South Dakota Accredited Investor Representation Letter

Description

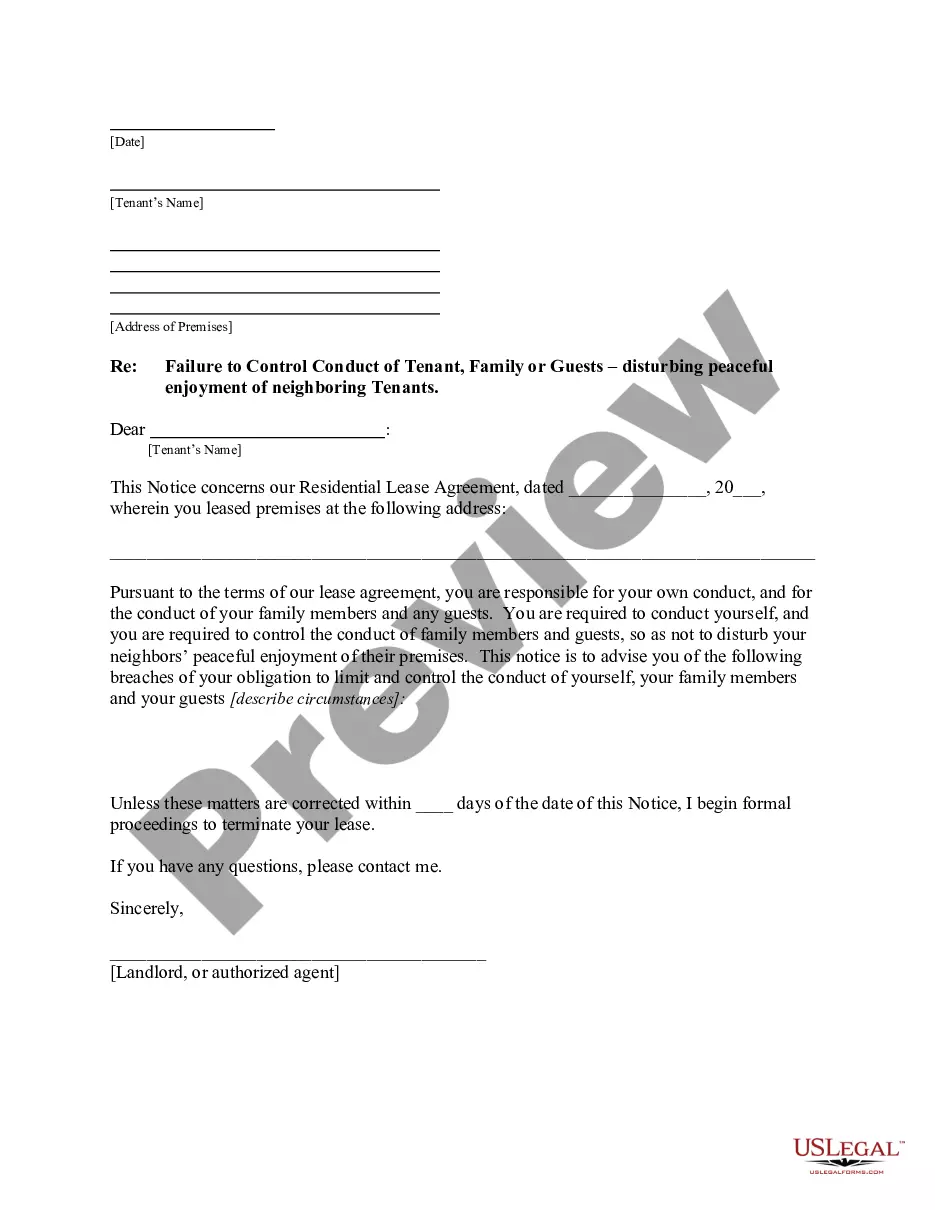

How to fill out Accredited Investor Representation Letter?

Have you been within a situation the place you require papers for either enterprise or person purposes virtually every day? There are a variety of legitimate document themes available online, but getting types you can depend on isn`t simple. US Legal Forms provides thousands of type themes, just like the South Dakota Accredited Investor Representation Letter, which are composed to satisfy state and federal demands.

Should you be currently acquainted with US Legal Forms internet site and have your account, basically log in. After that, you can download the South Dakota Accredited Investor Representation Letter template.

Unless you provide an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is for that proper city/area.

- Take advantage of the Review key to review the form.

- Browse the description to actually have chosen the right type.

- When the type isn`t what you are searching for, take advantage of the Research area to discover the type that meets your requirements and demands.

- Whenever you discover the proper type, click on Purchase now.

- Select the prices prepare you want, fill out the necessary details to generate your money, and pay for the transaction making use of your PayPal or credit card.

- Choose a practical paper file format and download your duplicate.

Find all the document themes you might have purchased in the My Forms food selection. You can aquire a extra duplicate of South Dakota Accredited Investor Representation Letter at any time, if needed. Just click on the necessary type to download or print the document template.

Use US Legal Forms, by far the most comprehensive selection of legitimate types, to save lots of time as well as steer clear of faults. The assistance provides appropriately manufactured legitimate document themes which can be used for a selection of purposes. Create your account on US Legal Forms and start producing your life a little easier.