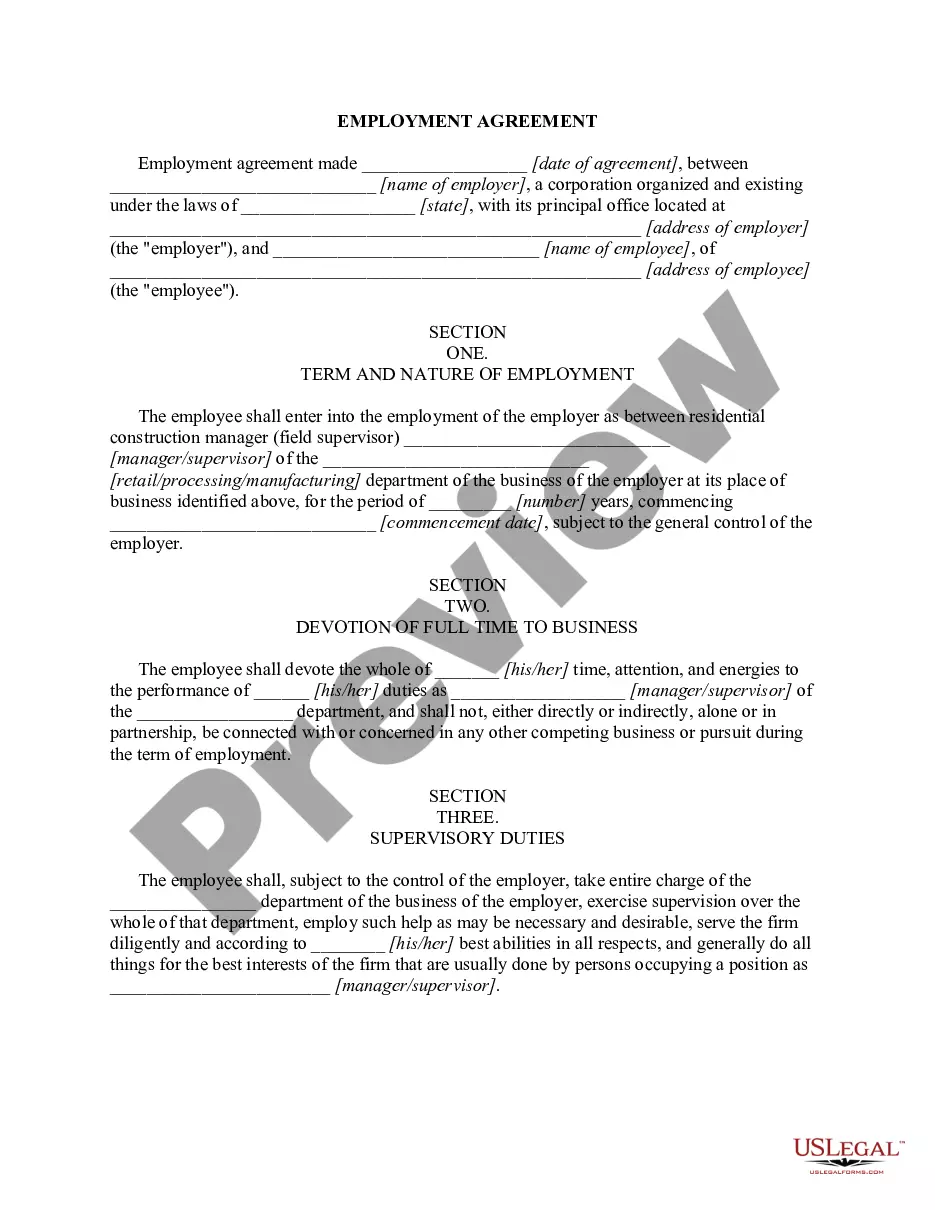

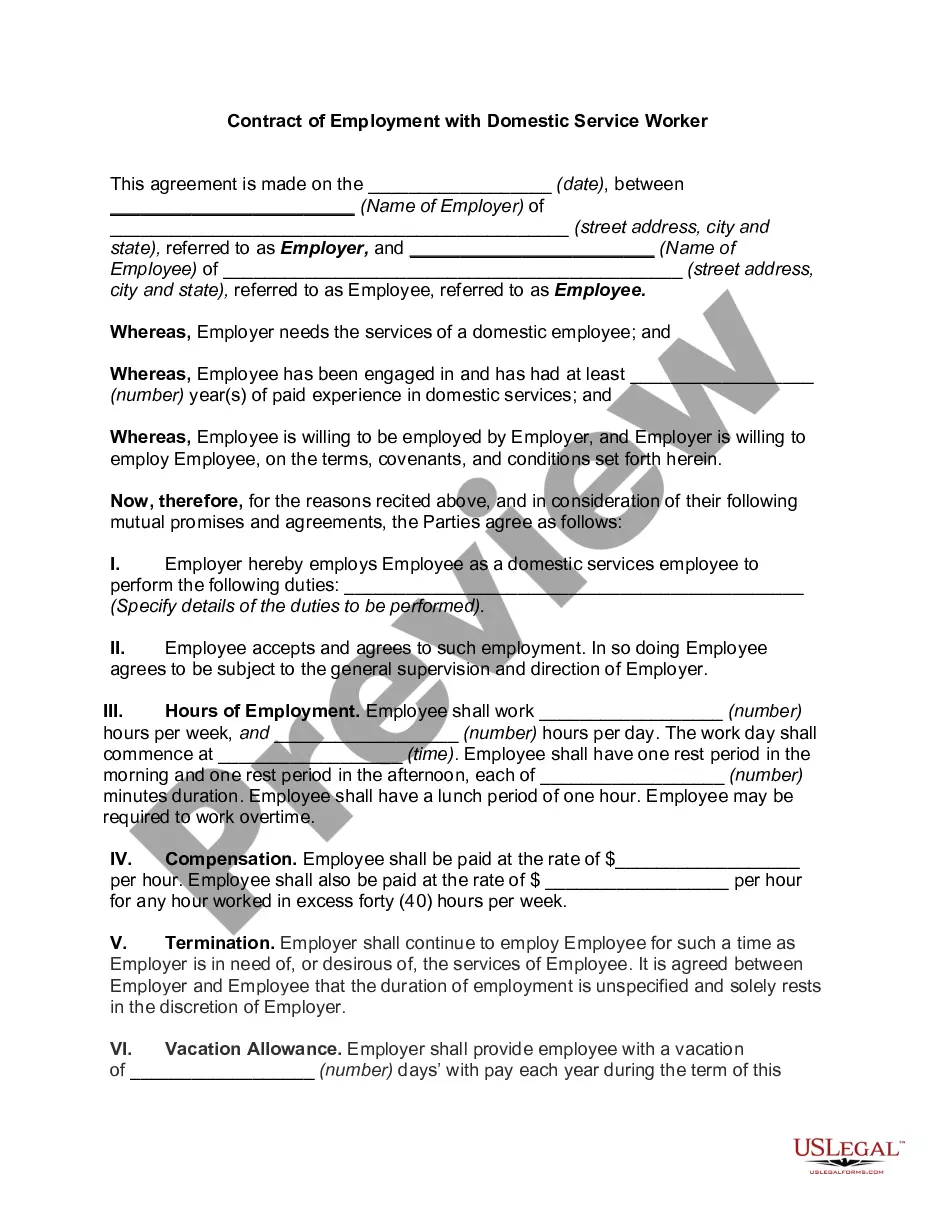

South Dakota Employment Agreement with Construction Worker

Description

How to fill out Employment Agreement With Construction Worker?

Finding the correct legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Dakota Employment Agreement for Construction Workers, suitable for both business and personal use.

First, ensure that you have chosen the correct form for your city/region. You can browse the form using the Preview button and review the form details to confirm it is the right one for you.

- All forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the South Dakota Employment Agreement for Construction Workers.

- Use your account to check the legal documents you have previously ordered.

- Navigate to the My documents section of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple instructions.

Form popularity

FAQ

7 things you need to include in an employment contractLegal disclaimer.Job information.Compensation and benefits.Time off, sick days and vacation policy.Employee classification.The schedule and employment period.Confidentiality, privacy and responsibility.Termination, severance and survival.More items...?

To ensure you're protected from start to finish, always follow these protocols before you hire.Get Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.More items...?

FEHA typically protects independent contractors as well as employees.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.

A contractor is not an employee; instead, they run their own entity (such as a sole proprietorship, limited liability company or limited liability partnership) and are contracted out by organizations to work on particular projects or assignments. Their contract relationships can be short- or long-term.

Key takeaway: Independent contractors are not employed by the company they contract with; they are independent as long as they provide the service or product agreed to. Employees are longer-term, on the company's payroll, and generally not hired for one specific project.

Employees at businesses with fewer than two employees. Employees at businesses that have an annual revenue of less than $500,000 and who do not engage in interstate commercei Railroad workers (covered instead by the Railway Labor Act) Truck drivers (covered instead by the Motor Carriers Act)

Employment rights no longer apply and the relationship between a contractor and the agency and client is a business one. Any disputes with agencies and clients are now governed by contract law there's no such thing as 'contractor rights'.

You should include the following terms and conditions in your employment contracts: Name and personal details of the employer and the employee. Commencement date of employment and probation period (if a permanent employee). Job title and description setting out the role and duties of the employee.

And in fact, under the law, employers cannot be held liable for the acts of their independent contractors. However, just because an employer asserts that a negligent worker is an independent contractor does not shut down the question of employer liability.