A Loan Commitment Agreement Letter in South Dakota is a legally binding document that outlines the terms and conditions of a loan commitment between a lender and a borrower in the state of South Dakota. This letter serves as proof that the lender has committed to providing a loan to the borrower and that the borrower has agreed to accept the loan under the specified terms. Keywords: South Dakota Loan Commitment Agreement Letter, loan commitment, terms and conditions, lender, borrower, legally binding, proof, loan, specified terms. There are several types of South Dakota Loan Commitment Agreement Letters that may vary based on the type of loan or the specific circumstances of the borrower. Some common types include: 1. Mortgage Loan Commitment Agreement Letter: This type of agreement letter is commonly used in real estate transactions where the borrower is seeking a loan to purchase a property. It outlines the terms and conditions of the mortgage loan commitment, such as the loan amount, interest rate, repayment schedule, and any applicable fees. 2. Business Loan Commitment Agreement Letter: This type of agreement letter is used when a business or entrepreneur is seeking a loan to fund their business operations or expansion. It specifies the loan amount, interest rate, repayment terms, and any collateral or guarantees required by the lender. 3. Personal Loan Commitment Agreement Letter: This agreement letter is used for individuals seeking loans for personal reasons, such as debt consolidation, home repairs, or education expenses. It outlines the loan amount, interest rate, repayment schedule, and any additional terms agreed upon between the lender and the borrower. 4. Student Loan Commitment Agreement Letter: This type of agreement letter is specific to student loans, which are designed to help students cover the costs of their education. It includes details about the loan amount, interest rate, repayment options, and any deferred or subsidized interest benefits. It's essential for both the lender and the borrower to carefully review and understand the terms and conditions stated in the Loan Commitment Agreement Letter before signing it. This document helps protect the rights and interests of both parties and ensures transparency in the loan process. Keywords: Mortgage Loan Commitment Agreement Letter, Business Loan Commitment Agreement Letter, Personal Loan Commitment Agreement Letter, Student Loan Commitment Agreement Letter, real estate transactions, loan amount, interest rate, repayment schedule, fees, business operations, expansion, collateral, guarantees, debt consolidation, home repairs, education expenses, student loans, deferred interest, subsidized interest, rights, interests, transparency.

South Dakota Loan Commitment Agreement Letter

Description

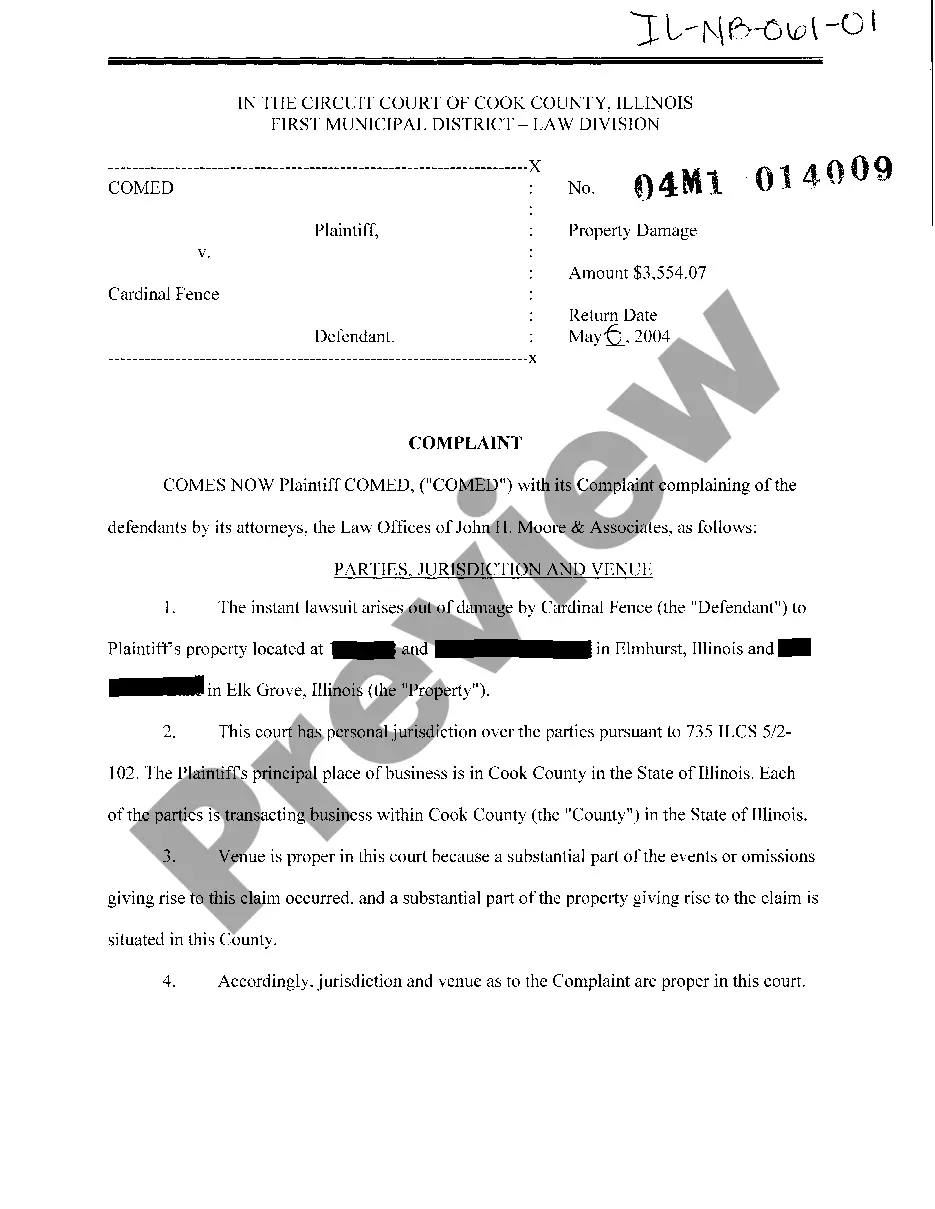

How to fill out South Dakota Loan Commitment Agreement Letter?

It is possible to invest hours on the web attempting to find the legitimate record design that meets the state and federal requirements you need. US Legal Forms supplies a large number of legitimate varieties which are examined by experts. It is possible to obtain or print out the South Dakota Loan Commitment Agreement Letter from our assistance.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain option. Afterward, you are able to comprehensive, change, print out, or indication the South Dakota Loan Commitment Agreement Letter. Every single legitimate record design you get is the one you have for a long time. To get yet another backup associated with a bought kind, go to the My Forms tab and click the related option.

If you work with the US Legal Forms website initially, keep to the straightforward directions listed below:

- Initially, ensure that you have selected the proper record design for your region/city that you pick. Browse the kind explanation to make sure you have picked the right kind. If offered, use the Review option to check with the record design too.

- If you would like find yet another variation of your kind, use the Lookup field to find the design that fits your needs and requirements.

- Upon having discovered the design you want, just click Acquire now to carry on.

- Select the rates plan you want, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal profile to cover the legitimate kind.

- Select the format of your record and obtain it for your product.

- Make adjustments for your record if possible. It is possible to comprehensive, change and indication and print out South Dakota Loan Commitment Agreement Letter.

Obtain and print out a large number of record layouts making use of the US Legal Forms site, which offers the largest selection of legitimate varieties. Use professional and status-specific layouts to tackle your business or person demands.

Form popularity

FAQ

Read our editorial guidelines here . A personal loan agreement is a written contract between two parties, generally a borrower and a lender. It outlines how much money is being borrowed, the repayment schedule and what should be done if there's a dispute over paying it back.

This final letter typically contains the following: The lender's name. The borrower's name. A statement of approval for the loan. The type of loan. The loan amount. The term. The interest rate. The date of commitment.

A loan agreement is any written document that memorializes the lending of money. Loan agreements can take several forms. The most basic loan agreement is commonly called an "IOU." These are typically used between friends or relatives for small amounts of money, and simply state the dollar amount that is owed.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

Two examples of open-end secured loan commitments for consumers are a secured credit card?where money in a bank account serves as collateral?and a home equity line of credit (HELOC)?in which the equity in a home is used as collateral.

We can define a commitment letter as a formal and legally binding document that a lender issues to a loan applicant. The commitment letter indicates that a loan applicant has passed the various underwriting guidelines and that their loan agreement or mortgage note has been approved.

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.

No, entering into a valid loan agreement does not necessarily mean that you are approved for the loan. This is a scenario that borrowers will face when applying for a loan through a financial institution like a bank. Typically, the loan approval process begins with the borrower requesting a loan from a lender.