South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor

Description

How to fill out Irrevocable Trust For Lifetime Benefit Of Trustor With Power Of Invasion In Trustor?

Are you presently in a position where you require documents for various companies or particular reasons almost all the time.

There are many legal form templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, including the South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor, designed to comply with federal and state regulations.

Access all the form templates you have purchased in the My documents list.

You can obtain another copy of the South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor whenever necessary; just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Find the form you need and ensure it's for the correct city/state.

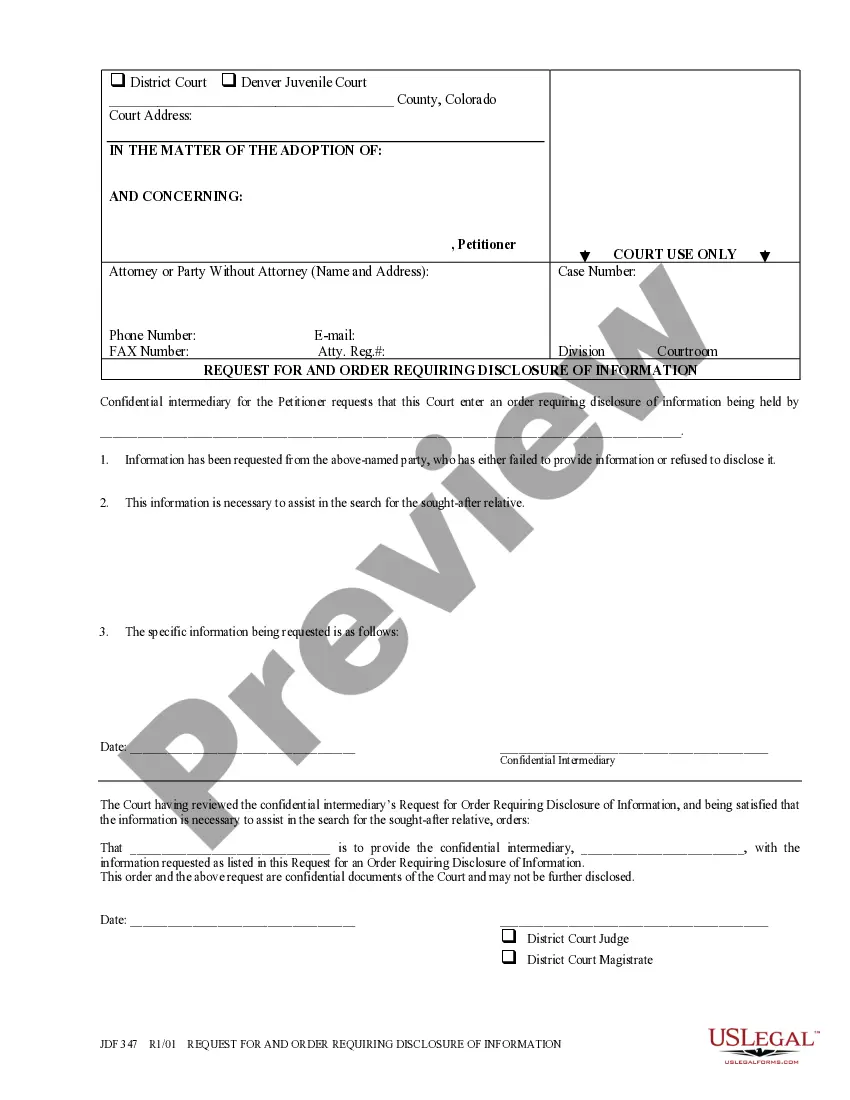

- Utilize the Review option to evaluate the form.

- Read the details to confirm you've chosen the right form.

- If the form isn’t what you’re looking for, use the Search section to find the form that meets your needs.

- If you find the appropriate form, click on Purchase now.

- Select the pricing plan you need, complete the necessary information to create your account, and pay for the order with your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

Codified law 55 2 13 in South Dakota pertains to the regulation of trusts and outlines specific provisions regarding the trust's terms and modifications. This law supports the establishment and management of trusts, including irrevocable trusts. Understanding this law is vital if you're considering a South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor. For a detailed breakdown, you may find useful tools on the USLegalForms platform to assist you.

Taking assets out of an irrevocable trust can be complex, as the terms of the trust dictate such actions. Generally, it requires a specific power outlined in the trust document, or the consent of beneficiaries may be needed. If you are managing a South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor, understanding your powers as trustee is essential. USLegalForms provides valuable resources to assist you in navigating these rules effectively.

Senate Bill 55 in South Dakota pertains to the laws surrounding trusts and estate planning. It addresses specific provisions related to the management and execution of trusts, including irrevocable trusts. Understanding the implications of this bill can enhance your planning strategies, particularly if you are considering a South Dakota Irrevocable Trust for Lifetime Benefit of Trustor with Power of Invasion in Trustor. For detailed insights, USLegalForms offers resources tailored to these legal nuances.

Removing a Trustee But if the trustor is no longer alive or has an irrevocable trust, anyone wishing to remove a trustee will have to go to court. Any party with a reasonable interest in the trustsuch as co-trustee or a beneficiarymust file a petition with the probate court requesting that it remove the trustee.

Although one person can be both trustor and trustee, or both trustee and beneficiary, the roles of the trustor, trustee, and beneficiary are distinctly different.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

A grantor does not have to give up rights of ownership and control of a living trust so s/he may be the Trustee of the living trust. On the other hand, if the grantor creates an irrevocable trust s/he cannot be the trustee of that trust.

The short answer is yes, a beneficiary can also be a trustee of the same trustbut it may not always be wise, and certain guidelines must be followed. Is it a good idea for a beneficiary to be a trustee? There are good reasons for naming a trust beneficiary as trustee. For one, it is convenient.

An irrevocable trust cannot be modified or terminated without permission of the beneficiary. "Once the grantor transfers the assets into the irrevocable trust, he or she removes all rights of ownership to the trust and assets," Orman explained.

First, an irrevocable trust involves three individuals: the grantor, a trustee and a beneficiary. The grantor creates the trust and places assets into it. Upon the grantor's death, the trustee is in charge of administering the trust.