South Dakota Cash Disbursements and Receipts refer to the financial transactions involving the movement of funds in and out of the state's coffers. These transactions are essential to track and manage the flow of money within South Dakota's government departments and agencies. Understanding the different types of cash disbursements and receipts is crucial to effectively manage public finances. 1. Cash Disbursements: Cash disbursements in South Dakota are payments made by the state government for various expenses and obligations. Some common types of cash disbursements include: — Payroll Disbursements: These encompass salaries, wages, and benefits paid to state employees, including teachers, law enforcement officers, healthcare workers, and administrative personnel. — Vendor Payments: Payments made to suppliers, contractors, and service providers for goods, services, and construction projects necessary for state operations. — Debt Service Payments: Payments made towards interest and principal repayments on outstanding loans and bonds issued by the state government, ensuring the fulfillment of financial obligations. — Operating Expenses: Payments to cover everyday expenses incurred by state agencies, such as office supplies, utilities, equipment, and maintenance. — Grants and Subsidies: Funds disbursed to individuals, non-profit organizations, and local governments as grants, subsidies, or financial assistance for various programs, initiatives, or community development projects. 2. Cash Receipts: Cash receipts in South Dakota represent money received by the state government from various sources. These receipts serve as revenue streams to finance government operations, public services, and investment initiatives. Some significant types of cash receipts include: — Taxes and Fees: Revenue collected from various taxes imposed on individuals, businesses, and other taxable entities. This can include income tax, sales tax, property tax, motor vehicle fees, and other levies. — Federal Grants and Aid: Funds received from the federal government in the form of grants, reimbursements, subsidies, or other financial assistance programs to support public services, healthcare, education, infrastructure, and social welfare initiatives. — Investment Income: Revenue generated from investing surplus funds held by the state government in financial instruments, such as stocks, bonds, and mutual funds. — Licensing and Permits: Revenue collected from issuing licenses, permits, and registrations, including professional licenses, business permits, hunting and fishing licenses, and vehicle registrations. — Fines and Penalties: Money collected as fines, penalties, and forfeitures resulting from law enforcement activities, regulatory violations, traffic citations, and other legal actions. These descriptions provide an overview of the different types of South Dakota Cash Disbursements and Receipts. Efficient tracking and management of these cash flows are vital for maintaining the state's financial stability and ensuring the responsible allocation of public funds.

South Dakota Cash Disbursements and Receipts

Description

How to fill out South Dakota Cash Disbursements And Receipts?

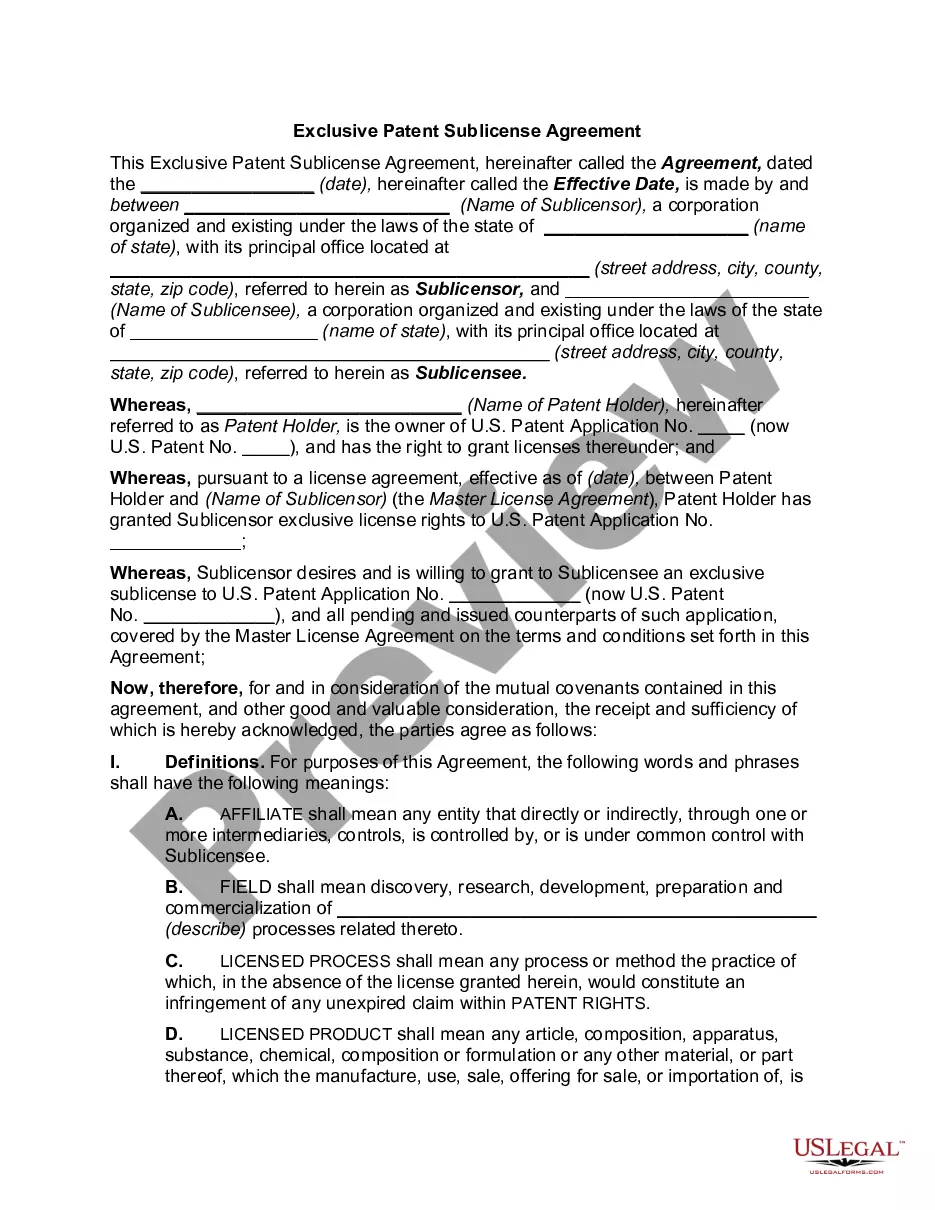

Choosing the best lawful document template might be a have difficulties. Needless to say, there are plenty of web templates available on the Internet, but how would you get the lawful develop you require? Take advantage of the US Legal Forms internet site. The support provides 1000s of web templates, including the South Dakota Cash Disbursements and Receipts, which you can use for organization and personal demands. All of the forms are checked out by pros and satisfy federal and state needs.

Should you be currently registered, log in in your account and click on the Down load option to get the South Dakota Cash Disbursements and Receipts. Make use of your account to appear through the lawful forms you might have acquired in the past. Proceed to the My Forms tab of your account and get an additional copy of your document you require.

Should you be a new end user of US Legal Forms, listed below are simple guidelines that you should follow:

- Initially, be sure you have selected the proper develop to your town/state. You are able to examine the form while using Review option and study the form explanation to make certain this is the right one for you.

- If the develop is not going to satisfy your needs, make use of the Seach area to obtain the right develop.

- Once you are certain the form would work, go through the Acquire now option to get the develop.

- Select the rates prepare you want and enter the required information and facts. Make your account and buy your order with your PayPal account or Visa or Mastercard.

- Select the data file file format and down load the lawful document template in your product.

- Complete, revise and print out and sign the received South Dakota Cash Disbursements and Receipts.

US Legal Forms is definitely the greatest local library of lawful forms where you can find different document web templates. Take advantage of the company to down load skillfully-produced paperwork that follow express needs.