South Dakota Loan Guaranty Agreement

Description

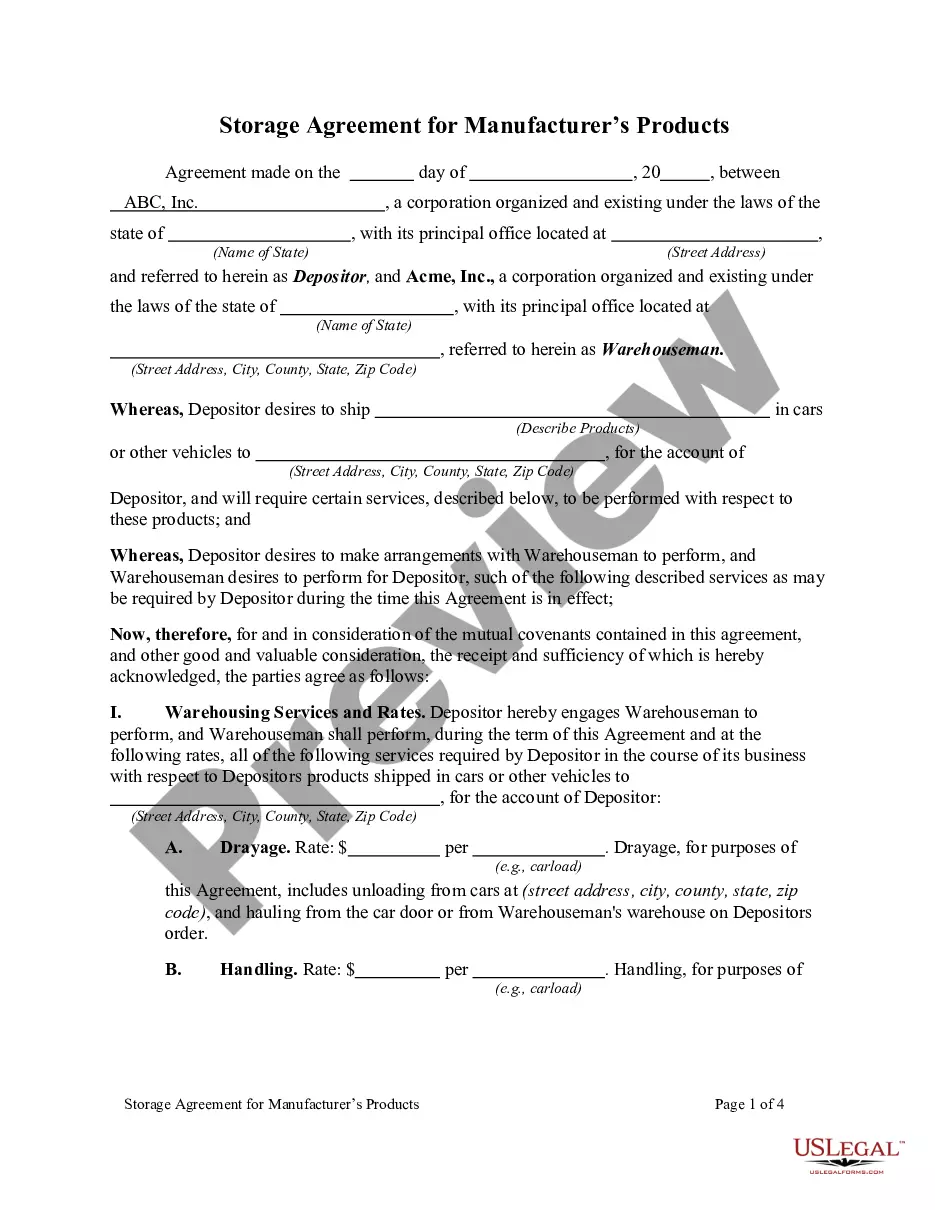

How to fill out Loan Guaranty Agreement?

If you wish to total, down load, or produce lawful record web templates, use US Legal Forms, the most important collection of lawful types, which can be found on the Internet. Make use of the site`s easy and hassle-free search to find the documents you require. Different web templates for business and personal purposes are categorized by types and claims, or search phrases. Use US Legal Forms to find the South Dakota Loan Guaranty Agreement with a few clicks.

Should you be previously a US Legal Forms customer, log in in your profile and then click the Down load button to find the South Dakota Loan Guaranty Agreement. Also you can access types you formerly saved within the My Forms tab of the profile.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for the correct town/country.

- Step 2. Utilize the Review method to look over the form`s content material. Don`t overlook to see the information.

- Step 3. Should you be unsatisfied with the kind, utilize the Research area at the top of the screen to discover other versions of the lawful kind web template.

- Step 4. After you have discovered the shape you require, click the Purchase now button. Opt for the rates strategy you like and include your references to sign up on an profile.

- Step 5. Process the transaction. You may use your Мisa or Ьastercard or PayPal profile to accomplish the transaction.

- Step 6. Pick the file format of the lawful kind and down load it on your own system.

- Step 7. Full, revise and produce or sign the South Dakota Loan Guaranty Agreement.

Every lawful record web template you acquire is your own forever. You might have acces to each and every kind you saved inside your acccount. Select the My Forms segment and choose a kind to produce or down load again.

Contend and down load, and produce the South Dakota Loan Guaranty Agreement with US Legal Forms. There are many professional and state-certain types you can utilize for your personal business or personal needs.

Form popularity

FAQ

A guaranty agreement, in the realm of commercial insurance, refers to a legally binding contract where one party, known as the guarantor, promises to be responsible for the obligations or debts of another party, known as the debtor, if they fail to fulfill their financial commitments.

However, some states, such as South Dakota, do not have a usury law, allowing in-state businesses to charge as much interest as they want. Congress has the power to regulate interstate commerce, which includes regulating nationally chartered banks which do business in more than one state.

Delaware is home to the credit card businesses of Chase, Discover and Barclaycard U.S., ing to the Federal Deposit Insurance Corp. Bank of America and Citi also maintain certain card operations there. Together, those issuers represent about half of the U.S. credit card market.

In 1980, Citibank took advantage of that decision and moved its money-losing credit-card operations to South Dakota, after persuading that state's legislature and governor to repeal its anti-usury law.

Soon, Citi was losing money on every card transaction its customers made. The bank needed a solution. It found one in South Dakota, a state that in 1980 did not regulate bank interest rates of any kind.

Because South Dakota had just passed a law that eliminated caps on interest rates. And the Supreme Court had just ruled that banks could charge interest based on where their credit-card operations were headquartered, even if the bank's main operations were somewhere else.