South Dakota Inquiry of Credit Cardholder Concerning Billing Error

Description

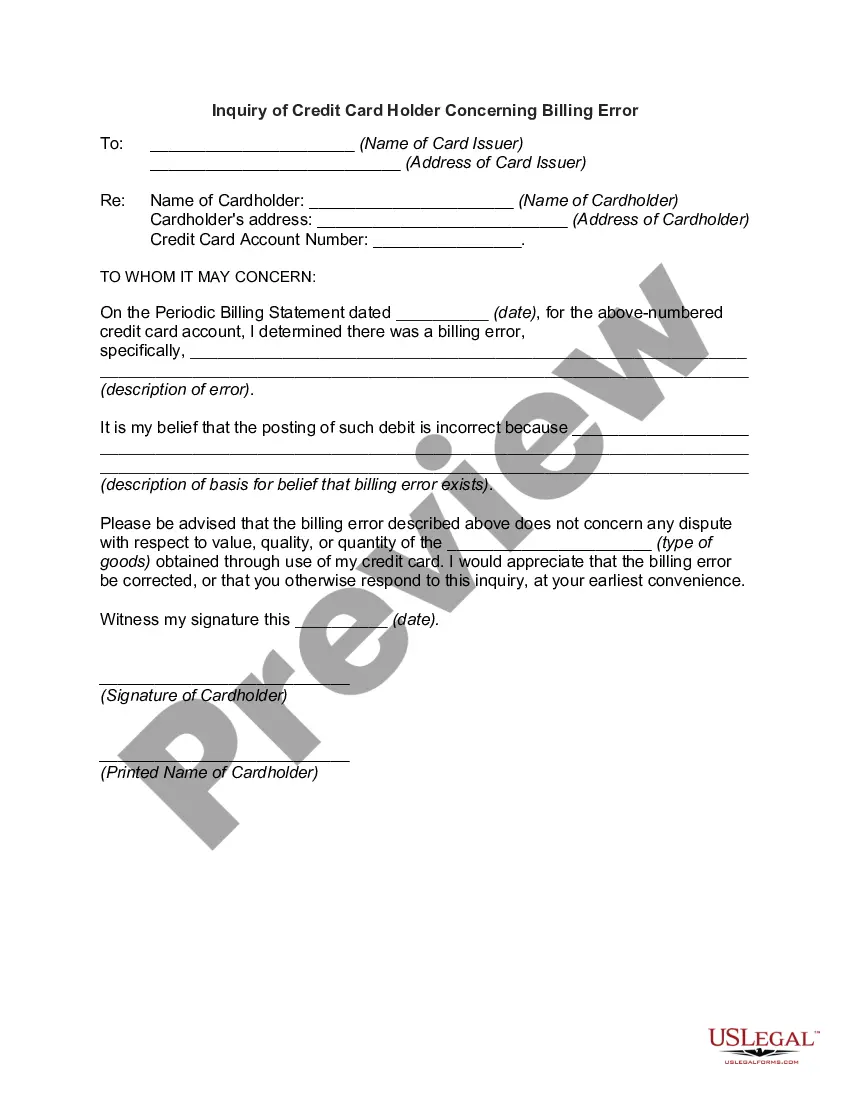

How to fill out Inquiry Of Credit Cardholder Concerning Billing Error?

Selecting the appropriate legal document template can be quite a challenge. Obviously, there are numerous templates available online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The platform provides thousands of templates, such as the South Dakota Inquiry of Credit Cardholder Regarding Billing Error, which can be utilized for both business and personal purposes. All forms are verified by experts and comply with state and federal regulations.

If you are currently registered, Log In to your account and then click the Download button to obtain the South Dakota Inquiry of Credit Cardholder Regarding Billing Error. Use your account to search for the legal forms you may have purchased previously. Visit the My documents section of your account to acquire another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the downloaded South Dakota Inquiry of Credit Cardholder Regarding Billing Error. US Legal Forms is the largest repository of legal forms where you can find a diverse range of document templates. Take advantage of the service to obtain professionally crafted documents that comply with state regulations.

- First, ensure you have selected the correct form for your area/state.

- You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not satisfy your needs, utilize the Search field to find the appropriate form.

- Once you are confident the form is suitable, click the Get Now button to obtain the form.

- Choose your desired pricing plan and fill in the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

Fixing a credit card error involves reviewing your billing statements for discrepancies and contacting your card issuer promptly. Clearly outline the error and submit any required documentation. If you need assistance, the South Dakota Inquiry of Credit Cardholder Concerning Billing Error process can help you clarify issues and ensure proper rectification.

Section 1026.13(c)(2) requires creditors to investigate the dispute, correct any errors found, and notify the consumer of the outcome no later than two complete billing cycles or 90 days after receiving the billing error notice.

Federal law only protects cardholders for a limited time 60 days to be exact after a fraudulent or incorrect charge has been made. Thankfully I noticed the billing error within a few days of it posting to my account and started the dispute process right away.

If the creditor has failed to send a periodic statement, the 60-day period runs from the time the statement should have been sent. Once the statement is provided, the consumer has another 60 days to assert any billing errors reflected on it.

The card issuer must send you a letter stating that it has received your billing dispute within 30 days of receiving it. The card issuer must complete its investigation within two complete billing cycles of receiving the dispute, which generally means two months, and cannot take more than 90 days.

If the lender confirms there is a billing error on your account, it must send you a written explanation of the corrections made to your account. In addition to crediting your account for the disputed amount, the lender must also remove all finance charges, late fees, or other charges related to the error.

(d) Acknowledgment of receipt. Within five days (excluding legal public holidays, Saturdays, and Sundays) of a servicer receiving a notice of error from a borrower, the servicer shall provide to the borrower a written response acknowledging receipt of the notice of error.

In 2015, there were a total of 69 distinct commercial banks in South Dakota, with total deposits of $450.49 billion. The Division of Banking, a part of the Department of Labor and Regulation, is responsible for the regulation of state-chartered financial institutions in South Dakota.

Write to your credit card company using the address for billing inquiries. Include in your letter your name, mailing address, account number and description of the billing error, including the date, amount and any other pertinent details. Mail the letter within 60 days after receiving the bill with the disputed error.

Generally, the bank must mail or deliver written acknowledgement to you within 30 days of receiving your written billing error notice. If the bank determines that a billing error has occurred, it shall resolve it within two complete billing cyclesbut no later than 90 days after receiving a billing error notice.