South Dakota Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

If you seek extensive, acquire, or generate legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the website's user-friendly and convenient search feature to locate the forms you require. Various templates for business and individual purposes are organized by categories and regions, or keywords.

Use US Legal Forms to quickly find the South Dakota Joint Trust with Income Payable to Trustors During Joint Lives in just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you have saved in your account. Select the My documents section and pick a form to print or download again.

Stay competitive and acquire and print the South Dakota Joint Trust with Income Payable to Trustors During Joint Lives with US Legal Forms. There are thousands of professional and state-specific documents you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to receive the South Dakota Joint Trust with Income Payable to Trustors During Joint Lives.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/region.

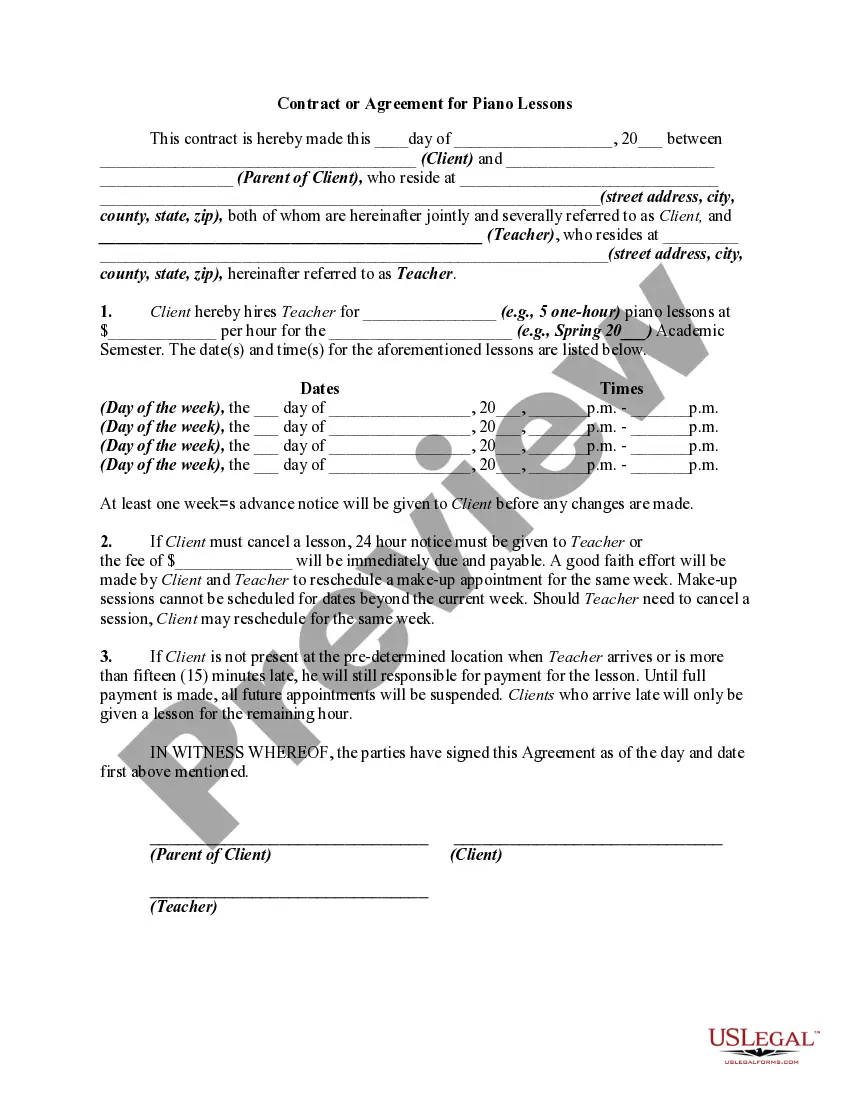

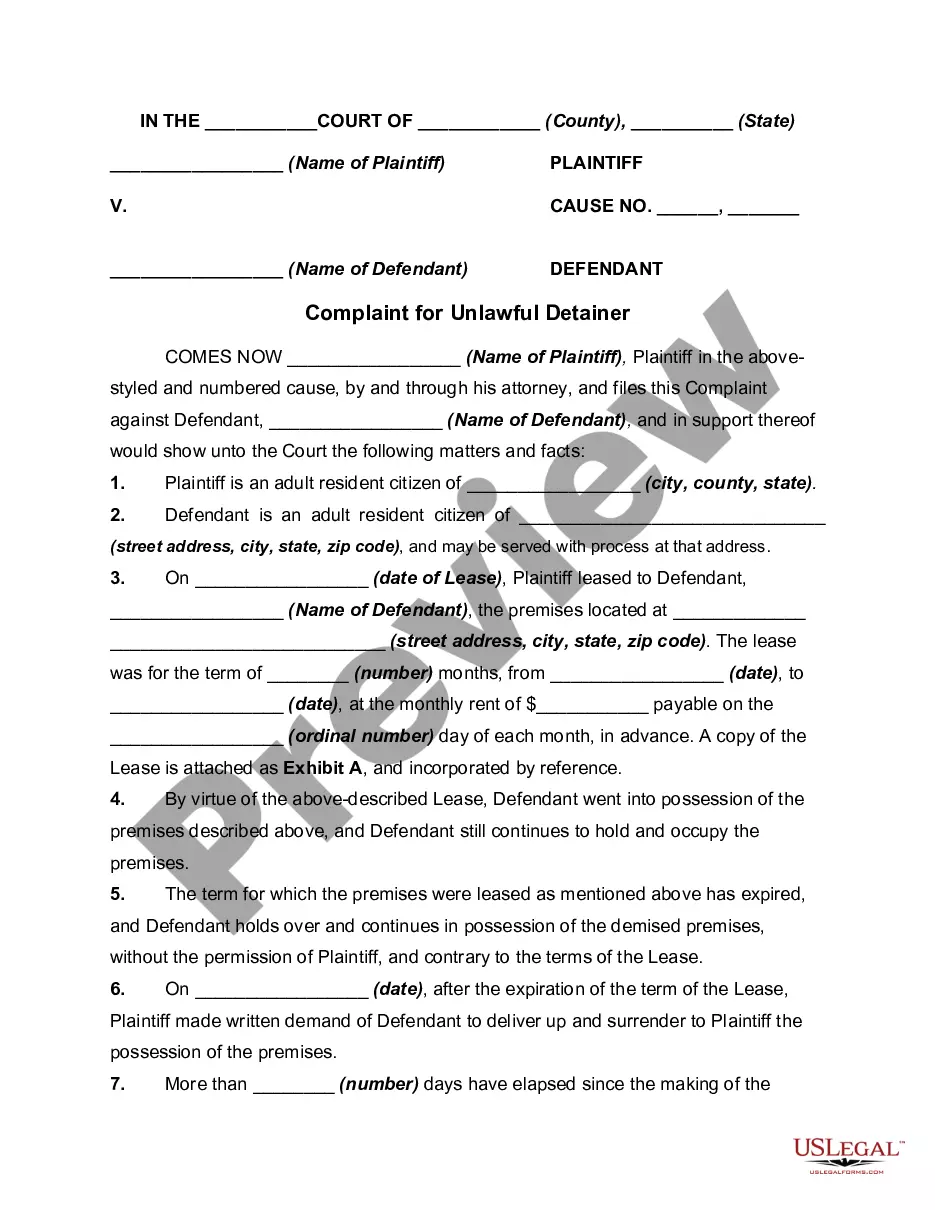

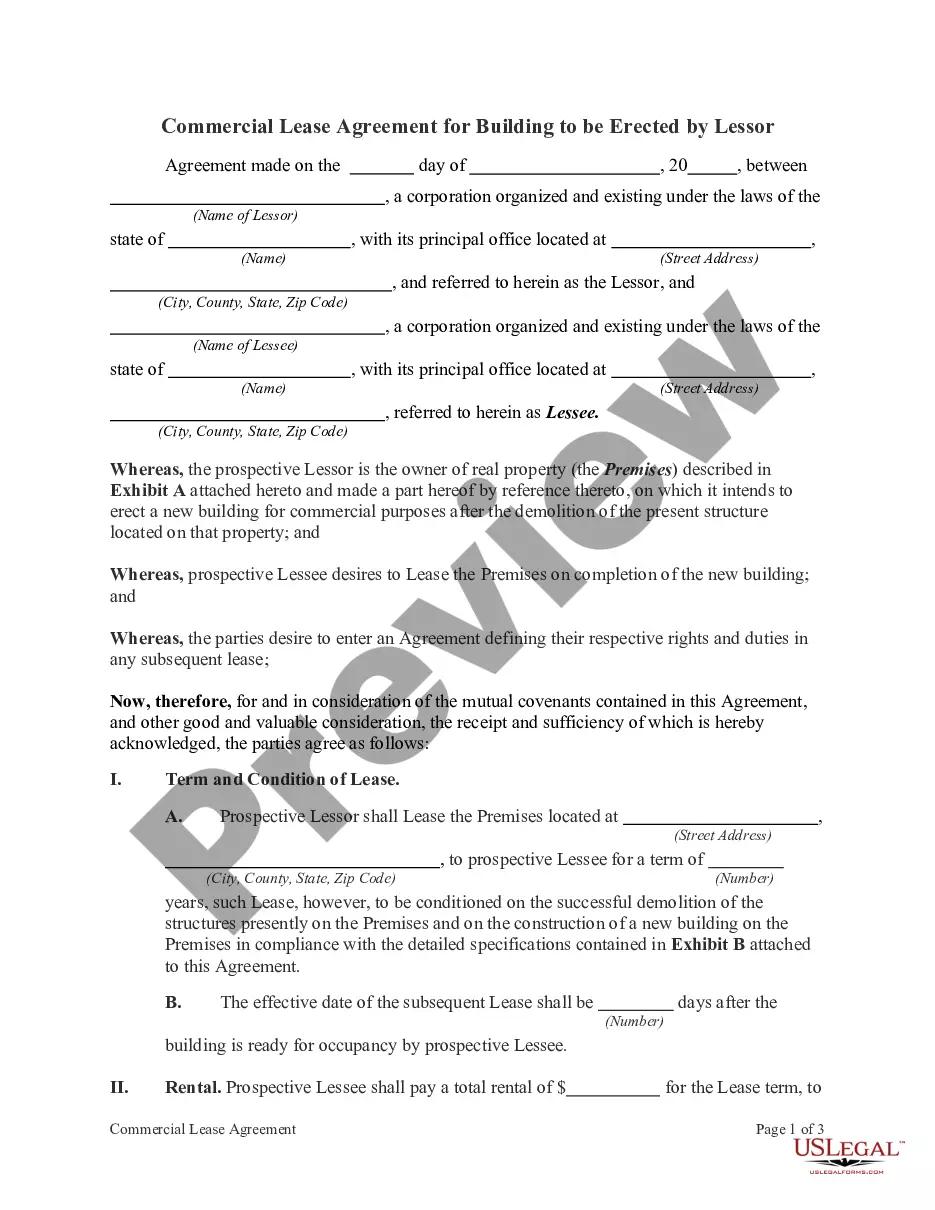

- Step 2. Use the Preview option to review the contents of the form. Remember to check the details.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the South Dakota Joint Trust with Income Payable to Trustors During Joint Lives.

Form popularity

FAQ

Joint trusts are also revocable living trusts, set up to hold all of the assets of a married couple and to provide access to the trust assets for both. Typically, at the first death, half of the assets receive a step-up in basis, but all of the assets stay in the trust.

Under typical circumstances, the surviving spouse would become the sole trustee after the death of one spouse. The surviving spouse would control the shared property, and the personal property of the deceased spouse would be distributed to the beneficiaries.

A revocable living trust becomes irrevocable once the sole grantor or dies or becomes mentally incapacitated. If you have a joint trust for you and your spouse, then a portion of the joint trust can become irrevocable when the first spouse dies and will become irrevocable when the last spouse dies.

The income from the revocable (living) trust is to be reported on the personal income tax returns of the Trustors (persons who formed the trust). The IRS and California taxing authorities do not recognize a living (revocable) trust as a separate taxpaying entity as long as both Trustors are alive.

A joint revocable trust is a single trust document that two persons establish to hold title to assets which they typically own together as a married couple. While both spouses are alive and competent, they both retain full control of the trust assets and can change the trust at any time.

After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

In general, most experts agree that Separate Trusts can provide more asset protection. Joint Trust: Marital assets are all together in a single trust. This means there's less asset protection, because if there's ever a judgment over one of the spouses, all of the assets could end up being at risk.

South Dakota offers everything a wealthy person setting up a trust could want. There is no state income tax or capital gains tax, so investment gains on assets placed in the trust are tax-free if it's structured correctly. Robust protections provide anonymity and shield assets from creditors.

What happens in this type of trust is that the trust is a joint revocable trust when both spouses are alive. When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse.