South Dakota Subrogation Agreement between Insurer and Insured

Description

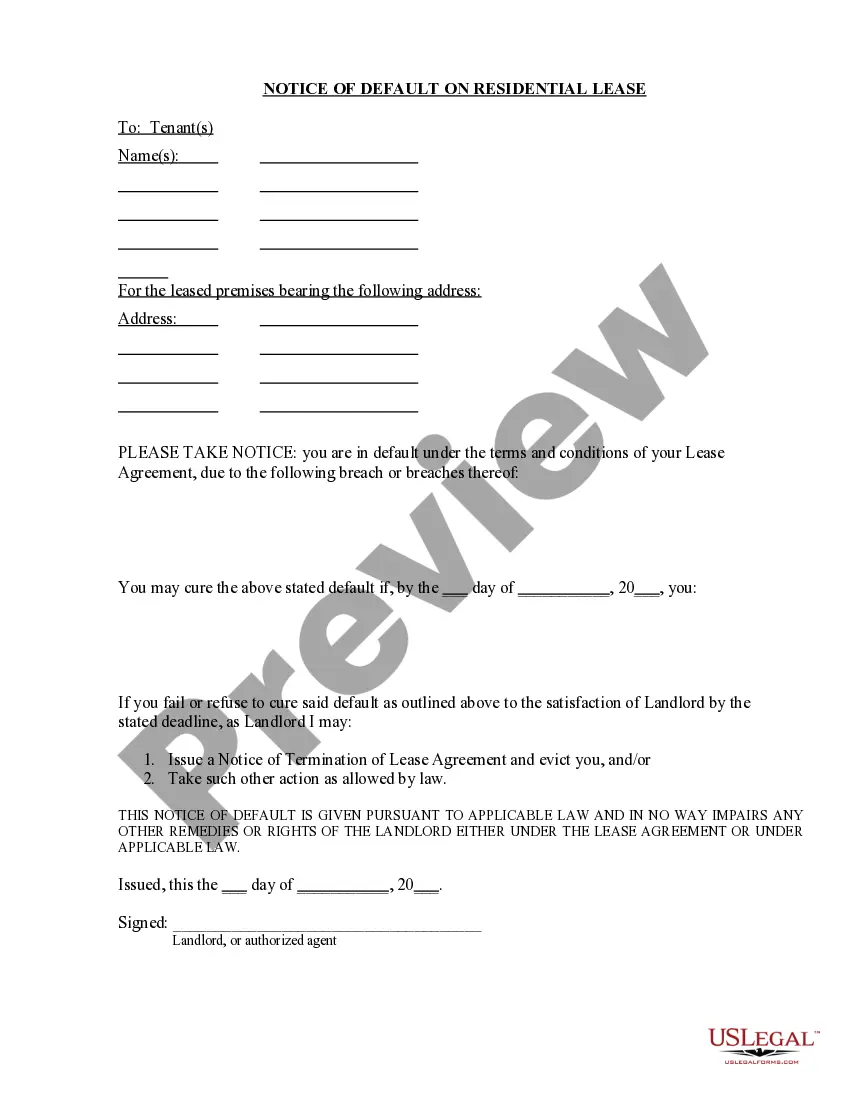

How to fill out Subrogation Agreement Between Insurer And Insured?

US Legal Forms - one of the largest libraries of lawful kinds in the USA - provides a variety of lawful file layouts you are able to acquire or produce. Using the site, you can get thousands of kinds for business and person uses, sorted by categories, claims, or keywords.You can get the latest variations of kinds such as the South Dakota Subrogation Agreement between Insurer and Insured within minutes.

If you already have a membership, log in and acquire South Dakota Subrogation Agreement between Insurer and Insured in the US Legal Forms collection. The Download switch will show up on every type you view. You have accessibility to all earlier saved kinds within the My Forms tab of your own account.

If you would like use US Legal Forms the very first time, listed below are basic guidelines to get you began:

- Make sure you have picked the best type for your personal town/area. Select the Review switch to check the form`s information. Look at the type description to actually have selected the right type.

- When the type does not fit your requirements, take advantage of the Search area at the top of the display to discover the one which does.

- In case you are pleased with the shape, affirm your choice by visiting the Purchase now switch. Then, opt for the costs prepare you prefer and offer your accreditations to register to have an account.

- Method the transaction. Make use of Visa or Mastercard or PayPal account to perform the transaction.

- Choose the format and acquire the shape on the gadget.

- Make alterations. Load, edit and produce and indication the saved South Dakota Subrogation Agreement between Insurer and Insured.

Every web template you put into your account does not have an expiry time and is the one you have for a long time. So, if you want to acquire or produce another version, just visit the My Forms section and click on about the type you need.

Obtain access to the South Dakota Subrogation Agreement between Insurer and Insured with US Legal Forms, probably the most comprehensive collection of lawful file layouts. Use thousands of professional and state-specific layouts that meet your organization or person needs and requirements.

Form popularity

FAQ

Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

Subrogation allows an insurer to step into the shoes of the policyholder and file a claim against a third party who caused the damage. The theory behind a subrogation clause is that the insurance company should not have to bear the loss when someone else was to blame for the damages.

Subrogation claims rely on fault, and insurance companies can only file claims against those they can prove are liable for property damage. If you can demonstrate that you are not liable for the property damage, the insurance company will have no grounds for their claim, and you will not have to pay it.

One example of subrogation is when an insured driver's car is totaled through the fault of another driver. The insurance carrier reimburses the covered driver under the terms of the policy and then pursues legal action against the driver at fault.

What is Subrogation? Subrogation in insurance is a legal right of the insurance company to legally pursue a third-party responsible for the damages/insurance loss caused to the insured. Subrogation is done to recover the claim amount insurance company pays to the insured for the damages.

3 Benefits of Subrogation in Car Insurance Speeds up the claims process for policyholders. Refunds insurers for claims if their customer wasn't at-fault. Keeps premiums low for policyholders who aren't responsible for damage.

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

Examples of subrogation clauses include: Example 1. Filing an auto insurance claim against a third party driver. Example 2. Trustee lenders subrogating trustee's indemnity rights. Example 3. Health insurance companies pursuing claims for third-party services.