South Dakota Sample Letter Requesting Payoff Balance of Mortgage

Description

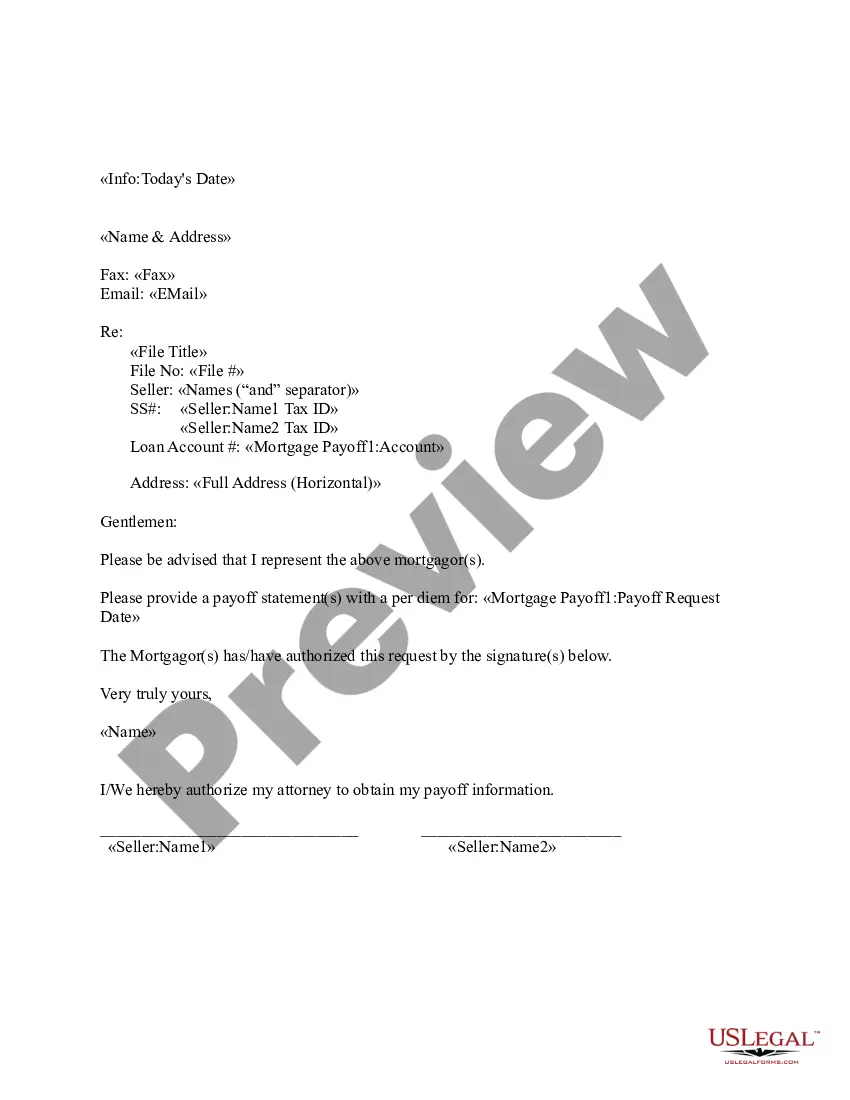

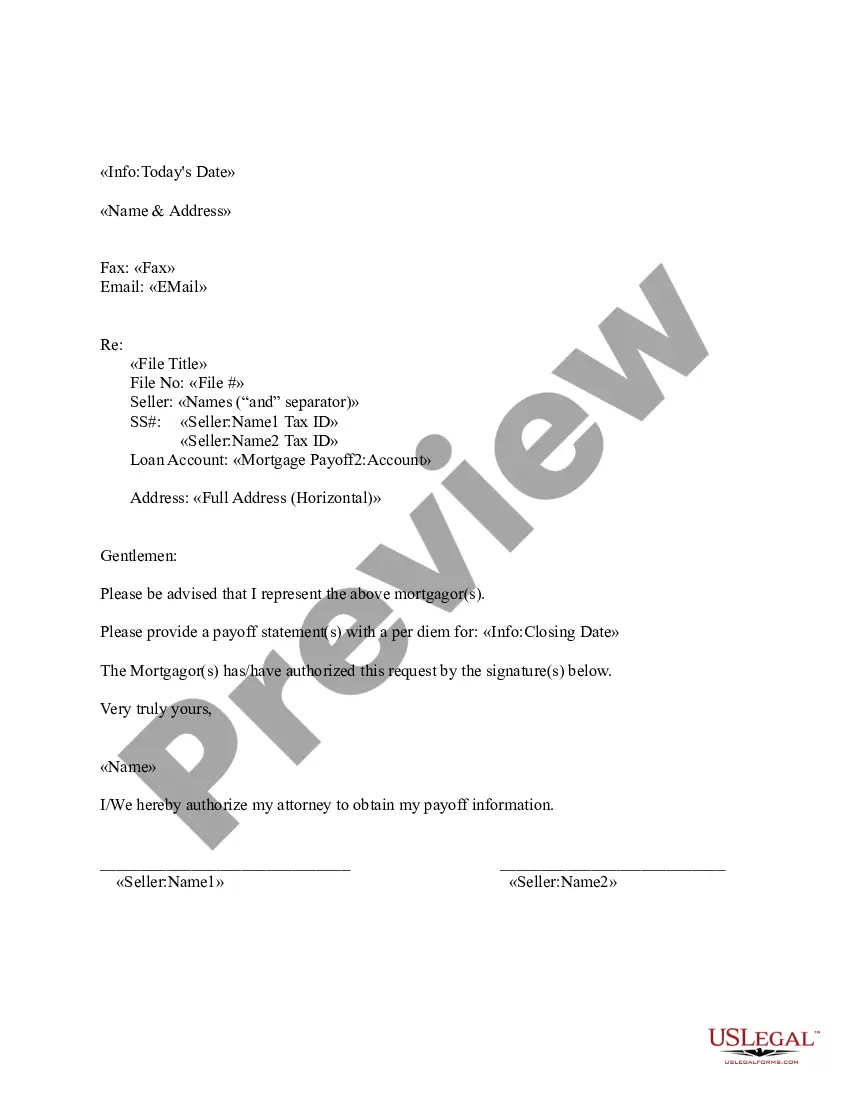

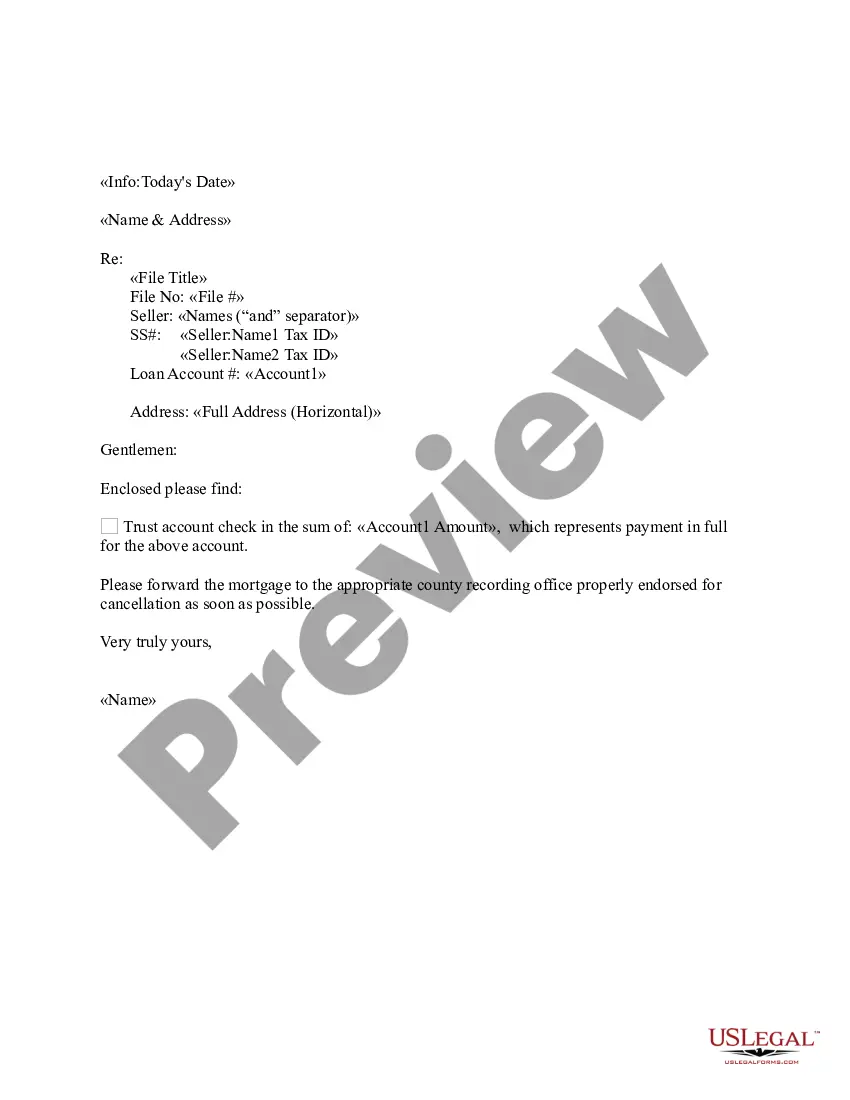

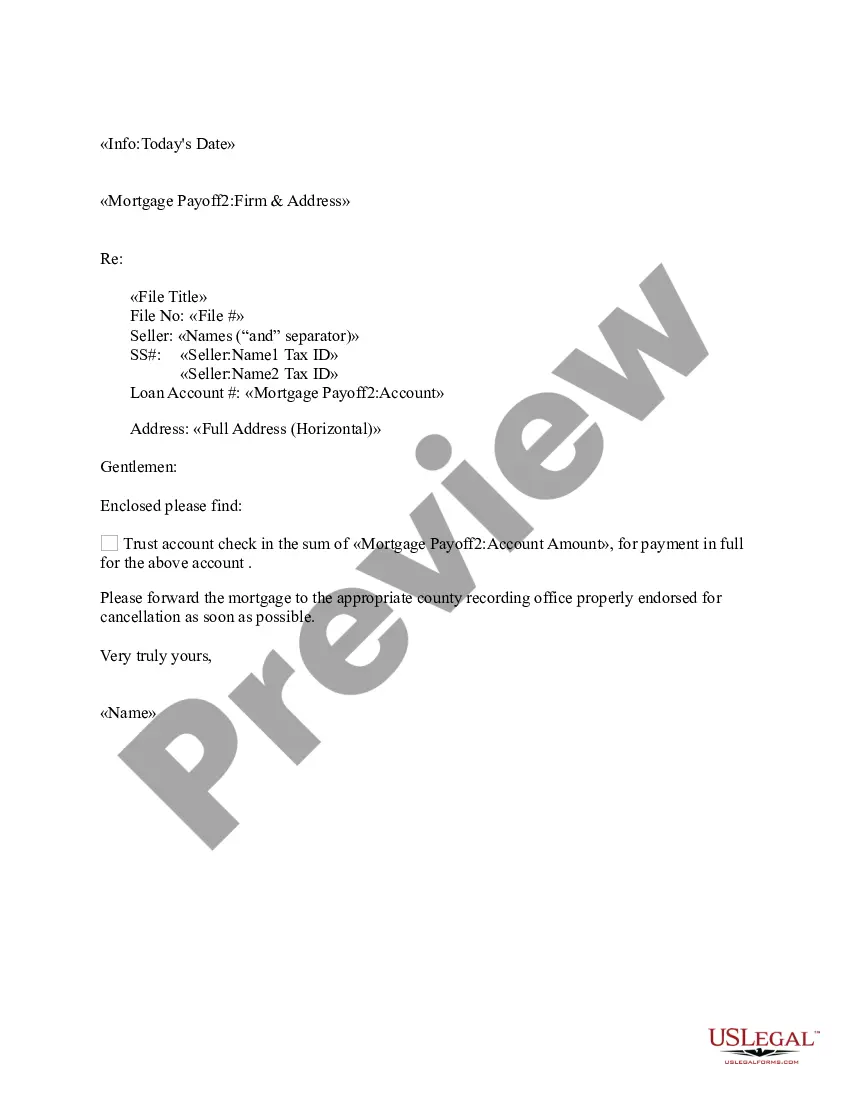

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

If you have to total, acquire, or print legal papers web templates, use US Legal Forms, the largest collection of legal kinds, that can be found on-line. Utilize the site`s easy and convenient research to discover the paperwork you will need. Numerous web templates for enterprise and personal purposes are sorted by classes and says, or key phrases. Use US Legal Forms to discover the South Dakota Sample Letter Requesting Payoff Balance of Mortgage in just a few clicks.

Should you be presently a US Legal Forms consumer, log in to the bank account and click on the Download button to have the South Dakota Sample Letter Requesting Payoff Balance of Mortgage. You can even accessibility kinds you formerly delivered electronically from the My Forms tab of your bank account.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Make sure you have selected the shape for your appropriate area/nation.

- Step 2. Use the Preview method to look through the form`s content material. Never overlook to see the explanation.

- Step 3. Should you be not happy with the form, utilize the Look for area towards the top of the monitor to get other variations of the legal form web template.

- Step 4. Once you have found the shape you will need, click on the Buy now button. Opt for the rates prepare you like and add your qualifications to register for the bank account.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal bank account to accomplish the purchase.

- Step 6. Find the formatting of the legal form and acquire it on the gadget.

- Step 7. Full, revise and print or indicator the South Dakota Sample Letter Requesting Payoff Balance of Mortgage.

Every legal papers web template you purchase is yours permanently. You may have acces to every single form you delivered electronically inside your acccount. Select the My Forms segment and choose a form to print or acquire again.

Remain competitive and acquire, and print the South Dakota Sample Letter Requesting Payoff Balance of Mortgage with US Legal Forms. There are millions of expert and status-specific kinds you can use for the enterprise or personal requires.

Form popularity

FAQ

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

Hear this out loud PauseLenders can also send you a payoff letter after you have finished paying off a loan. This letter serves as confirmation that your loan has been repaid in full, and your account has been closed. It's most often requested so that customers can prove to other lenders that they have no other outstanding debts.

What is a 10-day payoff and where can I get it? A 10-day payoff statement is a document from your lender that gives us the payoff amount to purchase your vehicle, including 10 days worth of interest. We need this document in order to finalize your trade-in or sale.

Hear this out loud PauseA payoff quote shows the remaining balance on your mortgage loan, which includes your outstanding principal balance, accrued interest, late charges/fees and any other amounts. You'll need to request your free payoff quote as you think about paying off your mortgage.

Include all relevant information in the payoff letter, including: Include the name of the loan or mortgage holder. Include the loan or mortgage number. Include the payment amount. Include the date you plan to make the payment. Include your name and address. Include your contact information.

Typically, a 10-day payoff letter includes: The 10-day payoff date and payoff quote for your loan. Your loan account number(s) Individual loans and their payoff amounts (if you're refinancing multiple loans) Instructions on how to pay off your current loan servicer.

Hear this out loud PauseEssentially, a loan payoff letter is a representation by the existing lender regarding the outstanding amounts owed on the loan, including principal, interest, fees and other charges required to pay the loan in full and release any collateral.