The South Dakota Investment Management Agreement for Separate Account Clients is a legal document that outlines the terms and conditions between a client and an investment management firm in South Dakota. This agreement is specifically designed for clients who wish to retain the services of a separate account manager to manage their investment portfolio. Under this agreement, the investment management firm is given the authority to make investment decisions on behalf of the client. The firm is responsible for implementing an investment strategy tailored to the client's objectives, risk tolerance, and financial situation. The investment manager will regularly monitor the client's investments, rebalance the portfolio when necessary, and provide periodic performance reports. The South Dakota Investment Management Agreement for Separate Account Clients typically includes a detailed description of the client's goals, objectives, and investment restrictions. It covers the responsibilities of both parties, including the investment manager's duty to act in the best interest of the client and to provide prudent investment advice. The agreement also outlines the fee structure, payment terms, and termination provisions. There may be different types of South Dakota Investment Management Agreement for Separate Account Clients, including: 1. Individual Client Agreement: This type of agreement is tailored for individual investors who want personalized investment management services. 2. Corporate Client Agreement: Specifically designed for corporate clients who require investment management services for their corporate funds or employee benefit plans. 3. Non-Profit Client Agreement: This agreement is suitable for non-profit organizations, foundations, or endowments that need professional investment management to grow and preserve their assets. 4. Family Office Agreement: For wealthy families or multi-generational families who seek comprehensive wealth management services and wish to have a separate account manager to oversee their investment portfolios. In conclusion, the South Dakota Investment Management Agreement for Separate Account Clients is an essential legal document that governs the relationship between a client and an investment management firm. It ensures that the client's investment objectives are properly addressed and provides a framework for a mutually beneficial partnership.

South Dakota Investment Management Agreement for Separate Account Clients

Description

How to fill out South Dakota Investment Management Agreement For Separate Account Clients?

Choosing the best legal papers template might be a have a problem. Of course, there are a lot of templates available on the net, but how would you obtain the legal kind you will need? Utilize the US Legal Forms internet site. The service delivers a huge number of templates, such as the South Dakota Investment Management Agreement for Separate Account Clients, that can be used for organization and private demands. Each of the kinds are inspected by specialists and fulfill state and federal requirements.

If you are currently authorized, log in to the bank account and click the Down load key to find the South Dakota Investment Management Agreement for Separate Account Clients. Make use of bank account to look with the legal kinds you may have bought previously. Go to the My Forms tab of your own bank account and have yet another duplicate in the papers you will need.

If you are a brand new user of US Legal Forms, listed here are straightforward guidelines that you can stick to:

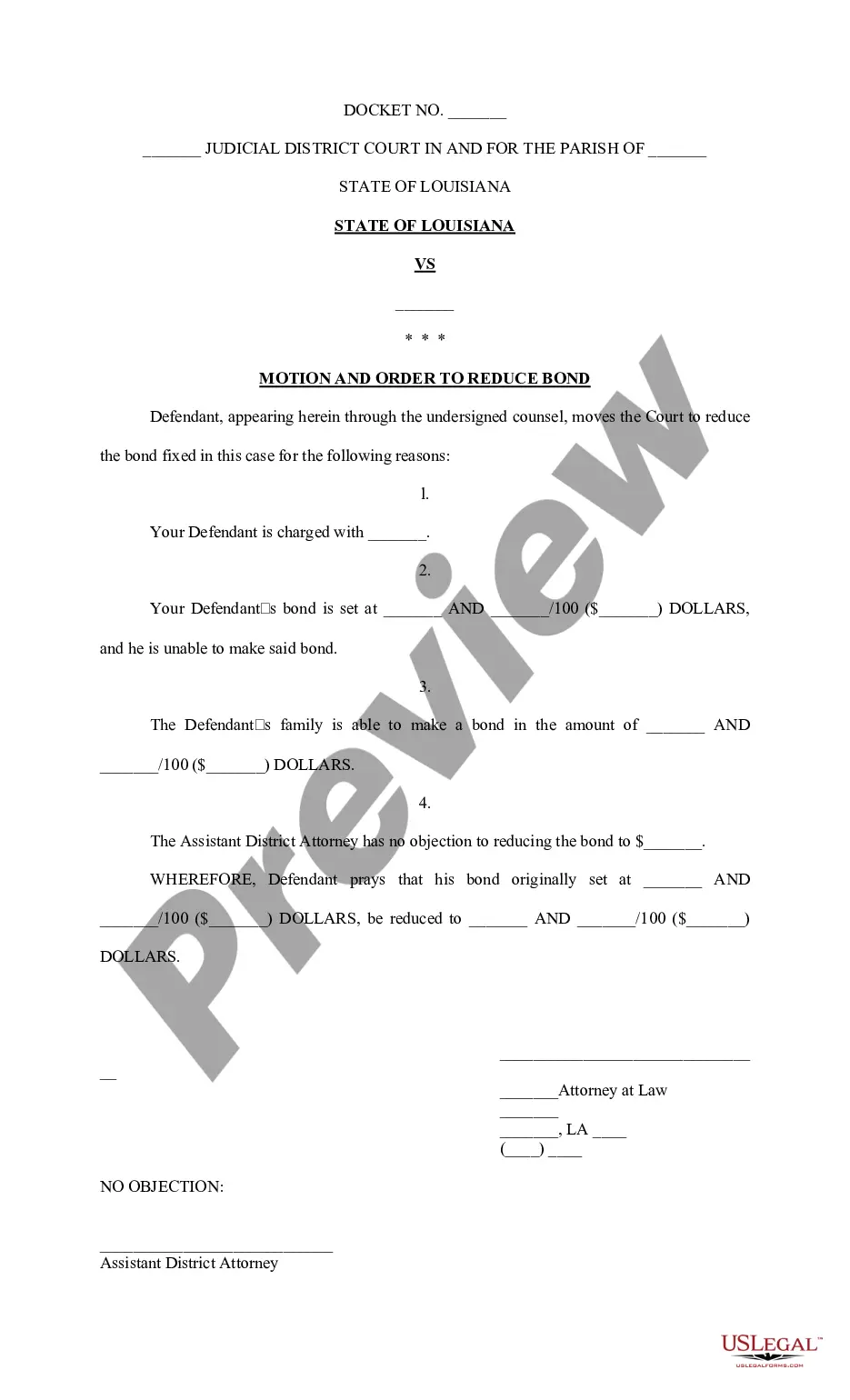

- First, make certain you have chosen the appropriate kind for your area/area. It is possible to look over the shape making use of the Review key and read the shape explanation to make certain this is the best for you.

- When the kind is not going to fulfill your needs, utilize the Seach field to find the correct kind.

- When you are certain the shape is suitable, select the Purchase now key to find the kind.

- Pick the rates prepare you need and type in the necessary information and facts. Build your bank account and purchase an order using your PayPal bank account or charge card.

- Choose the submit structure and acquire the legal papers template to the device.

- Full, edit and produce and indication the received South Dakota Investment Management Agreement for Separate Account Clients.

US Legal Forms may be the greatest library of legal kinds in which you can find numerous papers templates. Utilize the company to acquire skillfully-produced files that stick to status requirements.