South Dakota Agreement Pledge of Stock and Collateral for Loan

Description

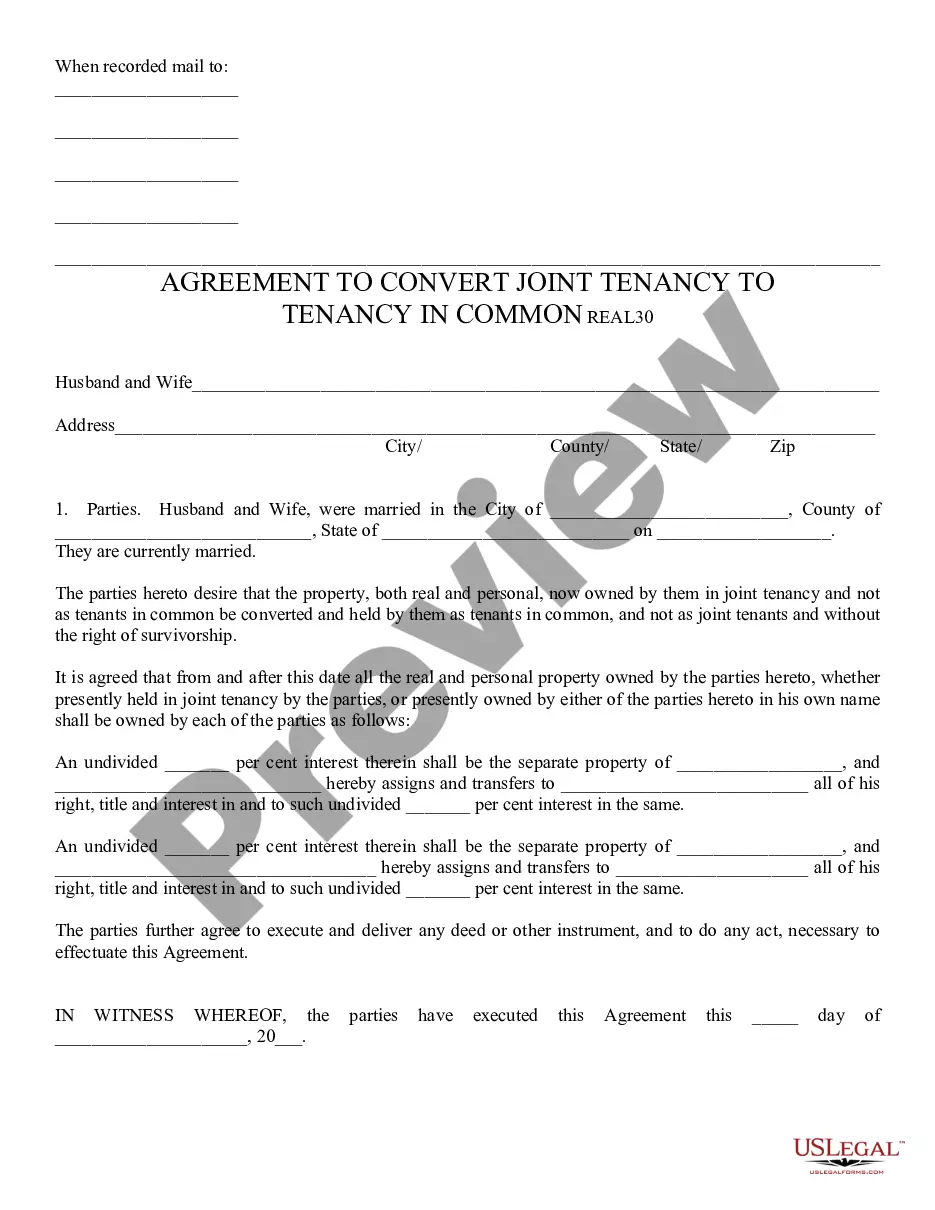

How to fill out Agreement Pledge Of Stock And Collateral For Loan?

US Legal Forms - one of many biggest libraries of legitimate types in America - delivers a wide array of legitimate file themes you may download or print out. Utilizing the site, you may get thousands of types for company and individual purposes, categorized by types, suggests, or search phrases.You can find the most up-to-date versions of types just like the South Dakota Agreement Pledge of Stock and Collateral for Loan in seconds.

If you already possess a subscription, log in and download South Dakota Agreement Pledge of Stock and Collateral for Loan in the US Legal Forms library. The Download option will appear on every single develop you look at. You have accessibility to all formerly downloaded types within the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, allow me to share basic recommendations to help you get started out:

- Be sure you have chosen the best develop for your metropolis/region. Click on the Review option to examine the form`s content material. Browse the develop information to actually have selected the right develop.

- When the develop does not satisfy your specifications, take advantage of the Search discipline near the top of the display screen to obtain the one which does.

- Should you be content with the shape, confirm your option by clicking on the Get now option. Then, opt for the pricing strategy you like and supply your references to sign up for the profile.

- Procedure the deal. Utilize your credit card or PayPal profile to perform the deal.

- Select the file format and download the shape on your gadget.

- Make changes. Complete, change and print out and indicator the downloaded South Dakota Agreement Pledge of Stock and Collateral for Loan.

Every single template you included in your money lacks an expiration time and is yours permanently. So, if you want to download or print out another copy, just visit the My Forms section and click around the develop you will need.

Obtain access to the South Dakota Agreement Pledge of Stock and Collateral for Loan with US Legal Forms, by far the most extensive library of legitimate file themes. Use thousands of specialist and state-certain themes that fulfill your business or individual demands and specifications.

Form popularity

FAQ

A pledge loan differs from a standard loan in that the loaned amount is completely backed with collateral from the borrower. A borrower can use their funds, such as a savings account, as collateral to obtain a loan. The funds used as collateral then become "frozen" until the loan is paid back in full.

When you pledge property or assets as collateral, you are offering your property as a way of securing a loan. Ideally, you should repay the loan, and your collateral will remain in your possession. If you default on the loan, the lender can seize the collateral to pay your debt.

Collateral refers to an asset that a borrower offers as a guarantee for a loan or debt. For a mortgage (or a deed of trust, exclusively used in some states), the collateral is almost always the property you're buying with the loan. Obtaining the financing puts a lien on the property.

To pledge shares on Console, follow these steps: Click on Portfolio and then on Holdings. Click on Options. Click on Pledge for margin. Agree to the terms of service for pledging. Enter the Quantity to be pledged. Click on Submit.

Some positive benefits of a pledge loan include the following: The borrower can often access a better interest rate by using pledged assets. The borrower's high-yield savings account, securities, and other investments can keep earning additional funds despite being used as pledge assets.

A pledged asset is an asset that is used by a lender to secure a debt or loan and can include cash, stocks, bonds, and other equity or securities. A pledged asset is collateral held by a lender in return for lending funds.

This is a standard form of pledge agreement to be used in connection with a syndicated loan agreement. It is intended to create a security interest over equity interests and promissory notes owned by the grantors. The grantors are usually the borrower, its parent and its subsidiaries.

Collateral, a borrower's pledge to a lender of something specific that is used to secure the repayment of a loan (see credit). The collateral is pledged when the loan contract is signed and serves as protection for the lender.