South Dakota Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

Are you currently in a location where you need documents for occasional business or specific reasons frequently? There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, like the South Dakota Assignment of Contract as Security for Loan, tailored to meet federal and state regulations.

If you're already familiar with the US Legal Forms site and hold an account, simply Log In. You can then download the South Dakota Assignment of Contract as Security for Loan template.

- Find the form you need and confirm it's for the correct city/region.

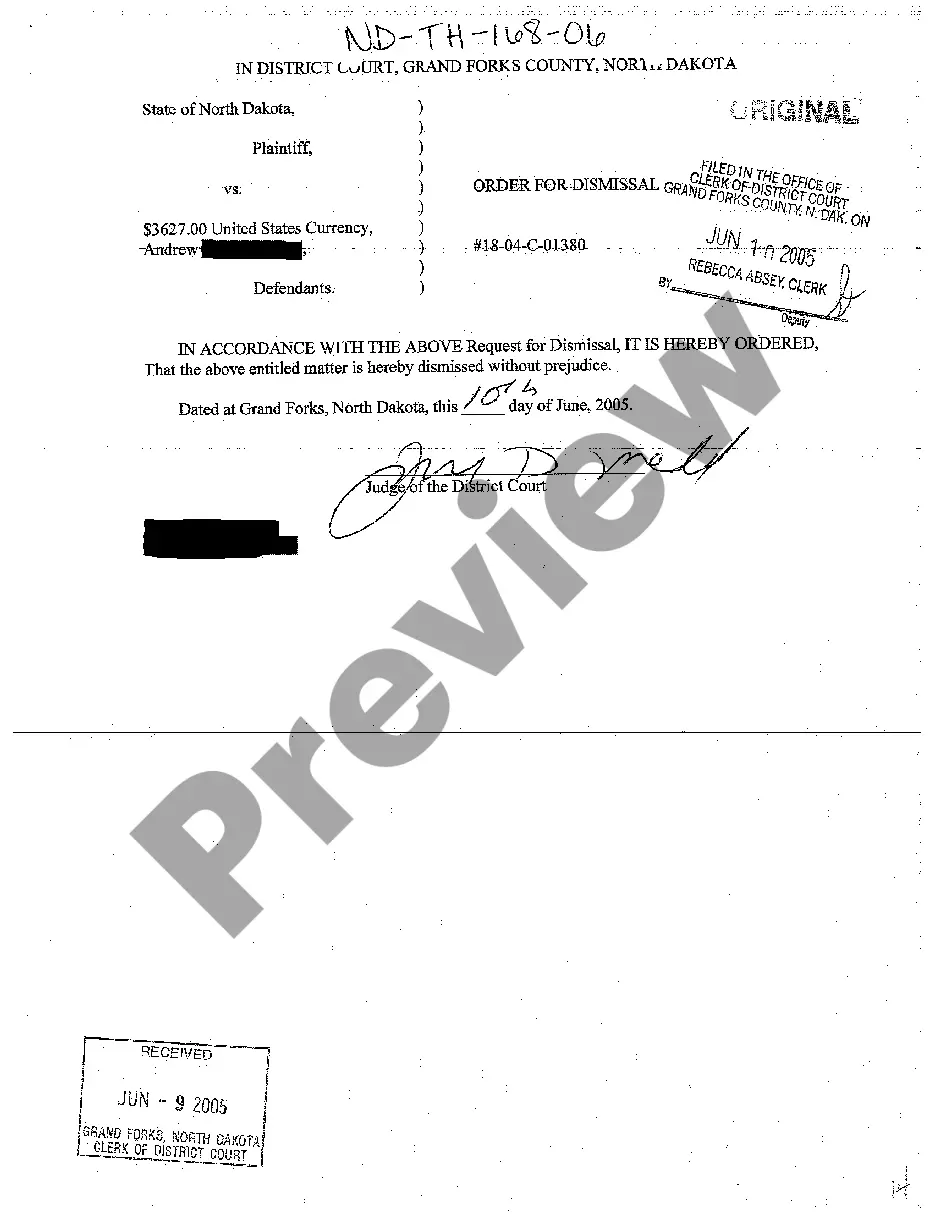

- Utilize the Review button to preview the document.

- Check the description to ensure you have chosen the right form.

- If the document isn’t what you’re looking for, use the Search field to locate the form that fits your needs.

- Once you find the correct form, click Buy now.

- Select the payment plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

The lender's right of assignment allows the lender to sell the mortgage at any time and free up the money the lender has invested in the property by means of the mortgage loan.

Loan Transfers. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

Assignable Loan means a Loan is capable of being assigned or novated to a different bank or financial institution as lender without the consent of the Reference Entity or guarantor, if any, of such Loan or any agent for the Loan.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

Assignment of Mortgage (AOM) Service.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

Lender shall have the right to sell, assign, participate, transfer or dispose of all or any part of its interest in the Loan without the consent or approval of Borrower or Guarantor.

Loan Transfers. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.