South Dakota Pot Testamentary Trust

Description

How to fill out Pot Testamentary Trust?

If you want to finish, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and convenient search to find the documents you need.

Numerous templates for business and personal use are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your information to sign up for an account.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to access the South Dakota Pot Testamentary Trust in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to locate the South Dakota Pot Testamentary Trust.

- You can also retrieve forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

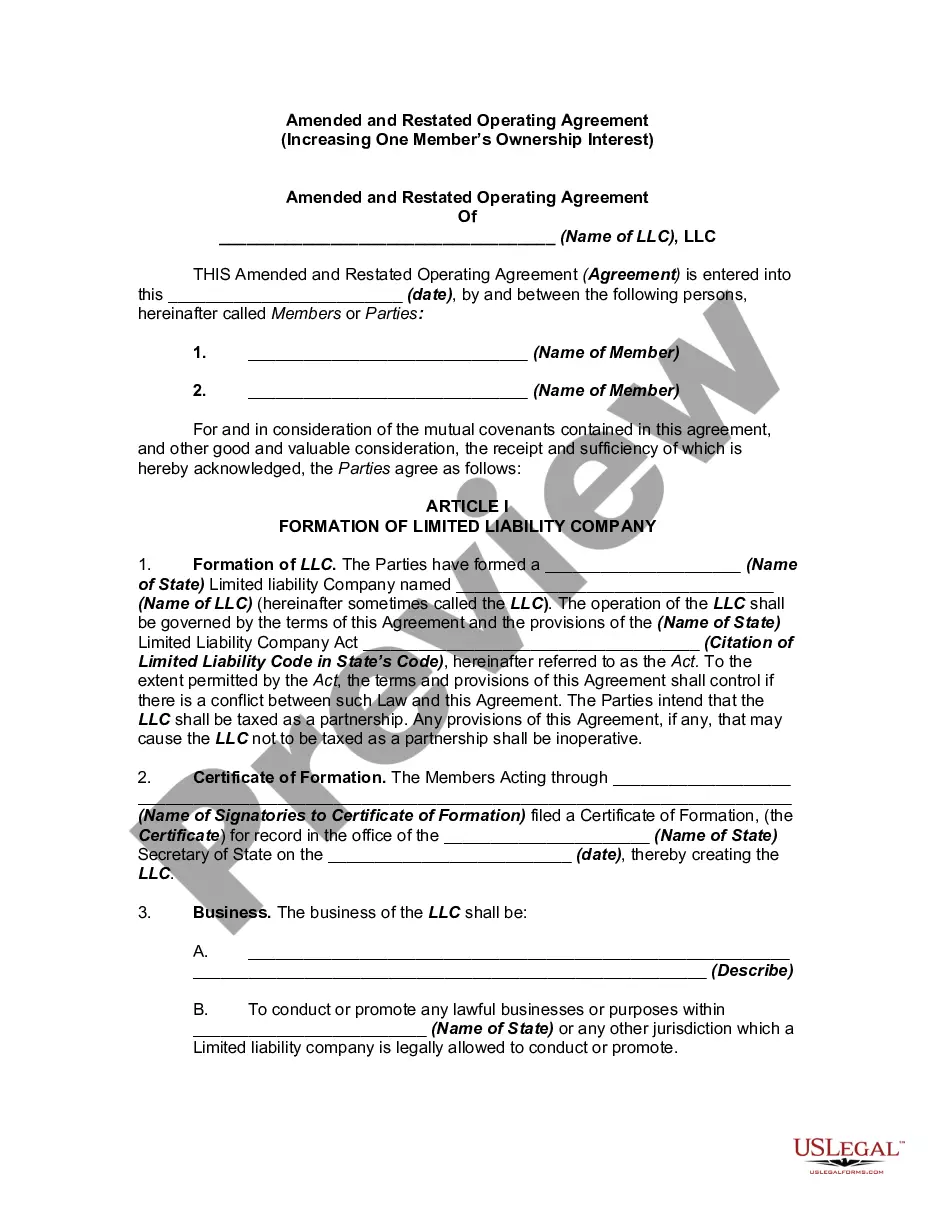

- Step 2. Use the Preview option to view the form’s details. Be sure to read through the information.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The minimum annual fee is $3,750 and the maximum annual fee is $20,000 for private trust companies, while the minimum annual fee is $4,500 and the maximum annual fee is $30,000 for public trust companies.

To make a living trust in South Dakota, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

South Dakota is a pure no income/capital gains tax state for trusts. However, if income is distributed from the trust to a beneficiary, the distributed income is generally taxed at the beneficiary's personal rates in his/her tax residence jurisdiction.

The minimum annual fee is $3,750 and the maximum annual fee is $20,000 for private trust companies, while the minimum annual fee is $4,500 and the maximum annual fee is $30,000 for public trust companies.

The South Dakota Trust AdvantageUnparalleled Tax Efficiency. South Dakota has no state income, capital gains, dividend/interest, or intangible tax.No South Dakota Residency Required.Lowest Insurance Premium Tax.Superior Asset Protection.No Required Termination.

As Daniel writes, Carefully designed, a South Dakota dynasty trust can operate as a perpetual estate-tax-avoidance machine. The trusts still must pay federal income tax on any capital gains and dividends they receive.

If a client is concerned about incapacity or wants their assets to transfer to beneficiaries in a particular manner, a trust is a useful tool to make that happen. Another thing to keep in mind is that as useful as trusts are, there are certain things the trust's creator can do to help the process.

The minimum annual fee is $3,750 and the maximum annual fee is $20,000 for private trust companies, while the minimum annual fee is $4,500 and the maximum annual fee is $30,000 for public trust companies.

South Dakota offers everything a wealthy person setting up a trust could want. There is no state income tax or capital gains tax, so investment gains on assets placed in the trust are tax-free if it's structured correctly. Robust protections provide anonymity and shield assets from creditors.

If you would like to create a living trust in South Dakota, you need to create a written trust agreement and sign it before a notary public. To make the trust effective, you must transfer your assets into it. A revocable living trust is a popular estate planning option. It may be an option that will work for you.